ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

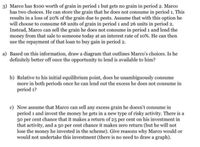

Transcribed Image Text:3) Marco has $100 worth of grain in period 1 but gets no grain in period 2. Marco

has two choices. He can store the grain that he does not consume in period 1. This

results in a loss of 20% of the grain due to pests. Assume that with this option he

will choose to consume 68 units of grain in period 1 and 26 units in period 2.

Instead, Marco can sell the grain he does not consume in period 1 and lend the

money from that sale to someone today at an interest rate of 10%. He can then

use the repayment of that loan to buy gain in period 2.

a) Based on this information, draw a diagram that outlines Marco's choices. Is he

definitely better off once the opportunity to lend is available to him?

b) Relative to his initial equilibrium point, does he unambiguously consume

more in both periods once he can lend out the excess he does not consume in

period 1?

c) Now assume that Marco can sell any excess grain he doesn't consume in

period 1 and invest the money he gets in a new type of risky activity. There is a

50 per cent chance that it makes a return of 25 per cent on his investment in

that activity, and a 50 per cent chance it makes zero return (but he will not

lose the money he invested in the scheme). Give reasons why Marco would or

would not undertake this investment (there is no need to draw a graph).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Assume a consumer has current-period income y = 200, future-period income y′ = 150, current and future taxes t = 40 and t′ = 50, respectively, and faces a market real interest rate of r = 0.05, or 5% per period. The consumer would like to consume according to the following utility function: U (c, c′ ) = ln(c) + ln(c′ ). Show mathematically the lifetime budget constraint for this consumer. Find the optimal consumption in the current and future periods and optimal saving. Suppose that instead of r = 0.05 the interest rate is r = 0.1. Repeat parts (a) and (b). Does the substitution effect or the income effect dominate?arrow_forwardThe following table shows the quantity D of wheat, in billions of bushels, that wheat consumers are willing to purchase in a year at a price P, in dollars per bushel. D = quantity of wheat P = price 1.0 $2.05 1.5 $1.75 2.0 $1.45 2.5 $1.15 In economics, it is customary to plot D on the horizontal axis and P on the vertical axis, so we will think of D as a variable and of P as a function of D. (a) Show that these data can be modeled by a linear function. For each increase of 0.50 in D there is of in P. Find its formula. (Use P for price and D for quantity.)P = −.6d+265 (b) Add the graph of the linear formula you found in part (a), which is called the market demand curve, to the following graph based on the following table for market supply curve. S = quantity of wheat P = price 1.0 $1.35 1.5 $2.40 2.0 $3.45 2.5 $4.50arrow_forwardSuppose your only source of income is work and that you are paid $20 per hour. This determines a budget constraint. You can buy free time at the expense of your income by working less. Likewise, you can get more income at the expense of your free time by working more. Suppose that you can choose how many hours you work. 5- Which of the two effects is the strongest in this example? How can you tell?arrow_forward

- Columns 1 through 4 of the accompanying table show the marginal utility, measured in utils, that Ricardo would get by purchasing various amounts of products A, B, C, and D. Column 5 shows the marginal utility Ricardo gets from saving. Assume that the prices of A, B, C, and D are $18, $6, $4, and $24, respectively, and that Ricardo has an income of $105. What quantities of A, B, C, and D will Ricardo purchase in maximizing his utility? How many dollars will Ricardo choose to save? Check your answers by substituting them into the algebraic statement of the utility‑maximizing rule. In other words, show it works when using this rule.arrow_forwardPlease teach not just solvearrow_forwardEngineering Econ HW3 Q2arrow_forward

- Greg has the following utility function: u=2057 20.43. He has an income of $96.00, and he faces these prices: (P1, P2) (9.00, 9.00). Suppose that the price of an increases by $1.00. Calculate the equivalent variation for this price change. =arrow_forwardA consumer has a budget of $3000 in a given period, and wishes to buy two goods, X and Y, so as to maximise his utility. The price of good X is $5 and the price of good Y is $2, and his MRS is given by the formula 2Y/X. How many units of good X will he buy in that period?arrow_forwardSuppose you have a monthly income of $1000, $850 in monthly expenses, and you can put money in a savings account that yields a monthly interest rate of 4%. Create a budget constraint showing the trade-off between present consumption (horizontal axis) and future consumption (vertical axis). How much will you have in the future if you choose to consume $850 now? Show this point on your budget constraint.arrow_forward

- 2. Suppose Jill derives utility from not only consuming goods, but also from enjoying leisure time. Let her utility function be defined as follows: U=C.25.R.75 where C is a consumption good that can be bought at a price of $1 and R is hours of leisure (relaxation) consumed per day. There are 24 hours in a day and leisure is defined as time spent not working. Jill has a job that pays $w per hour, a trust fund that pays her $M per day, and she can work any number of hours per day, L, she desires. C, consumption good; R, Leisure (relaxation); L, labor M, non-wage income; w, wage rate. a. Derive her labor supply function? b. Assume M = $100, at what wage is her quantity supplied of hours = 0?arrow_forward3. Consider a parent who is altruistic towards her child, but also cares about her own consumption. The parent's utility over her own consumption and that of her child is up = log(co) +a log(ci) where c is the child's consumption, and a > 0 is the degree of parental altruism. Suppose that the parent can invest in the child's human capital by spending money (e) on her education; education generates human capital h /() and human capital is paid at rate w. The parent has a total income of (a) Write down an expression for the child's future consumption in terms of the parent's choice of e. (b) Now write down the Lagrangian for the parent's decision problem.arrow_forwardFor each example listed, decide if the good is a normal good or an inferior good. Make sure you answer from the perspective of the individual or individuals doing the buying or consuming. Billy's mom increases his weekly allowance by %5. As a result, Billy increases the number of apps he downloads on his smartphone. Smartphone apps arearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education