Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

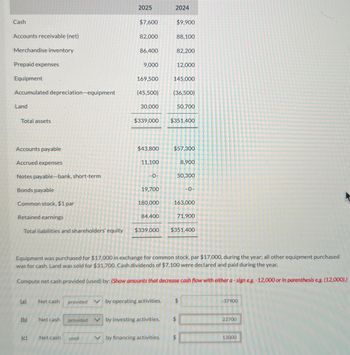

Transcribed Image Text:2025

2024

Cash

$7,600

$9,900

Accounts receivable (net)

82,000

88,100

Merchandise inventory

86,400

82,200

Prepaid expenses

9,000

12,000

Equipment

169,500

145,000

Accumulated depreciation-equipment

(45,500)

(36,500)

Land

30,000

50,700

Total assets

$339,000 $351,400

Accounts payable

$43,800

$57,300

Accrued expenses

11,100

8,900

Notes payable-bank, short-term

-0-

50,300

Bonds payable

19,700

-0-

Common stock, $1 par

180,000

163,000

Retained earnings

84,400

71,900

Total liabilities and shareholders' equity

$339,000

$351,400

Equipment was purchased for $17,000 in exchange for common stock, par $17,000, during the year; all other equipment purchased

was for cash. Land was sold for $31,700. Cash dividends of $7,100 were declared and paid during the year.

Compute net cash provided (used) by: (Show amounts that decrease cash flow with either a-sign e.g. -12,000 or in parenthesis e.g. (12,000).)

(a) Net cash

provided

by operating activities.

-37900

(6)

(b)

Net cash

provided by investing activities.

22700

(c)

Net cash

used

by financing activities.

13000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- PQ16.05 A company has the following assets: Buildings and Equipment, less accumulated depreciation of $5,000,000 Patents Trademarks Land $25,000,000 2,400,000 10,000,000 12,000,000 Goodwill 2,000,000 Cash 8,000,000 The total amount reported under Property, Plant, and Equipment would be??arrow_forwardLoss of 21300 is incurreed in selling (for cash) office qeuipment that cost 89000 and had accumulated depreciation of 22200, actual cash proceedsmust have been 1. 67700 2.88100 3.66800 4. 45500arrow_forwardP10.5A Journalise a series of equipment transactions related to purchase, sale, retirement, and depreciation At December 31, 2021. Grand Regency Limited reported the following as Non-current tangible assets: 4,000,000 16,400,000 June 11 July 1 Dec. 31 Land Buildings Less: Accumulated depreciation - buildings Equipment Less: Accumulated depreciation - equipment Total plant assets During 2022, the following selected cash transactions occurred. April 1 Purchased land for R2,130,000. May 1 (b) (c) (d) 28,500,000 12,100,000 48,000,000 5,000,000 Required: (a) 43,000,000 £63,400,000 Sold equipment that cost R750,000 when purchased on January 1, 2018. The equipment was sold for R450,000. Sold land purchased on June 1, 2012 for R1,500,000. The land cost R400,000. Purchased equipment for R2,500,000. Retired equipment that cost R500,000 when purchased on December 31, 2012. No salvage value was received. Prepare general journal entries the above transactions. The company uses straight-line…arrow_forward

- P10.5arrow_forwardRequired information [The following information applies to the questions displayed below.] The plant assets section of the comparative balance sheets of Anders Company is reported below. ANDERS COMPANY Comparative Balance Sheets 2019 2018 Plant assets Equipment Accumulated depreciation-Equipment $ 180,000 (100,000) $ 270,000 (210,000) $ 60,000 $ 400,000 (285,000) Equipment, net $ 80,000 Buildings Accumulated depreciation-Buildings $ 380, еее (100,000) $ 280,000 Buildings, net $ 115,000 ing 2019, equipment with a book value of $40,000 and an originartost of $210,000 was sold at a loss of $3,000. low much cash did Anders receive from the sale of equipment? Low much denreciation ano w rocorded a nouinnmant c ring 0102 10arrow_forwardBased on the following information, how much capital expenditures did FIN3300F24 incur in 2023? FIN3300F24 Balance Sheet As of 12/31/23 As of 12/31/22 Cash $19,000 $54,000 A/R 96,000 75,000 Inventories 273,000 174,000 Total CA $388,000 $303,000 Gross FA 750,000 540,000 Less: accumulated depreciation 238,000 168,000 Net FA $512,000 $372,000 Total Assets $900,000 $675,000 Accounts payable $108,000 $51,000 Accruals 27,000 12,000 Notes payable 273,000 102,000 Total CL $408,000 $165,000 Long-term debt 137,700 172,500 Common stock 189,000 189,000 Retained earnings 165,300 148,500 Total L & E $900,000 $675,000 FIN3300F24 Income Statement 2023 Sales $960,000 Cost of goods sold 576,000 Gross profit $384,000 Operating expenses excluding depreciation $222,000 Depreciation 70,000…arrow_forward

- Net intangible assets 2035 1,851,000 2034 970,000 The client provided further details regarding the intangible assets as follows: 2034 720,000 250,000 0 970,000 1 Customer list 2 Goodwill 3 Trademark XYZ Total net intangible assets 2035 1,100,000 237,500 513,500 1,851,000arrow_forwardDD&A for 2021. 12/31/18 $ 30,000 6,000 350,000 60,000 250,000 12/31/19 $30,000 19. Proved property cost Accumulated DD&A-proved property. Wells and equipment-IDC.. Accumulated DD&A-L&WE-IDC . Wells and equipment-L&WE.. Accumulated DD&A-wells and equipment-L&WE.. 55.000 450,000 325,000 2018 800,000 Mcf 900,000 Mci 500,000 Mcf 700,000 Mci 40,000 Mcf 60,000 Mcf 2019 Proved reserves, 12/31.. Proved developed reserves, 12/31 . Production during 2018 and 2019.. REQUIRED: Compute DD&A for the year ended 12/31/19.arrow_forwardrrarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning