Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

I need typing clear urjent no chatgpt used i will give 5 upvotes pls full explain

PLS TELL THE FINAL ANS THX

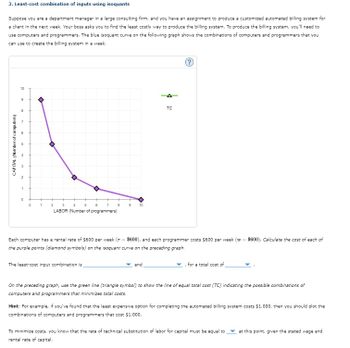

Transcribed Image Text:3. Least-cost combination of inputs using isoquants

Suppose you are a department manager in a large consulting firm, and you have an assignment to produce a customized automated billing system for

a client in the next week. Your boss asks you to find the least costly way to produce the billing system. To produce the billing system, you'll need to

use computers and programmers. The blue isoquant curve on the following graph shows the combinations of computers and programmers that you

can use to create the billing system in a week.

CAPITAL (Number of computers)

1

10

9

o

0

1

2

3

4

5

6

7

8

9

10

LABOR (Number of programmers)

A

TC

1=

Each computer has a rental rate of $600 per week (r = $600), and each programmer costs $600 per week (w= $600). Calculate the cost of each of

the purple points (diamond symbols) on the isoquant curve on the preceding graph.

The least-cost input combination is

and

for a total cost of

On the preceding graph, use the green line (triangle symbol) to show the line of equal total cost (TC) indicating the possible combinations of

computers and programmers that minimizes total costs.

Hint: For example, if you've found that the least expensive option for completing the automated billing system costs $1,000, then you should plot the

combinations of computers and programmers that cost $1,000.

To minimize costs, you know that the rate of technical substitution of labor for capital must be equal to

rental rate of capital.

at this point, given the stated wage and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 7 images

Knowledge Booster

Similar questions

- Assume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.arrow_forwardPlease answer all questions using exact terminlogy... Neptune Company has developed a small inflatable toy that it is anxious to introduce to its customers. The company’s Marketing Department estimates that demand for the new toy will range between 20,000 units and 30,000 units per month. The new toy will sell for $9.00 per unit. Enough capacity exists in the company’s plant to produce 25,000 units of the toy each month. Variable expenses to manufacture and sell one unit would be $5.00 , and incremental fixed expenses associated with the toy would total $34,000 per month. Neptune has also identified an outside supplier who could produce the toy for a price of $4.00 per unit plus a fixed fee of $67,000 per month for any production volume up to 25,000 units. For a production volume between 25,001 and 55,000 units the fixed fee would increase to a total of $134,000 per month. Required: 1. Calculate the break-even point in unit sales assuming that Neptune does not hire the outside…arrow_forward7. The semiconductor used in Costin Calculator has 5 components with the consistency of 90%, 95%,98%, 90%, and 99%, respectively. How reliable is one product of calculator?arrow_forward

- You are asked to help your boss deciding who is considering whether to make or buy a part fora top most demanding product of the company.Your company can make the component for $40 per unit or buy it for $50 per unit from vendor.If the Company decides to make the component, it will require 4 hours of machine time tomake each part. The company has 2,000 hours of machine time available per month. Shouldthe company make or buy the component? How many max parts company can make?________________________________________________________________arrow_forwardElsa Corporation, a company that manufactures and markets low-end table computers, asked ourfriend Ms. Market Researcher to create the demand curve for its SD 721 model. She conductedsome market research and gave Elsa the demand curve as well as some additional information:350,000 units of SD 721 will sell at a price of $250.(1) What is the point price elasticity if 500,000 units will sell at a price of $200? (2) What is the point price elasticity if 125,000 units will sell at a price of $305?arrow_forwardPlease do not give solution in image format thankuarrow_forward

- need help asaparrow_forward. A 100 cu.m. pit is to be excavated using a hydraulic excavator with a rate of 7.1 cu.m. per hour. The rental price of the hydraulic excavator is P12,600.00 per day. If the excavator is used 8 hours per day, determine the equipment cost to finish the excavation work. 18-21. The material cost of a certain scope of work has a total of P250,500.00. Determine the number of days to finish the work if they are using 3 tools that has a rental price of P760.00 per day each. Use (Labor Cost + Equipment Cost)/Material Cost = 30% Workers Salary per day P1050.00 P650.00 P480.00 P320.00 Project Engineer Foreman 2 Skilled Laborer 3 Laborerarrow_forward4. A nursery grows and sells rose bushes. To grow the bushes there is a fixed annual cost of $20,000 and an additional production cost of $10 per bush. The bushes sell for $25 each. (a) Write down the cost function. (b) Write down the revenue function. (c) Find the profit function. (d) Find the break even point. (e) How many rose bushes must the nursery sell to make a 20% profit?arrow_forward

- 3. A company has a linear total cost function and has determined that over the next three months it can produce 1,000 units at a total cost of $300,000. This same manufacturer can produce 2,000 units at a total cost of $400,000. The units sell for $180 each. Find (i) fixted cost (ii) marginal cost, (iii) the break-even point and (iv) construct the break-even chart.arrow_forwardThe Company has the oppotunity to introduce a new product. The sales manager believes that the firm could sell 5,000 units per year at 14 per unit for 5 years. The production manager has determined that machinery costing 60,000 and having a 5 year life and no salvage value could be required. The machinery will have an annual fixed cash operating costs of 4,000. Variable cost per unit will be 8. Straight-line depreciation is to be used for both book and tax purposes. The tax rate is 40% and the firm's cost of capital is 14%. What is the Net Present Value of the Investment?arrow_forwardWhat other real-world factors might be important to consider in designing the simulation and making a recommendation?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,