ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

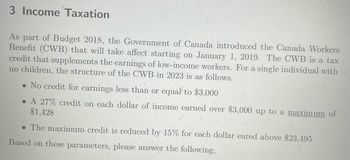

Transcribed Image Text:3 Income Taxation

As part of Budget 2018, the Government of Canada introduced the Canada Workers

Benefit (CWB) that will take affect starting on January 1, 2019. The CWB is a tax

credit that supplements the earnings of low-income workers. For a single individual with

no children, the structure of the CWB in 2023 is as follows.

• No credit for earnings less than or equal to $3,000

. A 27% credit on each dollar of income earned over $3,000 up to a maximum of

$1,428

. The maximum credit is reduced by 15% for each dollar eared above $23,495

Based on these parameters, please answer the following.

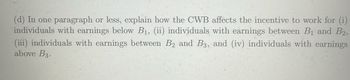

Transcribed Image Text:(d) In one paragraph or less, explain how the CWB affects the incentive to work for (i)

individuals with earnings below B₁, (ii) individuals with earnings between B₁ and B₂,

(iii) individuals with earnings between B₂ and B3, and (iv) individuals with earnings

above B3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Economics Over the past decade, holiday gift cards have become increasingly popular at online retailers. Not long ago, online shoppers had to really hunt at most e-retailer' sites to purchase a gift card, but today it is easier to purchase gift cards online than at traditional retail outlets. Provide a comprehensive initial post answering the following questions: Do you think online gift cards are merely a fad? Explain carefully.arrow_forward1. Understanding the implications of taxes on welfare The following graph represents the demand and supply for blinkies (an imaginary product). The black point (plus symbol) indicates the pre-tax equilibrium. Suppose the government has just decided to impose a tax on this market; the grey points (star symbol) indicate the after-tax scenario. PRICE (Dollars per blinkie) Demand Supply A 56.00 40.00 B DE 24.00 F QUANTITY (Blinkies) Complete the following table, given the information presented on the graph. Result Per-unit tax Value Price producers receive after tax Equilibrium quantity before tax (?) In the following table, indicate which areas on the previous graph correspond to each concept. Check all that apply. Concept Producer surplus before the tax is imposed Deadweight loss after the tax is imposed Consumer surplus after the tax is imposed A B C D E F ☐ ☐ ☐arrow_forwardA regressive tax is a tax for which people with lower incomes Group of answer choices pay a lower percentage of their incomes in tax than do people with higher incomes. pay a higher percentage of their incomes in tax than do people with higher incomes. pay the same percentage of their incomes in tax as do people with higher incomes. do not have to pay unless their incomes exceeds a certain amount.arrow_forward

- There are two individuals in a society. The federal income tax in this society is such that that the first $20,000 of income is taxed at 10% and income above that is taxed at 30%. The federal government allows taxes paid to local governments to be deducted. James earns a gross income of $40,000, and Jane earns a gross income of $65,000. Out of his income, James pays $1,000 in local taxes; out of her income, Jane pays $20,000 in local taxes. Which of the following statements is true? a. The federal tax system is proportional. b. James’ total (local + federal) tax bill is greater than Jane’s total tax bill. c. The federal tax system is regressive d. The federal tax system is progressive.arrow_forwardThere is a question that requires students to "explain how the tax rates apply to individuals in Australia and the alternative from flat tax rates that apply to companies. Students will also be required to explain generally how capital gains are dealt with as statutory income. Students are expected to be able to reflect on what they have learnt about the tax system as it is in 2024 especially in regard to the overall fairness between the rich and poor. Your reflection should show that you now understand the main principles in the tax system and can make a personal reflection appropriate for post graduate level students." How do you answer this type of question? what is the format? what are the things that need to be covered?arrow_forwardDefine the followingarrow_forward

- 12. Study Questions and Problems #12 Consider the first three columns of the following table, which outline a hypothetical Negative Income Tax plan. Complete the last column of the table. Family Income Negative Tax Positive Tax Total After-Tax Income $0 $10,000 $0 S 5,000 $7,500 0 S 10,000 $5,000 0 S 15,000 $2,500 0 S 20,000 0 0 S 25,000 0 -$2,500 S 30,000 -$5,000 S 35,000 -$7,500 Sarrow_forwardLabor Income, Tax Pald, and Average Tax Rate Individual Samantha Charles Amanda Young Labor Income (dollars) $45,000 60,000 80,000 105,000 Tax Paid (dollars) $100 100 100 100 Instructions: Round your answers to 2 decimal places. Average Tax Rate (percent) de dese % dearrow_forwardConsider the first three columns of the following table, which outline a hypothetical Negative Income Tax plan. Complete the last column of the table. Family Income Negative Tax Positive Tax Total After-Tax Income 50 $20,000 50 S 5,000 $15,000 0 S 10,000 $10,000 S 15,000 $5,000 0 20,000 0 0 S 25,000 0 -$5,000 30,000 35,000 OO -$10,000 S -$15,000arrow_forward

- Describe the relevance of taxation for understanding the American welfare state. How have political institutions shaped the American welfare state?arrow_forwardMACROECONOMICS Progressive Tax Based on your yearly income above, calculate the amount of tax each income bracket would pay under a progressive tax plan. Each row up to the total income amount should be filled in. For an example of a completed chart, go to Page 4 of Lesson 05.03: Sharing with Uncle Sam. Calculate the tax for $95,000. For example, $10,000x40%-%$4,000 in tax. Show your work!! Proposed Regressive Plan Calculate the tax for S25,000. For example, $10,000x40%=$4,000 in tax. Show your work!! 10% on income up to $25,000 20% on income between S25,000 and S34,000 25% on income between S34,000 and S44,000 30% on income between $44,000 and S80,000 40% on taxable income over S80,000 TOTAL TAX PAID (sum of all rows):arrow_forwardJohn works from 7am to 4pm 5 days a week, he does not receive overtime He gets an hour unpaid lunch During the year john gets paid for : 10 holiday days, 10 sick days, 14 vacation days, 5 personal days John is paid $20 an hour Johns weekly federal income tax deduction is $65, social security tax is .062 of his gross wage, medicare tax is .008 of his gross pay, and state tax is $25 per week What would John's gross and net pay be for the year ending December 31st, 2021?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education