FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Problem 11-5

Special Deductions and Limitations (LO 11.3)

Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2021. The corporation also has $30,000 in dividends from publicly-traded domestic corporations in which the ownership percentage was 45 percent.

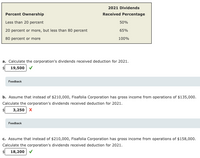

Below is the Dividends Received Deduction table to use for this problem.

Transcribed Image Text:2021 Dividends

Percent Ownership

Received Percentage

Less than 20 percent

50%

20 percent or more, but less than 80 percent

65%

80 percent or more

100%

a. Calculate the corporation's dividends received deduction for 2021.

19,500

Feedback

b. Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000.

Calculate the corporation's dividends received deduction for 2021.

3,250| х

Feedback

c. Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000.

Calculate the corporation's dividends received deduction for 2021.

18,200 v

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Exercise 4-11 (Algo) Comprehensive income [LO4-6] The Massoud Consulting Group reported net income of $1,362,000 for its fiscal year ended December 31, 2021. In addition, during the year the company experienced a positive foreign currency translation adjustment of $280,000 and an unrealized loss on debt securities of $55,000. The company's effective tax rate on all items affecting comprehensive income is 25%. Each component of other comprehensive income is displayed net of tax. Required: Prepare a separate statement of comprehensive income for 2021. (Amount to be deducted should be indicated with a minus sign.) THE MASSOUD CONSULTING GROUP Statement of Comprehensive Income For the Year Ended December 31, 2021 Net income Other comprehensive income, net of tax: Foreign currency translation adjustment Loss on debt securities Total other comprehensive income Comprehensive income $ 0arrow_forwardNonearrow_forward5 Misty Company reported the following before-tax items during the current year: Sales revenue $ 850 Selling and administrative expenses 410 Restructuring charges 20 Loss on discontinued operations 40 Misty's effective tax rate is 25%. What is Misty's net income for the current year?arrow_forward

- PROBLEM FIVE Wrap Ltd. is a Canadian-controlled private corporation. At the end of 2022, Wrap had the following tax account balances. Non-capital losses $ 8,000 Net capital losses 2,000 Non-eligible RDTOH 7,000 Dividend refund from non-eligible dividends 1,000 CDA 12,000 For the current year, 2023, net income for tax purposes is $261,000. Included in this amount is the following. Income from an active business carried on in Canada $200,000 Taxable capital gain 6,000 Eligible dividends from Canadian public companies 15,000 Canadian bond interest 40,000 The following is a summary of other information for Wrap Ltd. for the 2023 year. Taxable income Required: $236,000 Capital dividend paid 12,000 Eligible dividend paid 10,000 Non-eligible dividend paid 75,000 Small business deduction 38,000 Total Federal Part I tax payable 31,920 Determine the dividend refund for 2023. Would the dividend refund change if Wrap Ltd. was not a CCPC but instead was a private corporation or a public…arrow_forward4aarrow_forwardQUESTION 2 Pest Corporation Total Reasonable Business Needs for 2022 was $290,000. Pest Corporation's Accumulated Earnings And Profits (E&P) at the beginning of 2022 was $225,000 (including consideration for the Dividends listed below), Pest Corporation also had the following information for 2022: Regular Taxable Income-$300,000; Federal Income Tax-$100,250; Dividends Received (less than twenty percent (20%) owned domestic corporation)-$70,000; Cash Dividends Paid in 2022-$15,000; Dividends Pald February 28, 2023-$10,000; Consent Dividends $5,000; Excess Charitable Contributions-$16,000; Net Capital Loss Adjustment-$8,000. The Accumulated Earnings Tax (Section 531) for Pest Corporation for 2022 is: $51,381.00 $25,950.00 $45,533.50. $52.395.00arrow_forward

- PROBLEM FIVE Wrap Ltd. is a Canadian-controlled private corporation. At the end of 2022, Wrap had the following tax account balances. Non-capital losses $ 8,000 Net capital losses 2,000 Non-eligible RDTOH 7,000 Dividend refund from non-eligible dividends 1,000 CDA 12,000 For the current year, 2023, net income for tax purposes is $261,000. Included in this amount is the following. Income from an active business carried on in Canada $200,000 Taxable capital gain 6,000 Eligible dividends from Canadian public companies 15,000 Canadian bond interest 40,000 The following is a summary of other information for Wrap Ltd. for the 2023 year. Taxable income Required: $236,000 Capital dividend paid 12,000 Eligible dividend paid 10,000 Non-eligible dividend paid 75,000 Small business deduction 38,000 Total Federal Part I tax payable 31,920 Determine the dividend refund for 2023. Would the dividend refund change if Wrap Ltd. was not a CCPC but instead was a private corporation or a public…arrow_forwardTime left 0:43:13 Y Pty. Ltd. has assessable income of $100,000, deductions of $15,000 and tax offsets of $500. What is Y Pty. Ltd.'s tax payable for the year assuming a corporate tax rate of 25%? ut of O a. $21,200 O b. $25,500 O c. $20,750 O d. $25,000arrow_forwardQUESTION 6 A service-based company reports gross revenue of $125,000; sales discounts of $4,500; allowance for doubtful accounts of $6,000; operating expenses of $89,600; and a loss on sale of PP&E of $2,000. What is the company's net income after taxes assuming a tax rate of 20%?arrow_forward

- PROBLEM FIVE Wrap Ltd. is a Canadian-controlled private corporation. At the end of 2022, Wrap had the following tax account balances. Non-capital losses $ 8,000 Net capital losses 2,000 Non-eligible RDTOH 7,000 Dividend refund from non-eligible dividends 1,000 CDA 12,000 For the current year, 2023, net income for tax purposes is $261,000. Included in this amount is the following. Income from an active business carried on in Canada $200,000 Taxable capital gain 6,000 Eligible dividends from Canadian public companies 15,000 Canadian bond interest 40,000 The following is a summary of other information for Wrap Ltd. for the 2023 year. Taxable income Required: $236,000 Capital dividend paid 12,000 Eligible dividend paid 10,000 Non-eligible dividend paid 75,000 Small business deduction 38,000 Total Federal Part I tax payable 31,920 Determine the dividend refund for 2023. Would the dividend refund change if Wrap Ltd. was not a CCPC but instead was a private corporation or a public…arrow_forward8arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education