FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

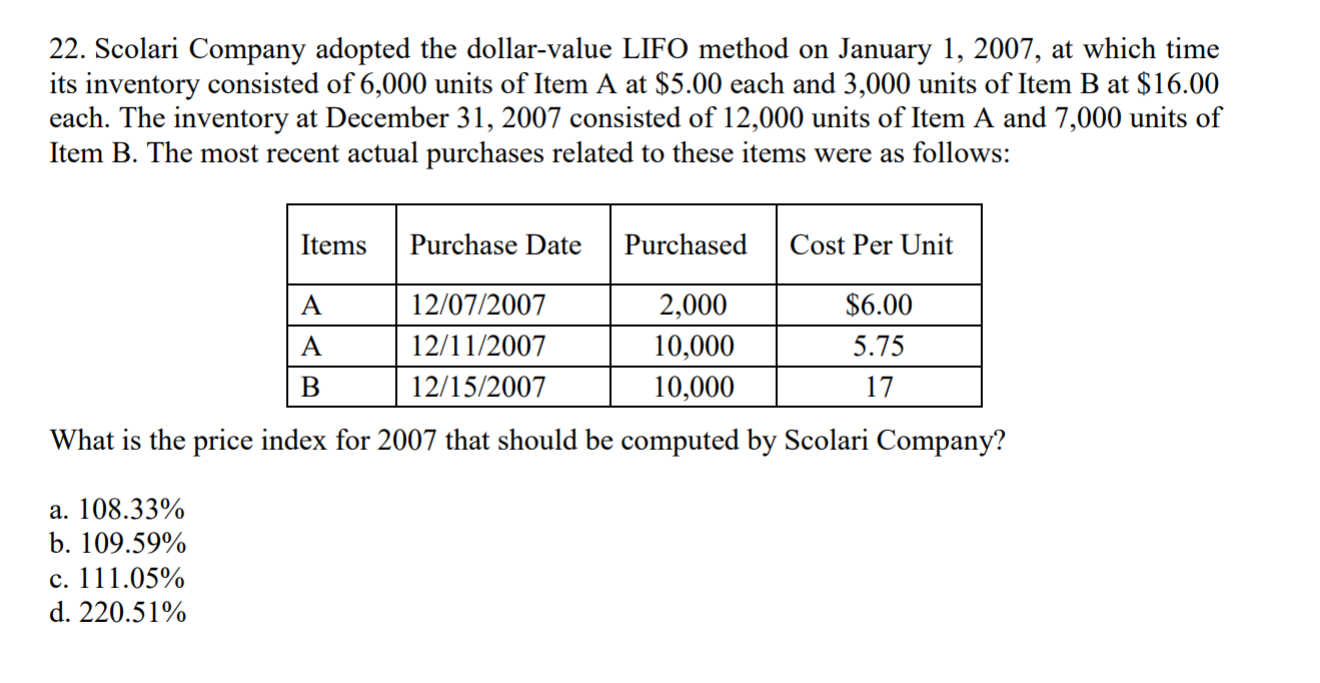

Transcribed Image Text:22. Scolari Company adopted the dollar-value LIFO method on January 1, 2007, at which time

its inventory consisted of 6,000 units of Item A at $5.00 each and 3,000 units of Item B at S16.00

each. The inventory at December 31, 2007 consisted of 12,000 units of Item A and 7,000 units of

Item B. The most recent actual purchases related to these items were as follows:

ItemsPurchase Date Purchased Cost Per Unit

12/07/2007

12/11/2007

12/15/2007

2,000

10,000

10,000

$6.00

5.75

17

What is the price index for 2007 that should be computed by Scolari Company?

a. 108.33%

b. 109.59%

c. 1 1 1.05%

d. 220.51%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Canova Corporation adopted the dollar-value LIFO retail method on January 1, 2024. On that date, the cost of the inventory on hand was $22,000 and its retail value was $27,500. Information for 2024 and 2025 is as follows: Date 12/31/2024 12/31/2025 Ending Inventory Retail Price at Retail $ 36,000 $ 39,000 Required: 1. What is the cost-to-retail percentage for the inventory on hand at 1/1/2024? 2. Calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO retail method. Required 1 Required 2 Index 1.25 1.30 Ending inventory Complete this question by entering your answers in the tabs below. 23,092 $ Cost-to-Retail Percentage 84% 854 Answer is complete but not entirely correct. Calculate the inventory value at the end of 2024 and 2025 using the dollar-value LIFO retail method. Note: Round your answers to the nearest whole dollar amount. 2024 2025 24,112arrow_forwardThe following units of an item were available for sale during the year: Beginning inventory 8, 400 units at $160 Sale 4, 800 units at $300 First purchase 15,100 units at $165 Sale 13, 200 units at $ 300 Second purchase 15, 600 units at $174 Sale 13,700 units at $300 The firm uses the perpetual inventory system, and there are 7,400 units of the item on hand at the end of the year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet What is the total cost of the ending inventory according to FIFO? Round your answer to the nearest dollar. $ fill in the blank 2 What is the total cost of the ending inventory according to LIFO? Round your answer to the nearest dollar. $ fill in the blank 3 Feedback Areaarrow_forward6, please read the qestion and answerarrow_forward

