FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

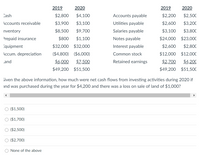

Transcribed Image Text:2019

2020

2019

2020

Cash

$2,800

$4,100

Accounts payable

$2,200

$2,500

Accounts receivable

$3,900

$3,100

Utilities payable

$2,600

$3,200

nventory

$8,500

$9,700

Salaries payable

$3,100

$3,800

Prepaid insurance

$800

$1,100

Notes payable

$24,000 $23,000

Equipment

$32,000 $32,000

Interest payable

$2,600

$2,800

Accum. depreciation

($4,800) ($6,000)

Common stock

$12,000 $12,000

.and

$6,000

$7,500

Retained earnings

$2,700

$4,200

$49,200

$51,500

$49,200 $51,50C

Given the above information, how much were net cash flows from investing activities during 2020 if

and was purchased during the year for $4,200 and there was a loss on sale of land of $1,000?

O ($1,500)

O ($1,700)

O ($2,500)

($2,700)

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- man.1arrow_forwardGiven this information: 2019 2020 2019 2020 Cash $3,000 $4,20O Accounts payable $8,500 $5,100 Accounts receivable $15,000 $14,000 Utilities payable $7,000 $4,000 Inventory $6,000 $7,000 Salaries payable $1,400 $800 Prepaid rent $4,000 $1,000 Notes payable $32,000 $34,000 Equipment $22,000 $26,000 Interest payable $1,200 $1,350 Accumulated depreciation ($4,000) ($5,200) Common stock $20,000 $20,000 Land $28,000 $21,000 Retained earnings $3,900 $2,750 $74,000 $68,000 $74,000 $68,000 How much cash was collected during 2020 if total sales were $160,000? $159,000 $161,200 $158,800 $161,000 None of the abovearrow_forward2019 2020 2019 2020 Cash $2,000 $1,600 Accounts payable $4,000 $3,500 Accounts receivable $4,200 $4,500 Utilities payable $800 $1,500 Inventory $2,600 $4,000 Salaries payable $2,200 $2,600 Prepaid rent $800 $500 Notes payable $10,000 $9,000 Equipment $24,000 $24,000 Interest payable $600 $900 Accum. depreciation ($2,200) ($2,800) Common stock $18,000 $18,000 Land $10,000 $6,500 Retained earnings $5,800 $2,800 $41,400 $38,300 $41,400 $38,300 How much land was purchased during 2020 if one plot that had been purchased in a prior year for $10,000 was sold during 2020 for $8,000? $4,500 O $18,500 $8,500 $14,500 None of the abovearrow_forward

- 2019 2020 2019 2020 Cash $2,200 $1,000 Accounts payable $3,100 $2,800 Accounts receivable $4,600 $8,200 Utilities payable $1,100 $1,800 Inventory $3,100 $7,200 Wages payable $500 $1,600 Prepaid insurance $800 $1,600 Notes payable $14,000 $16,000 Equipment $36,000 $36,000 Interest payable $2,000 $3,200 Accum. depreciation ($14,000) ($15,200) Common stock $9,000 $9,000 Land $7,600 $10,200 Retained earnings $10,600 $14,600 $40,300 $49,000 $40,300 $49,000 How much were fınancing cash flows during 2020 if net income was $87,000? $2,000 $89,000 ($81,000) O ($83,000) None of the abovearrow_forwardQuestion 97 Using Financial Statements for 2020, times interest earned for the year 2020 is 15.37. TRUE OR FALSE?arrow_forwardNotes 2022 2021 ASSETS Cash on hand 1,404,561 2,529,876 Statutory deposits with Central Banks 7,508,221 7,045,773 Due from banks 9,178,784 12,425,341 Treasury Bills 8,400,605 4,934,664 Advances 4 56,829,415 55,515,628 Investment securities 5 19,953,780 19,259,501 Investment interest receivable 203,693 205,204 Investment in associated companies 6 62,603 55,961 Premises and equipment 7 3,255,758 3,218,670 Right-of-use assets 8 (a) 398,405 477,858 Intangible assets 9 1,143,560 1,171,222 Pension assets 10 (a) 1,200,717 1,415,216 Deferred tax assets 11 (a) 316,556 246,214 Taxation recoverable 49,290 72,817 Other assets 12 1,071,755 594,950 TOTAL ASSETS 110,977,703 109,168,895 LIABILITIES AND EQUITY LIABILITIES Due to banks 445,410 155,985 Customers’ current, savings and deposit accounts 13 87,586,189 86,609,634 Other fund raising instruments 14 4,461,931 4,618,554 Debt securities in issue 15 1,674,719 1,865,895 Lease liabilities 8 (b) 420,088 482,867 Pension liability 10 (a) 40 25,356…arrow_forward

