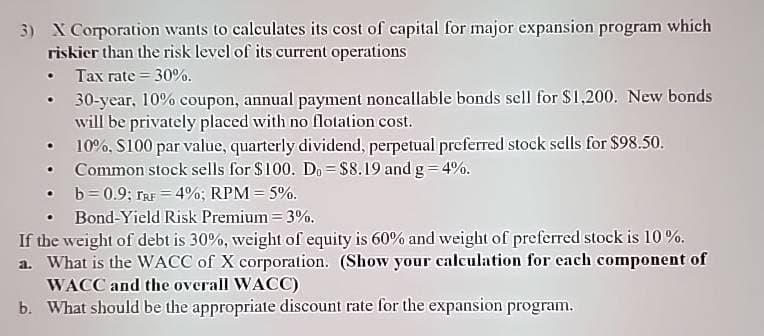

3) X Corporation wants to calculates its cost of capital for major expansion program which riskier than the risk level of its current operations ⚫ Tax rate=30%. • 30-year, 10% coupon, annual payment noncallable bonds sell for $1,200. New bonds will be privately placed with no flotation cost. ⚫ 10%, $100 par value, quarterly dividend, perpetual preferred stock sells for $98.50. ⚫ Common stock sells for $100. Do= $8.19 and g=4%. b=0.9; TRF 4%; RPM = 5%. Bond-Yield Risk Premium = 3%. If the weight of debt is 30%, weight of equity is 60% and weight of preferred stock is 10%. a. What is the WACC of X corporation. (Show your calculation for each component of WACC and the overall WACC) b. What should be the appropriate discount rate for the expansion program.

3) X Corporation wants to calculates its cost of capital for major expansion program which riskier than the risk level of its current operations ⚫ Tax rate=30%. • 30-year, 10% coupon, annual payment noncallable bonds sell for $1,200. New bonds will be privately placed with no flotation cost. ⚫ 10%, $100 par value, quarterly dividend, perpetual preferred stock sells for $98.50. ⚫ Common stock sells for $100. Do= $8.19 and g=4%. b=0.9; TRF 4%; RPM = 5%. Bond-Yield Risk Premium = 3%. If the weight of debt is 30%, weight of equity is 60% and weight of preferred stock is 10%. a. What is the WACC of X corporation. (Show your calculation for each component of WACC and the overall WACC) b. What should be the appropriate discount rate for the expansion program.

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:3) X Corporation wants to calculates its cost of capital for major expansion program which

riskier than the risk level of its current operations

⚫ Tax rate=30%.

• 30-year, 10% coupon, annual payment noncallable bonds sell for $1,200. New bonds

will be privately placed with no flotation cost.

⚫ 10%, $100 par value, quarterly dividend, perpetual preferred stock sells for $98.50.

⚫ Common stock sells for $100. Do= $8.19 and g=4%.

b=0.9; TRF 4%; RPM = 5%.

Bond-Yield Risk Premium = 3%.

If the weight of debt is 30%, weight of equity is 60% and weight of preferred stock is 10%.

a. What is the WACC of X corporation. (Show your calculation for each component of

WACC and the overall WACC)

b. What should be the appropriate discount rate for the expansion program.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning