Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

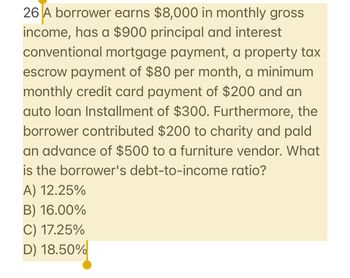

Transcribed Image Text:26 A borrower earns $8,000 in monthly gross

income, has a $900 principal and interest

conventional mortgage payment, a property tax

escrow payment of $80 per month, a minimum

monthly credit card payment of $200 and an

auto loan Installment of $300. Furthermore, the

borrower contributed $200 to charity and pald

an advance of $500 to a furniture vendor. What

is the borrower's debt-to-income ratio?

A) 12.25%

B) 16.00%

C) 17.25%

D) 18.50%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- A prospective car buyer can choose between a fixed and a variable interest rate and can also choose a payment period of 36 months, 48 months, or 60 months. How many total outcomes are possible?arrow_forwardSomeone needs to borrow $15,000 to buy a car and the person has determined that monthly payments of $300 are affordable. The bank offers a 3-year loan at 6% APR, a 4-year loan at 6.5%, or a 5-year loan at 7% APR. Which loan best meets the person's needs? Explain. Which loan best meets the person's needs? (Round to the nearest cent as needed.) A. The first loan best meets the person's needs because the monthly payment of $ is less than the maximum budgeted amount of $300 per month. OB. The second loan best meets the person's needs because the monthly payment of $ maximum budgeted amount of $300 per month. C. The third loan best meets the person's needs because the monthly payment of $ budgeted amount of $300 per month. O D. None of the loans meet the person's needs. is less than the is less than the maximumarrow_forwardLoans and Installment Plans 1. A loan used for buying a home is called a mortgage. The Fortunato family is borrowing $450,000 to buy a home. They are taking out a 30-year mortgage at a rate of 3.55%. a. Compute the monthly payment to the nearest cent. b. Find the total of all of the monthly payments for 30 years. c. What is the total interest? d. Which is greater, the interest or the original cost of the home?arrow_forward

- 1. Kate (she/her) is considering buying or leasing a new car. The cost of the car, before tax, is $31,071.00. a. The lease would cost $108.12/week, including tax, and the term of the lease is 60 months. How much would Kate pay by the end of the 60 months? b. If Kate buys the car, she must pay 13% tax on the selling price. She can finance it for a biweekly amount of $251.79 for 72 months. How much does the car cost, including tax? How much will she pay to purchase the car? c. What are the benefits of each of the options for Kate?arrow_forward10arrow_forward2. Jason's gross monthly income is $3800 a month and he pays monthly expenses of $670 for his mortgage payment, $105 for heating, and $187 in property taxes. a) Determine Jason's Gross Debt Service Ratio (GDSR) if he decides to make monthly mortgage payments of $900 instead of $670. b) Based on the GDSR can Jason afford to make these payments? Justify your answer. Make sure you have saved your work for each question and submit your file when you are ready. Save it as "M1LE4 assign_username.docx"arrow_forward

- 1.7: answersarrow_forwardYou have a credit card that has a balance of $3,589.90 and a credit limit of $5,000. If you have a good credit rating, how much must you pay at the end of the month to get the balance to the acceptable debt ratio percentage? Secured Unsecured Credit APR (%) APR (%) Excellent 4.75 5.50 Good 5.00 5.90 Average 5.85 6.75 Fair 6.40 7.25 Poor 7.50 8.40arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,