FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

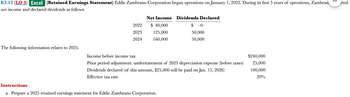

Transcribed Image Text:E3.12 (LO 3) Excel (Retained Earnings Statement) Eddie Zambrano Corporation began operations on January 1, 2022. During its first 3 years of operations, Zambran

net income and declared dividends as follows.

The following information relates to 2025.

2022

2023

2024

Net Income Dividends Declared

$ 40,000

125,000

160,000

$-0-

50,000

50,000

Income before income tax

Prior period adjustment: understatement of 2023 depreciation expense (before taxes)

Dividends declared (of this amount, $25,000 will be paid on Jan. 15, 2026)

Effective tax rate

Instructions

a. Prepare a 2025 retained earnings statement for Eddie Zambrano Corporation.

$240,000

25,000

100,000

20%

3

rted

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 1 of 6 > -/ 1 View Policies Current Attempt in Progress Coronado Corporation has temporary differences at December 31, 2020, that result in the following deferred taxes. Deferred tax liability related to depreciation difference $38,500 Deferred tax asset related to warranty liability 63,800 Deferred tax liability related to revenue recognition 104,000 Deferred tax asset related to litigation accruals 24.900 Indicate how these balances would be presented in Coronado's December 31, 2020, balance sheet. Coronado Corporation Balance Sheet (Partial) II %24arrow_forward[The following information applies to the questions displayed below.] Henrich is a single taxpayer. In 2023, his taxable income is $537,000. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places. a. All of his income is salary from his employer. Assume his modified AGI is $570,000. Income tax Net investment income tax Total tax liability Amountarrow_forwardrrarrow_forward

- pvn.6arrow_forwardWhat is the Asset Turnover Ratio in 2020?arrow_forward12/2/23, 11:25 AM 2023 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: $ 0 $ 11,000 $ 44,725 $ 95,375 $ 182.100 $ 231,250 $ 578,125 ezt.prod.mheducation.com/Media/Connect_Production/bne/accounting/spilker_15e/taxrateschedule2023.htm $ 95,350 $ 182,100 $ 231,250 $578,100 $ 11,000 $ 44,725 $ 95,375 $ 182,100 $ 231,250 $ 578,125 Schedule Z-Head of Household If taxable income is over: But not over: $ 0 $ 15,700 $ 15,700 $ 59,850 $ 59,850 $ 95,350 Schedule Y-1-Married Filing Jointly or Qualifying surviving spouse If taxable income is over: But not over: The tax is: $ 0 $ 22,000 $ 22,000 $ 89,450 $ 89,450 $ 190,750 $364,200 $ 462,500 $693,750 $ 190.750 $364,200 9 $ 462,500 $ 693,750 $ 0 $ 11,000 $ 44,725 $ 95,375 $ 182,100 $ 231,250 $ 346,875 The tax is: $ 182,100 $ 231,250 $578,100 10% of taxable income $1,100 plus 12% of the excess over $11,000 $5,147 plus 22% of the excess over $44,725 $16,290 plus 24% of the excess over $95,375 $37,104 plus 32%…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education