Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

GG

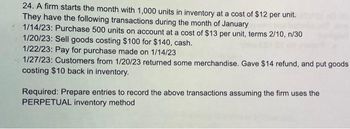

Transcribed Image Text:24. A firm starts the month with 1,000 units in inventory at a cost of $12 per unit.

They have the following transactions during the month of January

1/14/23: Purchase 500 units on account at a cost of $13 per unit, terms 2/10, n/30

1/20/23: Sell goods costing $100 for $140, cash.

1/22/23: Pay for purchase made on 1/14/23

1/27/23: Customers from 1/20/23 returned some merchandise. Gave $14 refund, and put goods

costing $10 back in inventory.

Required: Prepare entries to record the above transactions assuming the firm uses the

PERPETUAL inventory method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Logo Gear purchased $2,250 worth of merchandise during the month, and its monthly income statement shows cost of goods sold of $2,000. What was the beginning inventory if the ending inventory was $1,000?arrow_forwardAmusement tickets estimated sales are: What are the balances in accounts receivable for April, May, and June if 60% of sales are collected in the month of sale, 30% are collected the month after the sale, and 10% are collected the second month after the sale?arrow_forward1. DeForest Company had the following transactions for the month. Sales for the month are $85 per unit. Number of Units Cost per Unit Total Beginning inventory 500 $40 $20,000 Purchased Apr. 30 600 45 27,000 Purchased Aug. 15 650 40 26,000 Purchased Dec. 10 700 35 24,500 Totals (goods available) 2,450 97,500 Ending Inventory 550 ? In the table below, calculate the dollar value for the period for each of the following items using the listed cost allocation methods and using…arrow_forward

- Please Do both questions Delphino’s has sales for the year of $127,300 and cost of goods sold of $86,700. The firm carries an average inventory of $14,300 and has an average accounts payable balance of $13,600. What is the inventory period? 81.36 days 60.20 days 58.68 days 89.02 days The Lumber Yard has projected sales for April through July of $152,400, $161,800, $189,700, and $196,400, respectively. The firm collects 52 percent of its sales in the month of sale, 46 percent in the month following the month of sale, and the remainder in the second month following the month of sale. What is the amount of the July collections? $181,508 $122,852 $189,819 $192,626arrow_forwardPlease help mearrow_forward29. Use the following information for questions (29 to 32). The following information pertains to Adel Company Month Sales Purchases July P25,000 P10,000 August 10,000 2,500 September 15,000 5,000 October 12,500 4,000 November December 15,000 5,000 17,500 5,000 Forty percent of purchases are paid for in cash in the month of purchase, and the balance is paid the following month. Cash is collected from customers in the following manner. Month of sales 20% Month following sales 50% Two months following sales 25% Amount uncollectible 5% What is the amount collected from customers in September? а. Р14,250 b. P15,000 с. Р4,750 d. P13,000 30. What is the amount disbursed to suppliers in October? а. Р4,000 b. P4,600 с. Р5,200 d. P3.925 31. What is the amount disbursed to suppliers in November? a. P15,500 b. P5,400 C. P6.000 d. P4,400arrow_forward

- Use the following information for the next two questions: ABC Co. bills its branch for merchandise at 140% of cost. At the end of its first month, the branch submitted the following data: Merchandise from home office (at billed price) 98,000 Merchandise purchased locally by branch 40,000 Inventory, December 31 of which 7,000 are of local purchase 28,000 Net sales for the month 180,000 How much is the branch’s ending inventory at cost? a. 92,000 b. 20,000 c. 22,000 d. 23,800 How much is the branch’s gross profit in so far as the home office is concerned? a. 70,000 b. 72,000 c. 90,000 d. 92,000arrow_forward1. Bulk Wholesalers took in $378,800 in sales during July. They started the month with inventory worth $173,800 and spent $292,900 on new purchases during the month. Gross margin on sales was 76%. Using the gross profit method, estimate the cost value of the inventory at the end of July. A. $90,912 B. $292,900 C. $375,788 D. $466,700 2.Find the entry you would make on an income statement for TOTAL OPERATING EXPENSES for the year ended December 31, 2007: Gross Sales, $161,000; Sales Returns and Allowances, $9,600; Sales Discounts, $15,600; Merchandise Inventory, January 1, 2011, $52,500; Merchandise Inventory, December 31, 2011, $62,500; Net Purchases, $84,300; Freight In, $3,000; Salaries, $94,300; Rent, $29,800; Utilities, $2,245; Insurance, $3,250; and Income Tax, $19,100. A. $58,500 B. $77,300 C. $129,595 D. $135,800arrow_forwardFlint’s Fabrics sold merchandise for $185000 cash during the month of July. Returns that month totaled $4800. If the company’s gross profit rate is 40%, Flint will report monthly net sales revenue and cost of goods sold of $185000 and $111000. $180200 and $108120. $185000 and $108120. $180200 and $72080.arrow_forward

- Haala Inc. is a merchandising company. Last month the company's cost of goods sold was $68,000. The company's beginning merchandise inventory was $11,000 and its ending merchandise inventory was $17,000. What was the total amount of the company's merchandise purchases for the month? Question 20 options: $96,000 $62,000 $68,000 $74,000arrow_forward1.arrow_forwardAt the end of January, Mineral Labs had an inventory of 905 units, which cost $13 per unit to produce. During February the company produced 1,550 units at a cost of $17 per unit. a. If the firm sold 2,150 units in February, what was the cost of goods sold? (Assume LIFO inventory accounting.) b. If the firm sold 2,150 units in February, what was the cost of goods sold? (Assume FIFO inventory accounting.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning