FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

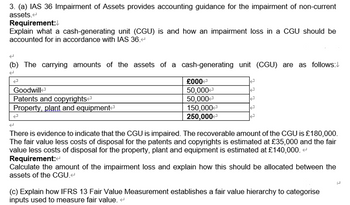

Transcribed Image Text:3. (a) IAS 36 Impairment of Assets provides accounting guidance for the impairment of non-current

assets.

Requirement:

Explain what a cash-generating unit (CGU) is and how an impairment loss in a CGU should be

accounted for in accordance with IAS 36.<

(b) The carrying amounts of the assets of a cash-generating unit (CGU) are as follows:

2

Goodwill

Patents and copyrights

Property, plant and equipment

J

£000

50,000

50,000

150,000

250,000

E

2

2

J

There is evidence to indicate that the CGU is impaired. The recoverable amount of the CGU is £180,000.

The fair value less costs disposal for the patents and copyrights is estimated at £35,000 and the fair

value less costs of disposal for the property, plant and equipment is estimated at £140,000. <

Requirement:<

Calculate the amount of the impairment loss and explain how this should be allocated between the

assets of the CGU.<

(c) Explain how IFRS 13 Fair Value Measurement establishes a fair value hierarchy to categorise

inputs used to measure fair value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Consolidated Balance Sheet Working Paper, Identifiable Intangibles International Auto (IA) acquires all of the stock of Genuine Parts (GP) and reports the acquisition as a stock investment on its own books. The acquisition involves the following payments. All amounts are in thousands. Cash paid to GP shareholders $10,000 2,400 Cash paid to consultants and lawyers Fair value of new IA stock issued, 1,000 shares, $4 par 72,000 1,800 500 Stock registration fees, paid in cash Fair value of earnings contingency The earnings contingency, if paid, will occur three years subsequent to the acquisition. The balance sheet accounts of GP and IA, just prior to the acquisition, are as follows: International Auto (in thousands) Current assets Fixed assets, net Trademarks Current liabilities Long-term liabilities Common stock, par value Additional paid-in capital Retained earnings Accumulated other comprehensive income Treasury stock Total Book Value Dr (Cr) $60,000 840,000 178,000 (50,000) (700,000)…arrow_forwardAASB 116 requires disclosure of the following by asset class: I II III IV The useful lives of assets Yes No Yes Yes Accumulated impairment losses No Yes Yes Yes Items pledged as security Yes Yes No Yes Additions during the year Yes Yes Yes No ΟΙ O IV. O III Ollarrow_forwardIntangible assets on the balance sheet are subject to: Depreciation Amortization O None of the Abovearrow_forward

- Explain the accounting treatment in the event that an impairment review of a non-current asset which has been previously revalued with a revaluation surplus revealed that the non-current asset has suffered an impairment loss.arrow_forwardThe main objective of IAS 36 Impairment of Assets is to prescribe the procedures that should ensure that an entity's assets are included in its statement of financial position at no more than their recoverable amounts. Where an asset is carried at an amount in excess of its recoverable amount, it is said to be impaired and IAS 36 requires an impairment loss to be recognized. Required: Define an impairment loss explaining the relevance of fair value less costs to sell and value in use and state how frequently assets should be tested for impairment. 2. Describe the possible incators of impairment. 3. Explain how an impairment loss is accounted for after it has been calculated.arrow_forwardPre-Lecture Question 01 Which of the following is a characteristic of intangible assets? 1 They are all subject to amortization. 2 They are long-term in nature. 3 They are financial instruments. 4 They have physical existence.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education