Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Question

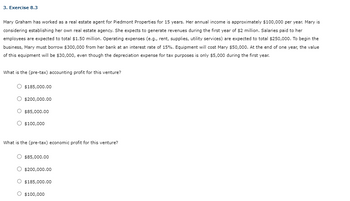

Transcribed Image Text:3. Exercise 8.3

Mary Graham has worked as a real estate agent for Piedmont Properties for 15 years. Her annual income is approximately $100,000 per year. Mary is

considering establishing her own real estate agency. She expects to generate revenues during the first year of $2 million. Salaries paid to her

employees are expected to total $1.50 million. Operating expenses (e.g., rent, supplies, utility services) are expected to total $250,000. To begin the

business, Mary must borrow $300,000 from her bank at an interest rate of 15%. Equipment will cost Mary $50,000. At the end of one year, the value

of this equipment will be $30,000, even though the depreciation expense for tax purposes is only $5,000 during the first year.

What is the (pre-tax) accounting profit for this venture?

$185,000.00

$200,000.00

$85,000.00

$100,000

What is the (pre-tax) economic profit for this venture?

$85,000.00

$200,000.00

$185,000.00

$100,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sandra lives in Melbourne and runs a business that sells guitars. In an average year, she receives $2.6 millionfrom sales of guitars. Of this sales revenue, she must pay the manufacturer a wholesale cost of $1,400,000. She also pays wages and utility bills totalling $1,100,000. If she does not operate this guitar business, she can work in an accounting firm and receive an annual salary of $70,000. She owns her showroom. If she chooses to rent it out, she will receive $50,000 in rent per year. Assume that the value of this showroom does not depreciate during the year. No other costs are incurred in running this guitar business. What is Sandra’s accounting profit (used for tax purposes)? What is her economic profit?arrow_forwardConsider the following example: Jordan currently works for a corporate law firm. She is considering opening her own independent legal practice, where she expects to earn $300,000 per year once she gets established. To run her own firm, she willI have to give up her current job with a salary of $165,000 and will incur the following annual expenses: Rent 22,490 Salary-Legal Assistant Computer Software License Office Supplies 21,830 120 800 Internet Subscription 1,750 How much are Jordan's explicit costs? Number How much is Jordan's accounting profit? Number How much are Jordan's implicit costs? Number How much is Jordan's economic profit? Number Assume Jordan values her leisure time at $80/hour, and starting her own firm would require her to put in 15 more hours than at the corporate firm: What is the change in Jordan's explicit costs? Number What is the change in Jordan's implicit costs? Numberarrow_forward11arrow_forward

- 2. Profit maximization A profit-maximizing firm will use more of a factor of production when: The marginal physical product of the additional factor unit is greater than the marginal revenue product (MRP) of the additional factor unit. The extra cost of using an additional factor unit is less than the marginal physical product of the additional factor unit. The extra cost of using an additional factor unit is less than the marginal revenue product of the additional factor unit. The marginal physical product of the additional factor unit is less than the marginal revenue product of the additional factor unit. Apply your answer as an argument to the labor market-when the wage rate is above the MRP, the firm should hire Therefore, what is the relationship between a perfectly competitive firm's MRP curve for an input and that firm's demand curve for that input? The firm's demand curve for an input is the downward-sloping portion of the MRP curve. workers. They are identical except for the…arrow_forwardSam owns and operates ye olde yogurt shoppe. His revenue this year was $135,000. he paid food supplier $50,000 for fruit, yogurt and milk and paid $5000 For paper and cleaning supplies. In addition to working again the store himself, he hired student lady to work part time and it cost him $25,000 in labor costs. He paid $12,500 to rent his store. He borrowed money from bank and had to pay them $5000 in interest costs. To run his company, sam gave up $50000 per year job and $1500 in interest amount he put into the business. He estimates that companies similar to his earn at least $6750 over costs. 1. separate(list) sam's accounting costs into fixed costs be variable costs by name and amount. 2. list each of sam's implicit costs by name and amount 3. calculate sam's economic profit/loss. Show what costs are included, and if Sam expects the Sam revenue and costs next year, he should continue in this business? Why/ why not?arrow_forward4-2 Game Day Shuttle Service You run a game day shuttle service for parking services for the local ball club. Your costs for different customer loads are 1: $30, 2: $32, 3: $35, 4: $38, 5: $42, 6: $48, 7: $57, and 8: $68. What are your MCs for each customer load level? What is the AC? If you are compensated $10 per ride, what customer load would you want?arrow_forward

- 12.arrow_forwardDennis, a potato farmer, earns $400,000/month in revenue. His monthly cost include: administrative cost: $30,000, fertilizers: $50,000, equipment and maintenance: $35,000, Labor: $73,000, Transportation: $15,000, Miscellaneous: $10,000, Foregone rent for the land is $20,000, and the owner’s salary is $20,000. Dennis's economic profit is ______. Group of answer choices $147,000 $167,000 $187,000arrow_forward4. Exercise 9.4 If the Occupational Safety and Health Administration (OSHA) requires a firm to install new ventilating equipment in its plant, then its break-even point will . (Assume that all other factors remain unchanged and that this action has no effect on worker productivity.)arrow_forward

- 5. Last year, Jarod left a job that pays $60,000 to run his own bike-repair shop. Jarod's shop charges $65 for a repair, and last year the shop performed 3,000 repairs. Jarod's production costs for the year included rent, wages, and equipment. Jarod spent $50,000 on rent and $100,000 on wages for his employees. Jarod keeps whatever profit the shop earns, but does not pay himself an official wage. Jarod used $20,000 of his savings to buy a machine for the inimo business. His savings were earning an annual interest rate of 5 percent. a. What is Jarod's annual accounting profit? 7 2hes you'l awoda woled surgit odTasoda zozotontuner TRW001 vone T un node odi ni esvus todel to touborq sovs bus todel to souborg lanigrama b. What is Jarod's annual economic profit? to vy (toutarrow_forward4arrow_forwardKohl's takes its net sales and subtracts the cost of goods sold during the previous period. The result is Kohl's gross sales O net income O gross profit net margin O net purchasesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning