FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

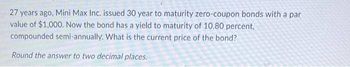

Transcribed Image Text:27 years ago, Mini Max Inc. issued 30 year to maturity zero-coupon bonds with a par

value of $1,000. Now the bond has a yield to maturity of 10.80 percent,

compounded semi-annually. What is the current price of the bond?

Round the answer to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Jackson Corporation's bonds have 10 years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 11%. The bonds have a yield to maturity of 12%. What is the current market price of these bonds? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardAdama's Fish Market Inc. issued a bond that will mature in 15 years. The bond has a face value of $1,000 and an 7% coupon rate, paid semiannually. The price of the bond is currently $1,165. The bond is callable in 5 years at a call price of $1,050. What is the bond's yield to maturity? What is the bond's yield to call?arrow_forwardA bond with a face value of $1,000 was issued at par (sold for its face value) 5 years ago when market interest rates were 3.6% p.a. (compounded annually). It now has exactly 3 years remaining until it matures. If it pays coupon interest annually, and current market rates are 2.4% p.a. (B.E.Y. convention – all maturities), calculate the duration of the bond.arrow_forward

- A corporate bond pays interest twice a year and has 22 years to maturity, a face value of $1,000 and a coupon rate of 6.1%. The bond's current price is $1,463.61. It is callable starting 16 years from now (years to call) at a call price of $1,047. What is the bond's (annualized) yield to maturity?arrow_forwardMadsen Motors's bonds have 15 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 7%, and the yield to maturity is 10%. What is the bond's current market price? Round your answer to the nearest cent. $arrow_forwardA bond that matures in 9years has a $1,000 par value. The annual coupon interest rate is 14 percent and the market's required yield to maturity on a comparable-risk bond is 16 percent. A. What would be the value of this bond if it paid interest annually? (Round to the nearest cent) B. What would be the value of this bond if it paid interest semiannually? (Round to the nearest two decimnal places)arrow_forward

- A 9 year bond with maturity value of $4300.02 and a yield rate of 4.9% was sold 18 months before maturity. If the seller earned 6% on the bond over the time that it was held, then for how much did they sell it? Give your answer rounded to the nearest centarrow_forwardSuppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face value of $1,000, and a coupon rate of 7.6% (annual payments). The yield to maturity on this bond when it was issued was 5.7%. What was the price of this bond when it was issued? www When it was issued, the price of the bond was $. (Round to the nearest cent.)arrow_forwardLast year Carson Industries issued a 10-year, 13% semiannual coupon bond at its par value of $1,000. Currently, the bond can be called in 6 years at a price of $1,065 and it sells for $1,200. a. What are the bond's nominal yield to maturity and its nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: % YTC: % Would an investor be more likely to earn the YTM or the YTC? -Select- b. What is the current yield? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Round your answer to two decimal places. % Is this yield affected by whether the bond is likely to be called? I. If the bond is called, the capital gains yield will remain the same but the current yield will be different. II. If the bond is called, the current yield and the capital gains yield will both be different. III. If the bond is called, the current yield and the capital gains yield will remain the same but the coupon rate will be…arrow_forward

- A bond that matures in 1212 years has a $1 comma 0001,000 par value. The annual coupon interest rate is 1414 percent and the market's required yield to maturity on a comparable-risk bond is 1515 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually?arrow_forwardGrohl Co. issued 9-year bonds a year ago at a coupon rate of 7 percent. The bonds make semiannual payments. If the YTM on these bonds is 10 percent, what is the current bond price?arrow_forwardLast year Carson Industries issued a 10-year, 15% semiannual coupon bond at its par value of $1,000. Currently, the bond can be called in 6 years at a price of $1,075 and it sells for $1,180. What are the bond's nominal yield to maturity and its nominal yield to call? Do not round intermediate calculations. Round your answers to two decimal places. YTM: YTC What is the current yield? What is the expected capital gains (or loss) yield for the coming year? Use amounts calculated in above requirements for calculation, if required. Negative value should be indicated by a minus sign. Round your answer to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education