ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

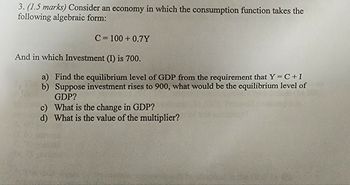

Transcribed Image Text:3. (1.5 marks) Consider an economy in which the consumption function takes the

following algebraic form:

C= 100+ 0.7Y

And in which Investment (I) is 700.

a) Find the equilibrium level of GDP from the requirement that Y=C+I

b) Suppose investment rises to 900, what would be the equilibrium level of

GDP?

c) What is the change in GDP?

d) What is the value of the multiplier?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2. Suppose we have the following data to study if a country's per capita income (measured in thousands of dollars) is a function of its R&D spending (measured as a percentage of GDP). ( country 1 2 3 4 xi yi 1 4 2 6 3 7 4 10 (1) Calculate beta hats with OLS. (2) Calculate R2 and adjusted R².arrow_forward4. Study Questions and Problems #4 Real GDP (Y) and aggregate expenditures (AE) are shown for an economy in the first two columns of the following table. Suppose that economic forecasters predict government spending to increase in the near future from G=$1 trillion to G=$1.25 trillion. Recalculate the value of aggregate expenditures given the new value of G=$1.25 trillion. Enter those values to the second decimal place in the third column of the table. Real GDP (Y) (Trillions of dollars per year) 0 1 2 3 4 5 6 7 8 9 10 G=$1 trillion (Trillions of dollars per year) 1.25 2.00 2.75 3.50 4.25 Aggregate Expenditures 5.00 5.75 6.50 7.25 8.00 8.75 G=$1.25 trillion (Trillions of dollars per year) 1.56 2.5 3.44 4.38 5.31 6.25 7.19 8.13 9.06 10 10.94 The black line on the following graph represents the 45-degree line where real GDP equals aggregate expenditures. Use the blue points (circle symbol) to plot the aggregate expenditures line for this economy when G-$1.25 trillion. Line segments will…arrow_forwardQuestion 35 Suppose real estate analysts expect that 100,000 homes will be needed in a particular community by 2014. If the current number of homes in the community is only 50,000, we can expect to see a significant increase in the demand for investment. True O Falsearrow_forward

- 8. (Continuing with the situation described in the preceding question.) Consider the economic model of an individual's labor-leisure choice with the following components: good w represents the hourly wage rate Y represents nonlabor income T represents total time available U(C, L) represents the individual's utility function MUC denotes the marginal utility of consumption MUL denotes the marginal utility of leisure Unless otherwise instructed, assume that consumption and leisure are normal goods. Whenever graphing the model, put C on the vertical axis and L on the horizontal axis. 4 C represents units of the consumption good L represents hours of leisure The individual maximizes his utility by choosing the optimal consumption bundle C*=90, L*=15, and H*=9. At this consumption bundle, MUC=4 and MUL=12. If p=2, what is w? 8 H represents hours of paid work p represents the unit price of the consumption O 10 O There is not enough information to determine w.arrow_forward6. Changes in taxes The following graph plots an aggregate demand curve. Using the graph, shift the aggregate demand curve to depict the impact that a tax hike has on the economy. PRICE LEVEL 130 120 110 g 100 90 80 Aggregate Demand 70 0 10 20 30 OUTPUT 40 50 60 Aggregate Demand (?) Suppose the governments of two very similar economies, economy Y and economy Z, implement a tax cut of equal size. The tax cut in economy Y is temporary, while the tax cut in economy Z is permanent. The economies are otherwise completely identical. The tax cut will have a smaller impact on aggregate demand in the economy with thearrow_forwardchoose the correct answer:arrow_forward

- P1arrow_forward4. Planned expenditure and income The following table shows consumption (C), investment spending (I), and government purchases (G), in a hypothetical economy for various levels of income. Also assume that there is an income tax rate of 25%, that base consumption is $100 billion, and that the MPC is 0.333, or 1/3. This economy is closed, with no international trade, therefore net exports are equal to zero and should not be considered. Use the given information to fill in disposable income, consumption, and planned expenditures in the following table. Income: Real Disposable (After Tax) Planned GDP Income C I, G Expenditures (Billions of (Billions of dollars) (Billions of (Billions of (Billions of (Billions of dollars) dollars) dollars) dollars) dollars) 100 50 150 100 50 150 200 50 150 300 50 150 400 50 150 500 50 150arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education