Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:3

Question 2 of 2

E

D

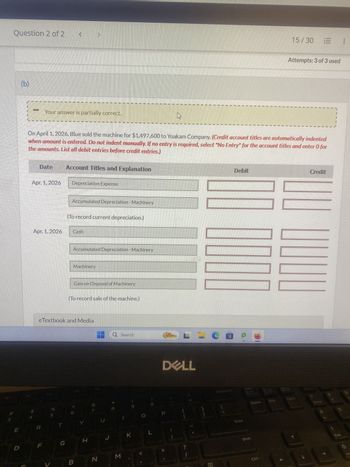

(b)

Your answer is partially correct.

Date

Apr. 1, 2026

Apr. 1, 2026

R

On April 1, 2026, Blue sold the machine for $1,497,600 to Yoakam Company. (Credit account titles are automatically indented

when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for

the amounts. List all debit entries before credit entries.)

%

V

T

Account Titles and Explanation

G

Depreciation Expense

Accumulated Depreciation - Machinery

(To record current depreciation.)

Cash

eTextbook and Media

Accumulated Depreciation - Machinery

Machinery

Gain on Disposal of Machinery

(To record sale of the machine.)

B

H

HQ Search

N

U

J

M

K

L

DELL

LCOP

{

[

1

?

1

Debit

111

Enter

Delete

Shift

Ctrl

End

15/30

1

1

Attempts: 3 of 3 used

1

PgDn

|||

↓

Credit

Home

End

400

0

Ins

Transcribed Image Text:W

S

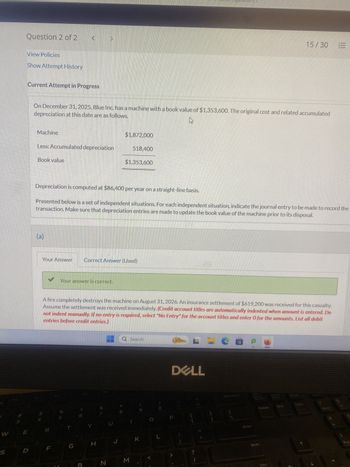

Question 2 of 2 <

View Policies

Show Attempt History

Current Attempt in Progress

D

depreciation at this date are as follows.

On December 31, 2025, Blue Inc. has a machine with a book value of $1,353,600. The original cost and related accumulated

Machine

Less: Accumulated depreciation

Book value

(a)

$

Depreciation is computed at $86,400 per year on a straight-line basis.

Presented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the

transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal.

✓ Your answer is correct.

Your Answer Correct Answer (Used)

F

%

Y

A fire completely destroys the machine on August 31, 2026. An insurance settlement of $619,200 was received for this casualty.

Assume the settlement was received immediately. (Credit account titles are automatically indented when amount is entered. Do

not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit

entries before credit entries.)

H

$1,872,000

N

U

518,400

$1,353,600

J

M

Search

K

L

DELL

{

?

1

CE

31

Enter

Delete

Shift

15/30 E

Ctrl

End

PgDn

Home

4

End

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Assuming that the market price as of December 31, 2020, is $2.97, record the journal entry. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places, eg. 6,225.) Date Account Titles and Explanation Debit Credit Dec. 31 Unrealized Holding Gain or Loss - Income 12540 Estimated Liability on Purchase Commitments 12540 eTextbook and Media List of Accounts Attempts: 1 of 1 used (c2) Give the entry in January 2021, when the 38,000-gallon shipment is received, assuming that the situation given in (b2) above existed at December 31, 2020, and that the market price in January 2021 was $2.97 per gallon. Prepare the journal entry for when the materials are received in January 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the…arrow_forwardPlease dont use any AI. It's strictly prohibited.arrow_forwardPlease dont provide solution image based thanxarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education