FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

|

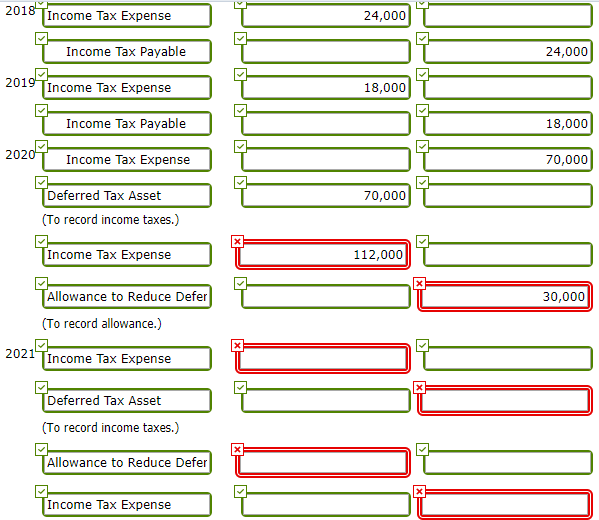

Transcribed Image Text:2018 Tincome Tax Expense

24,000

Income Tax Payable

24,000

2019

Income Tax Expense

18,000

Income Tax Payable

18,000

2020

Income Tax Expense

70,000

Deferred Tax Asset

70,000

(To record income taxes.)

Income Tax Expense

112,000

[Allowance to Reduce Defer

30,000

(To record allowance.)

2021 Tincome Tax Expense

Deferred Tax Asset

(To record income taxes.)

Allowance to Reduce Defer

Income Tax Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize Payroll Tax The payroll register of Chen Engineering Co. indicates $1,956 of social security withheld and $489.00 of Medicare tax withheld on total salaries of $32,600 for the period. Earnings of $10,100 are subject to state and federal unemployment compensation taxes at the federal rate of 0.6% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places.arrow_forwardJournalize payroll taxThe payroll register of Heritage Co. indicates $4,200 of social security withheld and $1,050 of Medicare tax withheld on total salaries of $70,000 for the period. Earnings of $12,000 are subject to state and federal unemployment compensation taxes at the federal rate of 0.8% andthe state rate of 5.4%. Journalize the entry to record the payroll tax expense for the period.arrow_forwardCurrent Attempt in Progress Wildhorse Inc. reports the following pre-tax incomes (losses) for both financial reporting purposes and tax purposes: Year 2021 2022 2023 2024 Accounting Income (Loss) $129,000 94,000 (302,000) 221,000 Tax Rate 25 % 25 % 30 % 30 % The tax rates listed were all enacted by the beginning of 2021. Wildhorse reports under the ASPE future income taxes method.arrow_forward

- Problem 15-58 (LO 15-6) In each of the following independent cases for tax year 2022, determine the amount of business interest expense deduction and disallowed interest expense carryforward, if any. Assume that average annual gross receipts exceed $27 million. Required: a. Company A has ATI of $70,000 and business interest expense of $20,000. b. Company B has ATI of $90,000, business interest expense of $50,000, and business interest income of $2,000. c. Company C has taxable income of $50,000 which includes business interest expense of $90,000 and depreciation of $20,000. Note: For all requirements, leave no cells blank - be certain to enter "0" wherever required. Enter your answers in dollar values not in million of dollars. a. Company A b. Company B c. Company C Interest expense deduction Disallowed interest expense carryforwardarrow_forwardCullumber Inc.'s only temporary difference at the beginning and end of 2024 is caused by a $3.75 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable (only one-half of which is classified as a current asset) is due in equal installments in 2025 and 2026. The related deferred tax liability at the beginning of the year is $1,125,000. In the third quarter of 2024, a new tax rate of 20% is enacted into law and is scheduled to become effective for 2026. Taxable income for 2024 is $6,250,000, and taxable income is expected in all future years.arrow_forwardPayroll Tax Entries According to a summary of the payroll of Mountain Streaming Co., $582,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $19,000 was subject to state and federal unemployment taxes. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 4.2%; federal unemployment, 0.8%. $ b. Journalize the entry to record the accrual of payroll taxes. If an amount box does not require an entry, leave it blank. ▼arrow_forward

- vroll taxes LO 4 layed below.} at Lukancic Inc., the firm's accountant neglected to ayrolls for the year then ended. that should have been made as of March 31, 2019. Indicate the to indicate a negative financial statement effect.) Answer is not complete. Income Statement Stockholders' Equity ties Net Income Revenues (6,370) Cash 6,370 Xarrow_forwardRequired information Problem 16-8 Multiple differences; taxable income given; two years; balance sheet classification; change in tax rate [LO16-4, 16-6, 16-8] [The following information applies to the questions displayed below.] Arndt, Inc., reported the following for 2018 and 2019 ($ in millions): 2018 2019 Revenues $ 995 $1,073 Expenses Pretax accounting income (income statement) Taxable income (tax return) 800 840 $ 195 $ 195 233 $ 245 Tax rate: 40% a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2018 for $60 million. The cost is tax deductible in 2018. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2018 and 2019 were $39 million and $57 million, respectively. Subscriptions included in 2018 and 2019 financial reporting revenues were $36 million ($14 million collected in 2017 but not…arrow_forwardPayroll tax entries Instructions Chart of Accounts First Question Journal Instructions According to a summary of the payroll of Guthrie Co., $770,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $42,000 was subject to state and federal unemployment taxes. Required: a. Compute the employer’s payroll taxes, using the following rates: state unemployment, 5.4%; federal unemployment, 0.6%. b. On December 31, journalize the entry to record the accrual of payroll taxes. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts CHART OF ACCOUNTS Guthrie Co. General Ledger ASSETS 110 Cash 111 Accounts Receivable 112 Interest…arrow_forward

- ournalize Payroll Tax The payroll register of Patel Heritage Co indicates $1,986 of social security withheld and $496.50 of Medicare tax withheld on total salaries of $33,100 for the period. Earnings of $9,600 are subject to state and federal unemployment compensation taxes at the federal rate of 0.8% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places. Payroll Tax Expense Payroll Tax Expense Social Security Tax Payable Social Security Tax Payable Medicare Tax Payable Medicare Tax Payable State Unemployment Tax Payable State Unemployment Tax Payable Federal Unemployment Tax Payable Federal Unemployment Tax Payablearrow_forwardSkip to question [The following information applies to the questions displayed below.]At March 31, 2019, the end of the first year of operations at Lukancic Inc., the firm’s accountant neglected to accrue payroll taxes of $6,370 that were applicable to payrolls for the year then ended. Exercise 7-7 (Algo) Part a - Horizontal Model Required:a-1. Use the horizontal model to show the effect of the accrual that should have been made as of March 31, 2019. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.)arrow_forwardtaxable income : 1225000 income taxes payable: 245000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education