FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

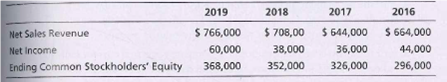

Computing trend analysis and return on common equity

Net sales revenue, net income, and common

Requirements

- Compute trend analyses for each item for 2017-2019. Use 2016 as the base year, and round to the nearest whole percent.

- Compute the

rate of return on common stockholders’ equity for 2017-2019, rounding to three decimal places.

Transcribed Image Text:2019

2018

2017

2016

$ 664,000

44,000

296,000

Net Sales Revenue

$ 766,000

60,000

$ 708,00

38,000

$ 644,000

36,000

326,000

Net Income

Ending Common Stockholders' Equity

368,000

352,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sunburst Corporation's net revenues over a five year period were as follows (in millions of dollars): $28,700 (2021) $22,800 (2020) $27,000 (2019) $24,500 (2018) $21,600 (2017) Calculate trend percentages for the five-year period using 2017 as the base year. (Round your answers to the nearest whole percent.) Sunburst Trend Data (in millions) Sales revenue Trend percentage 2021 28,700 % 2020 22,800 % $ 2019 27,000 % 1 2018 24,500 $ % Base Year 2017 $ 21,600 %arrow_forwardCompute DuPont Analysis Ratios Selected balance sheet and income statement information for Humana Inc., a health and well‑being company, follows. 2018 2017 2018 2018 Net 2018 2017 Stockholders’ Stockholders’ Company ($ millions) Ticker Revenue income Assets Assets Equity Equity Humana Inc HUM $66,610 $11,381 $35,111 $36,876 $19,859 $19,540 Compute the following 2018 ratios for Humana. a. Return on equity (ROE) Note: 1. Select the appropriate numerator and denominator used to compute ROE from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROE. Numerator Denominator ROE Answer Answer Answer Answer b. Profit margin (PM) Note: 1. Select the appropriate numerator and denominator used to compute PM from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute PM. Numerator Denominator PM Answer Answer Answer Answer c. Financial leverage…arrow_forwardListed here are data for five companies. These data are for the companies' 2019 fiscal years. The market price per share is the closing price of the companies' stock the day after they announced their 2019 earnings. Except for market price per share, all amounts are in millions. The shares outstanding number is the weighted-average number of shares the company used to compute basic earnings per share. Note that the numbers for Mountainview Investments are significantly different that the other companies. For example, the number for its shares outstanding includes a decimal, not a comma. Its shares outstanding are about are 1.6 million, not 1.6 billion. Company Nile.com Mountainview Investments Big Oil Soda Fizz Incorporated Ringer Corporation Net Earnings $12,495 82,355 15,280 8,255 6,088 Company Stockholders' Shares Market Price Equity Outstanding per Share $62,998 1,415 $2,006.00 429,386 1.652 Nile.com Mountainview Investments Big Oil Soda Fizz Incorporated Ringer Corporation 199,674…arrow_forward

- i, j and karrow_forwardGuinea C. Company is preparing trend percentages for its service fees earned for the period 2013 through 2017. The base year is 2013. The 2016 trend percentage is computed as: Question 23 options: A) 2016 service fees earned divided by 2012 service fees earned B) 2015 service fees earned divided by 2016 service fees earned C) 2016 service fees earned divided by 2013 service fees earned D) 2013 service fees earned divided by 2016 service fees earnedarrow_forwardCount the average of these weights for all three years. Please note that you are to assign weights of 3, 2 and 1 to the financial ratios for FISCAL YEAR 2019, FISCAL YEAR 2018 and FISCAL YEAR 2017 and then compute the weighted average. Current Ratlo Particulars FY'19 L&T BHEL NBCC 1.3 1.59 1.08 Slemens 191 FY'18 FY'17 132 1.44 1.83 1.96 1.18 1.26 1.82 ▷arrow_forward

- S-3 Calculating trend analysisarrow_forwardPrepare a multiple-step income statement for 2020. Assume that 66,880 shares of common stock are outstanding for the entire (Round earnings per share to 2 decimal places, e.g. 1.49.)arrow_forwardSee Table 2.5 LOADING... showing financial statement data and stock price data for Mydeco Corp. Suppose Mydeco's costs and expenses had been the same fraction of revenues in 2016-2019 as they were in 2015. What would Mydeco's EPS have been each year in this case? Calculate the new EPS for 2016-2019 below: (Round dollar amounts and number of shares to one decimal place. Round percentage amount and the EPS to two decimal places.)arrow_forward

- Use Tableau to calculate and display the trends for the debt to equity and times interest earned ratios for each of the two companies in the period 2018-2021. the average debt to equity ratio and times interest earned ratio for companies in the General Retailers industry sector in a comparable time period are 1.92 and 10.6, respectively. 1. Other things being equal, do both companies appear to have the ability to meet their obligations as measured by the debt to equity ratio? 2. Based solely on the times interest earned ratios, do you reach the same conclusion as in Requirement 1? 3. Is the margin of safety provided to creditors by Discount Goods improving or declining in recent years as measured by the average times interest earned ratio?arrow_forwardCalculate the projected price/earnings ratio and market/book ratio. Explain whether these ratios indicate that investors will be expected to have a high or low opinion of the company. Computron's Balance Sheets (Millions of Dollars) 2019 2020 Assets Cash and equivalents $ 60 $ 50 Short-term investments 100 10 Accounts receivable 400 520 Inventories 620 820 Total current assets $ 1,180 $ 1,400 Gross fixed assets $ 3,900 $ 4,820 Less: Accumulated depreciation 1,000 1,320 Net fixed assets $ 2,900 $ 3,500 Total assets $ 4,080 $ 4,900 Liabilities and equity Accounts payable $ 300 $ 400 Notes payable 50 250 Accruals 200 240 Total current liabilities $ 550 $ 890 Long-term bonds 800 1,100 Total liabilities $ 1,350 $ 1,990 Common stock 1,000 1,000 Retained earnings 1,730 1,910 Total equity $ 2,730 $ 2,910 Total liabilities and equity $ 4,080 $ 4,900…arrow_forwardThe following income statement and balance sheets for Virtual Gaming Systems are provided. VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31, 2021 Net sales Cost of goods sold Gross profit Expenses: Operating expenses. Depreciation expense Loss on sale of land Interest expense Income tax expense Total expenses Net income Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds $852,000 27,000 7,400 12,000 42,000 $3,006,000 1,944,000 1,062,000 940, 400 $ 121,600 VIRTUAL GAMING SYSTEMS Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable. Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Balance Sheets December 31 2021 $180,000 75,000 99,000 11,400 99,000 204,000 264,000 (63,000) $869,400 $ 60,000 4,800 12,000 279,000 294,000 219,600 2020 $138,000 54,000 129,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education