FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

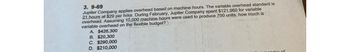

Transcribed Image Text:3. 9-69

Jupiter Company applies overhead based on machine hours. The variable overhead standard is

21 hours at $29 per hour. During February, Jupiter Company spent $121,960 for variable

overhead. Assuming 10,000 machine hours were used to produce 700 units, how much is

variable overhead on the flexible budget?

A. $426,300

B. $20,300

C. $290,000

D. $210,000

income of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gus Corporation manufactured 10,000 golf bags during April. The fixed overhead cost-allocation rate is $40.00 per machine-hour. The following is the fixed overhead data: Actual Static Budget Production 10,000 units 12,000 units Machine-hours 5,100 hours 6,000 hours Fixed overhead cost $244,000 $240,000 What is the flexible-budget amount? A) $200,000 B) $204,000 C) $240,000 D) $244,000 What is the amount of fixed overhead allocated to production (Actual Qty x Bud Price column)? A) $200,000 B) $204,000 C) $240,000 D) $244,000 The total Fixed overhead variance is: A) overallocated by $4,000 B) underallocated by $4,000 C) overallocated by $44,000 D) underallocated by $44,000arrow_forwardDd.18.arrow_forwardInterplast Ghana is a rubber fabricating company based at North Industrial Area. The company produce rubber buckets for the West African market and plans to produce 1,000 units of buckets in the month of January. The bucket requires a single operation and the standard cost for the operation is presented below: Standard cost card (bucket) GH₂ Direct material (plastics): 10 kg at GHe 0.50 per kg) Direct labour (5hours@ GHe 20 per hours) Variable overheads (3 hours at GHe 2 per direct labour) Total standard variable cost Standard contribution margin Standard selling price Budget statement for the month of January Sales (1.000 units of buckets at GHe 140 per unit) Direct materials: (10,000 at GHe 0.50) Direct labour (4,000 hours @GHe 20per hour) Variable overheads (4,000 hours @GHe 2 per direct hour) 93,000 Budget contribution 47,000 Fixed overheads 20,000 Budgeted profit 27,000 The annual budgeted fixed overheads is GH€ 240,000 and are assume to be incurred evenly throughout the year.…arrow_forward

- Nonearrow_forwardMC Qu. 6-26 Ralston has the following budgeted costs... Ralston has the following budgeted costs at its anticipated production level (expressed in hours): variable overhead, $172,200; fixed overhead, $330,000. If Ralston now revises its anticipated production slightly upward, it would expect: Multiple Choice total fixed overhead of $330,000 and a lower hourly rate for variable overhead. total fixed overhead of $330,000 and the same hourly rate for variable overhead. total fixed overhead of $330,000 and a higher hourly rate for variable overhead. total variable overhead of less than $172,200 and a lower hourly rate for variable overhead. total variable overhead of less than $172,200 and a higher hourly rate for variable overhead.arrow_forward-730 i= The master manufacturing overhead budget for the month based on the normal productive capacity of 20,400 direct labour hours (10,200 units) shows total variable costs of $81,600 ($4.00 per labour hour) and total fixed costs of $61,200 ($3.00 per labour hour). Normal production capacity is 20,400 direct hours. Overhead is applied based on direct labour hours. Actual costs for producing 9,970 units in November were as follows: Direct materials (20,500 kg) $108,650 Direct labour (19,940 hours) 228,313 Variable overhead 79,560 Fixed overhead 60,180 Total manufacturing costs $476,703 The purchasing department normally buys the quantities of raw materials that are expected to be used in production each month. Raw materials inventories, therefore, can be ignored.arrow_forward

- View Policies Current Attempt in Progress The predetermined overhead rate for Crane Company is $4, comprised of a variable overhead rate of $2 and a fixed rate of $2. The amount of budgeted overhead costs at normal capacity of $120000 was divided by normal capacity of 30000 direct labor hours, to arrive at the predetermined overhead rate of $4. Actual overhead for June was $8600 variable and $5900 fixed, and 2000 units were produced. The direct labor standard is 2 hours per unit produced. The total overhead variance is $2000 F. $1500 F. $1500 U. $2000 U.arrow_forwardNonearrow_forwardDhapaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education