FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

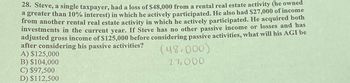

Transcribed Image Text:28. Steve, a single taxpayer, had a loss of $48,000 from a rental real estate activity (he owned

a greater than 10% interest) in which he actively participated. He also had $27,000 of income

from another rental real estate activity in which he actively participated. He acquired both

investments in the current year. If Steve has no other passive income or losses and has

adjusted gross income of $125,000 before considering passive activities, what will his AGI be

after considering his passive activities?

A) $125,000

B) $104,000

C) $97,500

D) $112,500

(48,000)

27,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Martha has a net capital loss of $17,000 and other ordinary taxable income of $45,000 for the current year. What is the amout of Marth's capital loss carryover?arrow_forwardAram's taxable income before considering capital gains and losses is $82,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer) Required: a. Aram sold a capital asset that he owned for more than one year for a $5,440 gain, a capital asset that he owned for more than one year for a $720 loss, a capital asset that he owned for six months for a $1,640 gain, and a capital asset he owned for two months for a $1,120 loss. b. Aram sold a capital asset that he owned for more than one year for a $2.220 gain, a capital asset that he owned for more than one year for a $2,940 loss, a capital asset that he owned for six months for a $420 gain, and a capital asset he owned for two months for a $2.340 loss c. Aram sold a capital asset that he owned for more than one year for a $2.720 loss, a capital asset that he owned for six months for a $4,640 gain, and a capital asset…arrow_forwardNoah Yobs, age 55, who has $57,400 of AGI (solely from wages) before considering rental activities, has $51,660 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity from which he has $28,700 of income. He has other passive activity income of $18,368. a. What amount of rental loss can Noah use to offset active or portfolio income in the current year?$fill in the blank 3ed587f89fd0031_1 b. Compute Noah's AGI on Form 1040 [page 1; also complete Schedule 1 (Form 1040)] for the current year. Use the minus sign to indicate a loss.arrow_forward

- Timothy died in January of this year. He had an allowable capital loss of \\( \\$ 80,000 \\) in the year of his death. He had taxable capital gains of \\( \\$ 25,000 \\) in each of prior three years. He had no other income in the last four years. What is the amount of Timothy's unabsorbed net loss? a) \\( \\$ 0 \\) b) \\(\\$ 5,000 \\) c) \\( \\$ 80,000 \\) d) \\( \\$ 30,000 \\)arrow_forwardAram's taxable income before considering capital gains and losses is $71,000. Determine Aram's taxable income and how much of the income will be taxed at ordinary rates in each of the following alternative scenarios (assume Aram files as a single taxpayer). Required: Aram sold a capital asset that he owned for more than one year for a $5,220 gain, a capital asset that he owned for more than one year for a $610 loss, a capital asset that he owned for six months for a $1,420 gain, and a capital asset he owned for two months for a $1,010 loss. Aram sold a capital asset that he owned for more than one year for a $2,110 gain, a capital asset that he owned for more than one year for a $2,720 loss, a capital asset that he owned for six months for a $310 gain, and a capital asset he owned for two months for a $2,120 loss. Aram sold a capital asset that he owned for more than one year for a $2,610 loss, a capital asset that he owned for six months for a $4,420 gain, and a capital asset he…arrow_forwardTim, a single taxpayer, operates a business as a single-member LLC. In 2023, his LLC reports business income of $367,500 and business deductions of $643, 125, resulting in a loss of $ 275,625. What are the implications of this business loss? a. Tim has an excess business loss of $fill in the blank 1 44,000. b. Can this business loss be used to offset other income that Tim reports? If so, how much? If not, what happens to the loss? Tim may use Sfill in the blank 2 289,000 of the $333,000 LLC business loss, to offset nonbusiness income. The excess business loss is treated as part of Tim's NOL carryforward.arrow_forward

- In 2021, Avi, a single taxpayer, had taxable income of $110,000. This amount included short-term capital losses of $2,000 and long-term capital losses of $12,000. He had no other capital transations in prior years. What is Avi's capital loss carryover to 2022? - $0 - $9,000 - $11,000 - $14,000arrow_forwardReview the following scenario. Use the information provided to answer questions about the taxpayer’s 2020 return.Liam Hernandez (38) paid $112,000 for a single-family home on July 1, 2020, and immediately placed it in service as a residential rental property. At the time, the land was valued at $10,000. The property generated $6,000 in rental income for the year. Liam’s only expenses consisted of depreciation, $500 in insurance, and $750 in real estate taxes.Liam is not a real estate professional, but he does actively participate in his rental real estate activity. He did not provide any personal services during the year, although he has notified his tenant that he will make minor repairs to the property as needed. Liam has no other passive income or losses. Question 1 What amount should Liam report for his total rental real estate and royalty income? His partially completed Schedule E, Supplemental Income and Loss, is shown below. You may use the form to assist you in answering this…arrow_forwardwho has AGI of $80,000 before considering rental activities, is activein three separate real estate rental activities and is in the 22% tax bracket.She has $12,000 of losses from Activity A, $18,000 of losses from Activity B, and income of $10,000 from Activity C. She also has $2,100 of tax credits from Activity A. Calculate the deductions and credits that she is allowed and the suspended losses and creditsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education