- Balance Sheet for Bearcat Hathaway, 2022 2021 2022 Cash Accounts. Receivable $5,268,485 $10,268,485 Inventory $529,062 $696,685 Current Assets $8,371,777 $13,279,842 Less $2,574,230 $2,314,672 Gross Fixed Assets $16,251,665 $20,567,330 Accum.Depreciation Total Assets $7,460,897 $10,117,819 Accounts Payable Notes. Payable Current Liabilities Calculate the net working capital in 2022. Long Termi Debt Total Liabilities, None of these options are correct $10,572,740 $5,664,675 $8,854,338 $3,946,273 Total $17,162,545 $23,729,353 Liabilities and Equity Capital Surplus Retained. Earnings 2021 2022 $1,673,992 $2,438,271 Common Net Fixed Assets $8,790,768 $10,449,511 Stock ($0.50 $1,300,000 $1,600,000 par) $1,033,110 $1,987,233 $2,707,102 $4,425,504 $9,242,830 $11,468,302 $11,949,932 $15,893,806 $1,148,120 $1,800,969 $2,764,493 $4,434,578 $17,162,545 $23,729,353arrow_forwardplease answer do not image formatarrow_forwardTB Problem 21-167 (Algo) The Murdock Corporation reported the following balance sheet data for 2021 and 2020: 2021 2020 Cash $ 96,245 $ 33,155 Available-for-sale debt securities (not cash equivalents) 24,000 102,000 Accounts receivable 97,000 83,550 Inventory 182,000 160,300 Prepaid insurance 3,030 3,700 Land, buildings, and equipment 1,284,000 1,142,000 Accumulated depreciation (627,000 ) (589,000 ) Total assets $ 1,059,275 $ 935,705 Accounts payable $ 91,640 $ 165,670 Salaries payable 26,800 33,000 Notes payable (current) 40,300 92,000 Bonds payable 217,000 0 Common stock 300,000 300,000 Retained earnings 383,535 345,035 Total liabilities and shareholders' equity $ 1,059,275 $ 935,705 Additional information for 2021: (1) Sold available-for-sale debt securities costing…arrow_forward

- 2018 2019 2020 Income before depreciation, amortization, interest, and taxes $1,598 $2,832 $3,618 Interest expense 165 318 419 Cash 51 105 239 Current liabilities (does not include any debt) 547 799 1,192 Bank loan payable (all long-term) 1,800 4,270 4,200 Shareholders' equity 4,593 6,030 6,835 (a) Calculate the debt to equity, net debt as a percentage of total capitalization, and interest coverage ratios. (Round answers to 1 decimal place, e.g. 18.4 or 15.3%.) Net debt as a percentage of total capitalization Debt to equity ratio Interest coverage 2018 51.1 33.81 % 9.68 2019 84.1 45.67 8.9 2020 78.9 44.09 % 8.63arrow_forward2019 2020 2019 2020 Cash $2,200 $1,000 Accounts payable $3,100 $2,800 Accounts receivable $4,600 $8,200 Utilities payable $1,100 $1,800 Inventory $3,100 $7,200 Wages payable $500 $1,600 Prepaid insurance $800 $1,600 Notes payable $14,000 $16,000 Equipment $36,000 $36,000 Interest payable $2,000 $3,200 Accum. depreciation ($14,000) ($15,200) Common stock $9,000 $9,000 Land $7,600 $10,200 Retained earnings $10,600 $14,600 $40,300 $49,000 $40,300 $49,000 How much was cost of goods sold in 2020 if $51,000 was paid to suppliers? $50,700 $46,600 O $55,100 $46,900 None of the abovearrow_forward2021 2$ Cash Available-for-sale debt securities (not cash equivalents) Accounts receivable Inventory Prepaid insurance Land, buildings, and equipment Accumulated depreciation 94,025 23,000 95,000 180,000 2,850 1,280,000 (625,000) $1,049,875 2020 31,955 100,000 81,750 158,500 3,500 1,140,000 (587,000) $ 928,705 $ 163,670 32,000 90,000 Total assets Accounts payable Salaries payable Notes payable (current) Bonds payable Common stock Retained earnings 2$ 89,840 26,000 38,500 215,000 300,000 380,535 300,000 343,035 $ 928,705 ces Total liabilities and shareholders' equity $1,049,875 Additional information for 2021: (1) Sold available-for-sale debt securities costing $77,000 for $83,000. (2) Equipment costing $20,000 with a book value of $6,500 was sold for $8,250. (3) Issued 6% bonds payable at face value, $215,000. (4) Purchased new equipment for $160,000 cash. (5) Paid cash dividends of $27,500. (6) Net income was $65,000. Required: Prepare a statement of cash flows for 2021 in good form…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education