Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

please help me check my work and help solve any unsolved questions, thanks!

![23. An investor is considering adding one additional stock to a 3-stock portfolio, to form a 4-stock portfolio. The

investor is highly risk averse and has asked for your advice. The three stocks currently held in the portfolio all

have Beta = 1.0. Potential new Stocks A and B both have expected returns of 15%, are in equilibrium [neither

over- or under-valued], and are equally correlated with the market, with correlation coefficient r = 0.75.

However, Stock A's standard deviation of returns is 12% versus 8% for Stock B. Which stock should this

investor add to the portfolio, or does the choice not matter?

a. Stock A since its Beta is lower.

b.

Stock B since its Beta is lower.

C.

Neither A nor B, as neither has a return sufficient to compensate for risk.

d. It does not matter whether A or B is added, since both will reduce the portfolio's risk by the same amount.

e. There is not enough information to determine which stock would reduce portfolio risk by a greater amount.

24. Stock A's beta is 1.7 and Stock B's beta is 0.7. Which of the following statements must be true about these

securities? (Assume both stocks are at their market equilibriums.)

25. Which of the following statements is CORRECT?

a. If you found a stock with a zero historical beta and held it as the only stock in your portfolio, you would by

definition have a riskless portfolio.

b. The beta coefficient of a stock is normally found by regressing past returns on a stock against past market

returns. One could also construct a scatter diagram of returns on the stock versus those on the market,

estimate the slope of the line of best fit, and use it as beta. However, this historical beta may differ from the

beta that exists in the future.

c. The beta of a portfolio of stocks is always larger than the betas of any of the individual stocks.

d.

It is theoretically possible for a stock to have a beta of 1.0. If a stock did have a beta of 1.0, then, at least in

theory, its required rate of return would be equal to the risk-free (default-free) rate of return.

The beta of a portfolio of stocks is always smaller than the betas of any of the individual stocks.

e.

26. Stock X has a beta of 0.7 and Stock Y has a beta of 1.7. Which of the following statements must be true,

according to the CAPM?

Stock Y's realized return during the coming year will be higher than Stock X's return.

b. If the expected rate of inflation increases but the market risk premium is unchanged, the required returns on

the two stocks should increase by the same amount.

Stock Y's return has a higher standard deviation than Stock X.

If the market risk premium declines, but the risk-free rate is unchanged, Stock X will have a larger decline in

its required return than will Stock Y.

C.

d.

a. Stock B must be a more desirable addition to a portfolio than A.

b. Stock A must be a more desirable addition to a portfolio than B.

c. The expected return on Stock A should be greater than that on B.

d. The expected return on Stock B should be greater than that on A.

e. When held in isolation, Stock A has more risk than Stock B.

e.

a.

27. Which of the following statements is CORRECT?

Suppose the returns on two stocks are negatively correlated. One has a beta of 1.2 as determined in a

regression analysis using data for the last 5 years, while the other has a beta of -0.6. The returns on the stock

with the negative beta must have been negatively correlated with returns on most other stocks during that

5-year period.

C.

If you invest $50,000 in Stock X and $50,000 in Stock Y, your 2-stock portfolio would have a beta significantly

lower than 1.0, provided the returns on the two stocks are not perfectly correlated.

e.

Page 6 of 9

b. Suppose you are managing a stock portfolio, and you have information that leads you to believe the stock

market is likely to be very strong in the immediate future. That is, you are convinced that the market is about

to rise sharply. You should sell your high-beta stocks and buy low-beta stocks in order to take advantage of

the expected market move.

You think that investor sentiment is about to change, and investors are about to become more risk averse.

This suggests that you should re-balance your portfolio to include more high-beta stocks.

d. If the market risk premium remains constant, but the risk-free rate declines, then the required returns on

low-beta stocks will rise while those on high-beta stocks will decline.