- On January 1, 2024, Select Variety Store adopted the dollar-value LIFO retail inventory method. Accounting records provided the following information: Beginning inventory Net purchases Net markups Net markdowns Net sales Retail price index, end of year Cost $ 51,600 207,640 Retail $ 86,000 360,000 6,000 8,000 337,000 1.04 During 2025 (the following year), purchases at cost and retail were $258,885 and $470,700, respectively. Net markups, net markdowns, and net sales for the year were $5,000, $6,000, and $370,000, respectively. The retail price index at the end of 2025 was 1.06. Estimate ending inventory in 2025 using the dollar-value LIFO retail method. Note: Round ratio calculation to 2 decimal places and round other intermediate calculations and final answer to the nearest whole dollar. Ending inventoryarrow_forwardOn August 31, 2010, Harvey Co. decided to change from the FIFO periodic inventory system to the weightedaverage periodic inventory system. Harvey is on a calendar year basis. The cumulative effect of the change is determineda. As of January 1, 2010.b. As of August 31, 2010. c. During the eight months ending August 31, 2010, by a weighted-average of the purchases.d. During 2010 by a weighted-average of the purchases.arrow_forwardThe Rockwell Corporation uses a periodic inventory system and has used the FIFO cost method since inception of the company in 1982. In 2021, the company decided to change to the average cost method. Data for 2021 are as follows: Beginning inventory, FIFO (6,500 units @ $45.00) Purchases: 6,500 units @ $51.00 6,500 units @ $55.00 Cost of goods available for sale Sales for 2021 (11,000 units @ $85.00) Additional information: 1. The company's effective income tax rate is 25% for all years. 2. If the company had used the average cost method prior to 2021, ending inventory for 2020 would have been $266,500. 3. 8,500 units remained in inventory at the end of 2021. Answer is not complete. Complete this question by entering your answers in the tabs below. $331,500 357,500 Required: 1. Prepare the journal entry at the beginning of 2021 to record the change in principle. 2. In the 2021-2019 comparative financial statements, what will be the amounts of cost of goods sold and inventory reported…arrow_forward

- On January 1, 2024, the Coldstone Corporation adopted the dollar-value LIFO retail inventory method. Beginning inventory at cost and at retail were $170,000 and $273,000, respectively. Net purchases during the year at cost and at retail were $719,200 and $890,000, respectively. Markups during the year were $9,000. There were no markdowns. Net sales for 2024 were $844,400. The retail price index at the end of 2024 was 1.05. What is the inventory balance that Coldstone would report in its 12/31/2024 balance sheet? Note: Do not round intermediate calculations. Multiple Choice $249,600 $327,600 $202,760 $262,080arrow_forwardOn June 1, Delaware Co. had one unit in beginning inventory that cost $10.00. During June, Delaware paid cash to purchase two additional inventory items. Delaware purchased the first item for cash at a cost of $10.00, and the second at a cost of $12.00. Delaware Co. sold two inventory items for $24.00 each, receiving cash. Based on this information alone, indicate whether each of the following items is true or false. a) The amount of ending inventory will be $10 assuming the LIFO cost flow was used. b) Cost of goods sold would be $24 assuming the weighted average cost flow was used. c) Cash flow from operating activities in June would be $28 assuming a FIFO cost flow was used. d) Cash flow from operating activities in June would be $26 independent of what cost flow assumption was used. e) The amount of gross margin would be $26 assuming the FIFO cost flow was used.arrow_forward7. Taylor Corporation reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. The company’s records under this system reveal the following inventory layers at the beginning of 2021 (listed in chronological order of acquisition): 17,500 units @ $15 $ 262,500 22,500 units @ $20 450,000 Beginning inventory $ 712,500 During 2021, 45,000 units were purchased for $25 per unit. Due to unexpected demand for the company's product, 2021 sales totaled 55,000 units at various prices, leaving 30,000 units in ending inventory. Required:1. Calculate the amount to report for cost of goods sold for 2021.2. Determine the amount of LIFO liquidation profit that the company must report in a disclosure note to its 2021 financial statements. Assume an income tax rate of 25%.3. If the company decided to purchase an additional 10,000 units at $25 per unit at the end of the year, how much income tax currently payable would be saved?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education