FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:25.

Salaries and Wages Expense account was debited

Increased

Decreased

Lesson 3

Preparation of the Trial Balance

EXTEND

Lampad,alin

gake

3-4 Pm

Name:

Time:

The following problem is a continuation to Lesson 2. Use your solutions to

made in Lesson 2. Do requirement no. 3 for this lesson:

John Karlo Dalangin, a dentist, established Dalagan Clinic. The following

transactions occurred during June of this year:

a. Dalangin deposited P280,000 in a bank account in the name of the

business.

b. Bought a 3-in-1 office equipment from Pitular Equipment for P4,950

paying P1,000 in cash and the balance on account.

c. Bought waiting room chairs and a table, paying cash, P12,300.

d. Bought office intercom on account from NE office Supply, P2,750.

e. Received and paid the telephone bill, P1,080.

f. Performed professional services on account, P12,940.

g. Received and paid the electric bill, P1,850.

h. Received and paid the bill for the Regional Dental Convention, P3,500.

i. Performed professional services for cash, P17,650.

j. Partially settled accounts with NE Office Supply, P1,000.

k. Paid rent for the month, P8,400.

1. Paid salaries of the part-time receptionist, P3,500.

m. Dalangin withdrew cash for personal use, P8,500.

n. Received P5,500 on account from patients who were previously billed.

Required:

1. Establish the following accounts in the Ledger: Cash; Accounts

Receivable; Office Equipment; Office Furniture; Accounts Payable;

Dalangin, Capital; Dalangin, Withdrawals; Professional Fees; Salaries

Expense; Rent Expense; Utilities Expense and Miscellaneous Expense.

2. Record the transactions directly into the Ledger using the alphabets

to identify each transaction. Use the sample format below.

3. Prepare the trial balance. (use the blank journal paper in lesson 1)

EVALUATE

3-A Pm

iampod, avinjake

Name:

Time:

Presented below is a trial balance of Elenita Dedumo which was prepared by

an unexperienced bookkeeper:

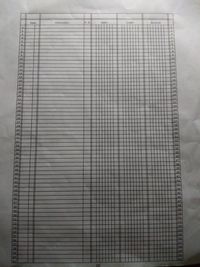

Transcribed Image Text:Date

Particulars

P.R.

Debit

Credit

Balance

2.

3

4.

4.

7.

10

11

12

13

14

15

16

17

18

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

19

20

21

22

23

24

25

25

26

26

27

27

28

28

29

29

30

31

30

31

32

33

32

33

34

34

35

36

35\

36

37

38

37

38

39

39

40

40

41

42

43

41

42

43

44

44

45

45

46

46

47

47

48

48

49

49

50

50

51

51

52

52

53

54

55

53

54

55

56

56

57

57

58.

58

59

59

60

61

10

EEEEEEE

267

234 567

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- **** I want to know in what im wrong and what im missing, Thank you**** Balance Sheet Easy Weight Loss Co. offers personal weight reduction consulting services to individuals. After all the accounts have been closed on November 30, 20Y7, the end of the fiscal year, the balances of selected accounts from the ledger of Easy Weight Loss are as follows: Line Item Description Amount Accounts Payable $10,160 Accounts Receivable 24,490 Accumulated Depreciation - Equipment 30,580 Cash ? Common Stock 180,000 Equipment 88,390 Land 118,000 Prepaid Insurance 5,690 Prepaid Rent 3,560 Retained Earnings 23,810 Salaries Payable 3,960 Supplies 610 Unearned Fees 2,950arrow_forwardSolve thisarrow_forward*Skip Step 1 if using CengageNow PROBLEM 5-4B The account balances of Miss Beverly's Tutoring Service as of June 30, 1,2,3 the end of the current fiscal year, are as follows: TRIAL BALANCE CREDIT LGL DEBIT 6. ACCOUNT NAME 6,491.00 Cash 624.00 Accounts Receivable 527.00 9. Supplies 1,280.00 10 Prepaid Insurance 5,497.00 11 Equipment 2,472.00 12 Accumulated Depreciation, Equipment 13,674.00 13 Van Accumulated Depreciation, Van Accounts Payable 4,168.00 1,436.00 14,848.00 14 15 B. Morrow, Capital B. Morrow, Drawing 18 16 17 18,000.00 Fees Earned 43,680.00 19 Salaries Expense Advertising Expense 21 16,000.00 2,200.00 20 Van Operating Expense 22 705.00 Utilities Expense Miscellaneous Expense 1,248.00 23 358.00 24 25 66,604.00 66,604.00 Sheet1 Sheet2 Sheet3 igure ,567 Required 1. Data for the adjustments are as follows: a. Expired or used up insurance, $470. b. Depreciation expense on equipment, $948.arrow_forward

- please answer all with working please answer with everything like explanation , computation , formulation with steps no copy paste please answer in text not image thanks need complete and correct answer please remember answer all or leave answer all or skiparrow_forwardHow do I figure out each class medical services and meals and residential amounts pleasearrow_forwardPractice help, please.arrow_forward

- Please help me solve itarrow_forwardLearning Outcomes Covered in the Assignment: Outcome No. 3, 4 and 5 > Recording the Journal > Posting in the ledger > Preparing unadjusted trial balance Assignment Question(s) Problem 1. Mr. Amjad started his Car Repair Business in Muscat in June 2020. During the month of June, the following transactions occurred: June 1 Amjad opened the business by investing OMR 200,000. June 2 Purchased Computers for OMR 2,500 and immediately paid OMR 2,000 cash and promised the supplier to pay the remaining amount in the future. June 5 Purchased supplies on account for OMR 8,500. June 6 Provided repair service to a customer, OMR 5,600. The customer paid OMR 2,000 and the remaining will be paid in the near future. June 10 Paid the remaining amount of OMR 500 for the Computers bought June 2. June 15 Provided repair service to a customer on account, OMR 20,000. June 16 Purchased Computer Equipment by cash, OMR 9,000 June 23 Received cash from the customer who was billed on June 15", OMR 20,000. June 24…arrow_forward(Learning Objective 4: Journalize and post transactions) Consultant Mary Gervaispurchased supplies on account for $4,300. Later Gervais paid $3,450 on account.1. Journalize the two transactions on the books of Mary Gervais, Consultant. Include anexplanation for each transaction.2. Open a T-account for Accounts Payable and post to Accounts Payable. Compute thebalance and denote it as Bal.3. How much does the business owe after both transactions? In which account does thisamount appear?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education