Paid-in-Full Inc. is in the business of collecting past-due accounts for other companies, i.e., it is a collection

agency. Paid-in-Full's revenues, profits, and stock price tend to rise during recessions. This suggests that

Paid-in-Full Inc.'s beta should be quite high, say 2.0, because it does so much better than most other

companies when the economy is weak.](https://content.bartleby.com/qna-images/question/3daea104-4b11-414e-ab05-caf231aaf22d/cb7bb4c4-0d0b-4e13-b082-5a30d77c7cf6/tq26mte_thumbnail.png)

Transcribed Image Text:23. An investor is considering adding one additional stock to a 3-stock portfolio, to form a 4-stock portfolio. The

investor is highly risk averse and has asked for your advice. The three stocks currently held in the portfolio all

have Beta = 1.0. Potential new Stocks A and B both have expected returns of 15%, are in equilibrium [neither

over- or under-valued], and are equally correlated with the market, with correlation coefficient r = 0.75.

However, Stock A's standard deviation of returns is 12% versus 8% for Stock B. Which stock should this

investor add to the portfolio, or does the choice not matter?

a. Stock A since its Beta is lower.

b.

Stock B since its Beta is lower.

C.

Neither A nor B, as neither has a return sufficient to compensate for risk.

d. It does not matter whether A or B is added, since both will reduce the portfolio's risk by the same amount.

e. There is not enough information to determine which stock would reduce portfolio risk by a greater amount.

24. Stock A's beta is 1.7 and Stock B's beta is 0.7. Which of the following statements must be true about these

securities? (Assume both stocks are at their market equilibriums.)

25. Which of the following statements is CORRECT?

a. If you found a stock with a zero historical beta and held it as the only stock in your portfolio, you would by

definition have a riskless portfolio.

b. The beta coefficient of a stock is normally found by regressing past returns on a stock against past market

returns. One could also construct a scatter diagram of returns on the stock versus those on the market,

estimate the slope of the line of best fit, and use it as beta. However, this historical beta may differ from the

beta that exists in the future.

c. The beta of a portfolio of stocks is always larger than the betas of any of the individual stocks.

d.

It is theoretically possible for a stock to have a beta of 1.0. If a stock did have a beta of 1.0, then, at least in

theory, its required rate of return would be equal to the risk-free (default-free) rate of return.

The beta of a portfolio of stocks is always smaller than the betas of any of the individual stocks.

e.

26. Stock X has a beta of 0.7 and Stock Y has a beta of 1.7. Which of the following statements must be true,

according to the CAPM?

Stock Y's realized return during the coming year will be higher than Stock X's return.

b. If the expected rate of inflation increases but the market risk premium is unchanged, the required returns on

the two stocks should increase by the same amount.

Stock Y's return has a higher standard deviation than Stock X.

If the market risk premium declines, but the risk-free rate is unchanged, Stock X will have a larger decline in

its required return than will Stock Y.

C.

d.

a. Stock B must be a more desirable addition to a portfolio than A.

b. Stock A must be a more desirable addition to a portfolio than B.

c. The expected return on Stock A should be greater than that on B.

d. The expected return on Stock B should be greater than that on A.

e. When held in isolation, Stock A has more risk than Stock B.

e.

a.

27. Which of the following statements is CORRECT?

Suppose the returns on two stocks are negatively correlated. One has a beta of 1.2 as determined in a

regression analysis using data for the last 5 years, while the other has a beta of -0.6. The returns on the stock

with the negative beta must have been negatively correlated with returns on most other stocks during that

5-year period.

C.

If you invest $50,000 in Stock X and $50,000 in Stock Y, your 2-stock portfolio would have a beta significantly

lower than 1.0, provided the returns on the two stocks are not perfectly correlated.

e.

Page 6 of 9

b. Suppose you are managing a stock portfolio, and you have information that leads you to believe the stock

market is likely to be very strong in the immediate future. That is, you are convinced that the market is about

to rise sharply. You should sell your high-beta stocks and buy low-beta stocks in order to take advantage of

the expected market move.

You think that investor sentiment is about to change, and investors are about to become more risk averse.

This suggests that you should re-balance your portfolio to include more high-beta stocks.

d. If the market risk premium remains constant, but the risk-free rate declines, then the required returns on

low-beta stocks will rise while those on high-beta stocks will decline.

