Algebra and Trigonometry (6th Edition)

6th Edition

ISBN: 9780134463216

Author: Robert F. Blitzer

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

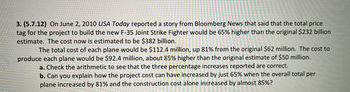

Transcribed Image Text:**Article: Understanding Cost Increases in the F-35 Joint Strike Fighter Project**

On June 2, 2010, USA Today reported a story from Bloomberg News regarding a significant cost overrun in the development of the F-35 Joint Strike Fighter. Initially, the total project cost was estimated at $232 billion. However, it increased by 65%, bringing the new estimate to $382 billion.

The breakdown is as follows:

- The total cost of each plane is projected to be $112.4 million, an increase of 81% from the original $62 million.

- The production cost per plane rose to $92.4 million, which is about 85% higher than the initial estimate of $50 million.

**Questions for Analysis:**

a. Verify the arithmetic accuracy of the three reported percentage increases.

b. Discuss the reasons why the overall project cost increased by only 65%, despite the per-plane and construction costs increasing by 81% and 85%, respectively.

**Key Considerations:**

- Consider how fixed and variable costs, economies of scale, and project management strategies might impact total expenditure differently on a large scale project like this.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- An environmental engineer wants to evaluate three different methods for disposing of nonhazardous chemical waste: land application, fluidized-bed incineration, and private disposal contract. Use the estimates below to help her determine which has the least cost at /= 15.00% per year on the basis of an annual worth evaluation. First Cost AOC per Year Salvage Value Life Land $-145000 $-86000 $23000 4 years Incineration $-760000 $-70000 $260000 6 years Contract O $-132000 O 2 yearsarrow_forwardOn February 23, 2011 Matthew Wald blogged in The New York Times that, “a car buyer who lays out an extra $6,200 to buy the hybrid version of the Lexus RX will get the money back in gas savings within five years, according to Consumer Reports magazine, but only if gasoline averages $8.77 a gallon. Otherwise, the nonhybrid RX 350 is a better buy than the Hybrid 450h, the magazine says.”Wald notices that the study assumes:▪ The car will be driven 12,000 miles a year.▪ Gas will cost $2.80 a gallon.▪ The hybrid gets 26 miles per gallon while the nonhybrid gets 21.(a) Show that the computation is wrong—that at $8.77 per gallon of gas you can’t save $6,200 in 60,000 miles of driving.(b) Show that you can save that much with that much driving if gas costs $8.77 per gallon more than $2.80 per gallon.arrow_forwardOver the past 10 years (actually, 2007 to 2017), it is estimated that the population of China has increased from 1.318 billion to 1.386 billion people, whereas the population of India has increased from 1.18 to 1.339 people. If both countries continued to grow at these rates, will China or India have the greater population in 2027? Show your calculations below.arrow_forward

- A surfboard manufacturer lost $500,000 last year during a recession. Total revenue was $5,000,000 and total variable costs were 40% of sales. The production facility ran at 50% capacity. The production manager wants to know the following: a. What is the percent capacity required to break even? b. When the economy recovers this year, if the plant runs at 100% capacity what net income could the company realize? c. There is a possibility that sales could be so strong this year that the plant may be required to run at 120% capacity by offering a lot of overtime to its production workers. This would result in total variable costs rising by 35%. On a strictly financial basis, should the production manager plan to exceed capacity or should he advise top management to freeze production at 100% capacity? Justify your answer. Answer Solution- 9a. 58.3% 9b. $2,500,000 9c. $3,100,000arrow_forwardCompute the NPV statistic for Project Y if the appropriate cost of capital is 12 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Project Y Time: 1 2 3 4 Cash flow: -$8,000 $3,350 $4,180 $1,520 $300arrow_forwarda plant has a 200 horsepower that works cpnsstatnly for 3000 hours per year. it is using a drive motor with an efficiency of 84.3%. The motor has reached its life span, and needs to be changed. A new one will cost $1,100. A motor with an efficiency of 86.3% will cost $13,000 and the installation of the motor will be $1,200. Both motors will last for 20 years but then would need a new one Find the annual savings when it comes to replacing the old compressor with the more efficient compressor.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Algebra and Trigonometry (6th Edition)AlgebraISBN:9780134463216Author:Robert F. BlitzerPublisher:PEARSON

Algebra and Trigonometry (6th Edition)AlgebraISBN:9780134463216Author:Robert F. BlitzerPublisher:PEARSON Contemporary Abstract AlgebraAlgebraISBN:9781305657960Author:Joseph GallianPublisher:Cengage Learning

Contemporary Abstract AlgebraAlgebraISBN:9781305657960Author:Joseph GallianPublisher:Cengage Learning Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning

Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning Algebra And Trigonometry (11th Edition)AlgebraISBN:9780135163078Author:Michael SullivanPublisher:PEARSON

Algebra And Trigonometry (11th Edition)AlgebraISBN:9780135163078Author:Michael SullivanPublisher:PEARSON Introduction to Linear Algebra, Fifth EditionAlgebraISBN:9780980232776Author:Gilbert StrangPublisher:Wellesley-Cambridge Press

Introduction to Linear Algebra, Fifth EditionAlgebraISBN:9780980232776Author:Gilbert StrangPublisher:Wellesley-Cambridge Press College Algebra (Collegiate Math)AlgebraISBN:9780077836344Author:Julie Miller, Donna GerkenPublisher:McGraw-Hill Education

College Algebra (Collegiate Math)AlgebraISBN:9780077836344Author:Julie Miller, Donna GerkenPublisher:McGraw-Hill Education

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:9781305657960

Author:Joseph Gallian

Publisher:Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:9781285463247

Author:David Poole

Publisher:Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:9780135163078

Author:Michael Sullivan

Publisher:PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:9780980232776

Author:Gilbert Strang

Publisher:Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:9780077836344

Author:Julie Miller, Donna Gerken

Publisher:McGraw-Hill Education