FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

Transcribed Image Text:2:14

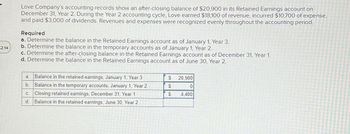

Love Company's accounting records show an after-closing balance of $20,900 in its Retained Earnings account on

December 31, Year 2. During the Year 2 accounting cycle, Love earned $18,100 of revenue, incurred $10,700 of expense,

and paid $3,000 of dividends. Revenues and expenses were recognized evenly throughout the accounting period.

Required

a. Determine the balance in the Retained Earnings account as of January 1, Year 3.

b. Determine the balance in the temporary accounts as of January 1, Year 2.

c. Determine the after-closing balance in the Retained Earnings account as of December 31, Year 1.

d. Determine the balance in the Retained Earnings account as of June 30, Year 2.

a. Balance in the retained earnings, January 1, Year 3

b.

Balance in the temporary accounts, January 1, Year 2

C. Closing retained earnings, December 31, Year 1

d. Balance in the retained earnings, June 30, Year 2

$

$

$

20,900

0

4,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduce to statement of retained earnings

VIEW Step 2: Working for retained earnings, January 1, Year 3

VIEW Step 3: Working for retained earnings, December 31, Year 1 and Retained earnings, June 30, Year 2

VIEW Step 4: Working for balance in temporary account on Jan 1, Year 2

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPlease do not give image format and explanationarrow_forwardUrgent Please answer a soon as possible. Answer must be plagirism free What is the role of auditors and explain the importance of the role.arrow_forward

- 1. Choose the ethical considerations that Amahle Khumalo should recognize in deciding how to proceed. Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. Check my work is not available. Khumalo should exercise initiative and good judgment in providing management with information having a potentially adverse economic impact Khumalo should determine whether the controller's request violates her professional or personal standards or the company's code of ethics. ? Khumalo should protect proprietary information and should not violate the chain of command by discussing this matter with the controller's superiors ?Khumalo should not try to convince the controller regarding the probable failure of reworks.arrow_forwardPlease describe a time when you were faced with a personal dilemma regarding whether to blow the whistle on a wrongdoing. Some examples of a wrongdoing are witnessing cheating on an exam, witnessing someone trying to steal, noticing someone trying to take advantage of another, and completing a project at work without recording time spent in order to meet time constraints. Who were the stakeholders in the situation and how were they impacted by the wrongdoing? How did rationalization encourage the wrongdoer to follow through with their wrongdoing? What did you do and why? Case scenario: for someone working but not clocking in How would this fit under this dilemma? Please explain:arrow_forwardNonearrow_forward

- Some accountants argue that the receiving department should be eliminated. Discuss the objective of eliminating the receiving function. What accounting/audit problems need to be resolved.arrow_forwardHow specifically do you contribute to or impact the financial health of your organization? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forward

- Urgent Answer please 2. Explain Audit Commitee by decribing the role and responsibilities. This is full question and not an eassy question at all. Answer must be plagirism free and in reasonable length. Length should not be too short or too long. Give reasonable answer please.arrow_forwardIt says they answers are wrong from your example.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education