Paid-in-Full Inc. is in the business of collecting past-due accounts for other companies, i.e., it is a collection

agency. Paid-in-Full's revenues, profits, and stock price tend to rise during recessions. This suggests that

Paid-in-Full Inc.'s beta should be quite high, say 2.0, because it does so much better than most other

companies when the economy is weak.

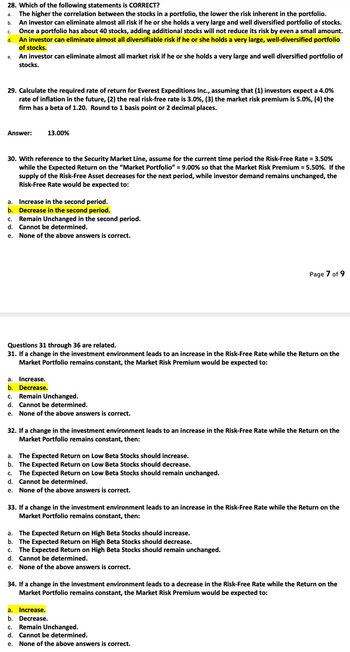

Transcribed Image Text:28. Which of the following statements is CORRECT?

The higher the correlation between the stocks in a portfolio, the lower the risk inherent in the portfolio.

An investor can eliminate almost all risk if he or she holds a very large and well diversified portfolio of stocks.

Once a portfolio has about 40 stocks, adding additional stocks will not reduce its risk by even a small amount.

An investor can eliminate almost all diversifiable risk if he or she holds a very large, well-diversified portfolio

of stocks.

An investor can eliminate almost all market risk if he or she holds a very large and well diversified portfolio of

stocks.

a.

b.

C.

d.

e.

29. Calculate the required rate of return for Everest Expeditions Inc., assuming that (1) investors expect a 4.0%

rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the

firm has a beta of 1.20. Round to 1 basis point or 2 decimal places.

Answer:

13.00%

30. With reference to the Security Market Line, assume for the current time period the Risk-Free Rate = 3.50%

while the Expected Return on the "Market Portfolio" = 9.00% so that the Market Risk Premium = 5.50%. If the

supply of the Risk-Free Asset decreases for the next period, while investor demand remains unchanged, the

Risk-Free Rate would be expected to:

a. Increase in the second period.

b. Decrease in the second period.

Remain Unchanged in the second period.

Cannot be determined.

None of the above answers is correct.

C.

d.

e.

Questions 31 through 36 are related.

31. If a change in the investment environment leads to an increase in the Risk-Free Rate while the Return on the

Market Portfolio remains constant, the Market Risk Premium would be expected to:

a. Increase.

b. Decrease.

c. Remain Unchanged.

d. Cannot be determined.

e. None of the above answers is correct.

32. If a change in the investment environment leads to an increase in the Risk-Free Rate while the Return on the

Market Portfolio remains constant, then:

a. The Expected Return on Low Beta Stocks should increase.

b. The Expected Return on Low Beta Stocks should decrease.

C. The Expected Return on Low Beta Stocks should remain unchanged.

d. Cannot be determined.

e. None of the above answers is correct.

Page 7 of 9

33. If a change in the investment environment leads to an increase in the Risk-Free Rate while the Return on the

Market Portfolio remains constant, then:

a. The Expected Return on High Beta Stocks should increase.

b. The Expected Return on High Beta Stocks should decrease.

c. The Expected Return on High Beta Stocks should remain unchanged.

d. Cannot be determined.

e. None of the above answers is correct.

34. If a change in the investment environment leads to a decrease in the Risk-Free Rate while the Return on the

Market Portfolio remains constant, the Market Risk Premium would be expected to:

a. Increase.

b. Decrease.

c. Remain Unchanged.

d. Cannot be determined.

e. None of the above answers is correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You own a portfolio equally invested in a risk-free asset and two stocks. If one of the stocks has a beta of 1.23 and the total portfolio is equally as risky as the market, what must the beta be for the other stock in your portfolio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Stock beta 1.20arrow_forwardAssume an economy in which there are three securities: Stock A with rA = 10% and σA = 10%; Stock B with rB = 15% and σB = 20%; and a riskless asset with rRF = 7%. Stocks A and B are uncorrelated (rAB = 0). Which of the following statements is most CORRECT? 1. b. The expected return on the investor’s portfolio will probably have an expected return that is somewhat below 10% and a standard deviation (SD) of approximately 10%. 2. d. The investor’s risk/return indifference curve will be tangent to the CML at a point where the expected return is in the range of 7% to 10%. 3. e. Since the two stocks have a zero correlation coefficient, the investor can form a riskless portfolio whose expected return is in the range of 10% to 15%. 4. a. The expected return on the investor’s portfolio will probably have an expected return that is somewhat above 15% and a standard deviation (SD) of approximately 20%. 5.…arrow_forwardQuestions: a. Compute the expected return for stock X and for stock Y b. Compute the standard deviation for stock X and for stock Y. c. Determine the best course to take for investing.arrow_forward

- Please do stepwise and correct please ill like.. pls correctarrow_forwardFinance The risk-free rate is 3.7 percent and the expected return on the market is 12.3 percent. Stock A has a beta of 1.1and an expected return of 13.1 percent. Stock B has a beta of .86 and an expected return of 11.4 percent. Arethese stocks correctly priced? Why or why not? Use E(Ri) = Rf + βi(E(RM) − Rf).arrow_forwardPlease answer fast I give you upvote.arrow_forward

- Give typing answer with explanation and conclusion The return on the Tarheel Corporation stock is expected to be 14 percent with a standard deviation of 9 percent. The beta of Tarheel is 0.9. The risk-free rate is 6 percent, and the expected return on the market portfolio is 16 percent. What is the probability that an investor in Tarheel will earn a rate of return less than the required rate of return? Assume that returns are normally distributed. Use Table V to answer the question. Round z value in intermediate calculation to two decimal places. Round your answer to the nearest whole number.arrow_forwardYou own a portfolio equally invested in a risk-free asset and two stocks. One of the stocks has a beta of 1.27 and the total portfolio is equally as risky as the market. What must the beta be for the other stock in your portfolio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Betaarrow_forwardCurrently the risk-free rate equals 5% and the expected return on the market portfolio equals 11%. An investment analyst provides you with the following information: Stock A Beta 1.33 Expected Return 12% Stock B Beta 0.7 Expected Return 10% (a) Calculate the reward-to-risk ratios of stock A, stock B and in market equilibrium. Are stock A and stock B overvalued, undervalued or fairly valued? Briefly explain. [within 150 words] (b) You want a portfolio with the same risk as the market. Calculate the weights of stock A and B respectively. (please show me steps and round the final answer to 2 decimal places, thanks)arrow_forward

- You own a portfolio equally invested in a risk-free asset and two stocks. One of the stocks has a beta of 1.16 and the total portfolio is equally as risky as the market. What must the beta be for the other stock in your portfolio? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Betaarrow_forwardStock X has a beta of 0.5 and Stock Y has a beta of 1.5. Which of the following statements must be true about these securities? (Assume market equilibrium.) Group of answer choices If the market risk premium declines, Stock Y will have a larger decline in its required return than Stock X. Stock Y has a higher standard deviation than Stock X. If you invest $50,000 in each of Stocks X and Y, your 2-stock portfolio will have a beta lower than 1.0. Stock Y's realized return next year will be higher than Stock X's return. If the expected rate of inflation increases but the market risk premium is unchanged, the required return on Stock Y will increase by more than that on Stock X.arrow_forward26. Two stocks, one high risk (Happy) and one low risk (Lonely), have been evaluated by your company. Your stock analysis team has predicted estimated returns and beta risk in the table below for the two stocks and the market. Using this information, and the CAPM model, draw the risk-return graph, with the security market line, and place the Est(R) and the CAPM required rate of return in their appropriate places on the graph and indicate to me on the graph why Happy and Lonely are either over-valued or under-valued. Provide your answer in the uploaded document. Market Happy Lonely Est(R) 26 1.00 ⠀⠀ 33 1.20 14 0.75 The risk-free rate is 3% Betaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT