FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

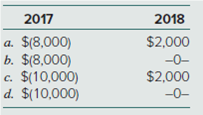

Dunn Corporation owns 100 percent of Grey Corporation’s common stock. On January 2, 2017, Dunn sold to Grey $40,000 of machinery with a carrying amount of $30,000. Grey is

(AICPA adapted).

Transcribed Image Text:2017

2018

a. $(8,000)

b. $(8,000)

c. $(10,000)

d. $(10,000)

$2,000

-0-

$2,000

--0-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On November 4, 2019, Blue Company acquired an asset (27.5-year residential real property) for $200,000 for use in its business. In 2019 and 2020, respectively, Blue deducted $642 and $5,128 of cost recovery. These amounts were incorrect; Blue applied the wrong percentages (i.c., those for 39 year rather than 27.5 year assets). Blue should have taken $910 and $7,272 cost recovery in 2019 and 2020, respectively. On January 1, 2021, the asset was sold for $180,000. If required, round all computations to the nearest dollar. Click here to access the depreciation tables in the textbook. a. The adjusted basis of the asset at the end of 2020 is $ b. The cost recovery deduction for 2021 is $ c. The loss on the sale of the asset in 2021 isarrow_forwardBerny Ltd owns 100 per cent of Cozy Ltd. On 1 July 2019 Berny Ltd sells an item of plant to Cozy Ltd for $3.6 million. This plant cost Berny $4.5 million and had accumulated depreciation of $1.8 million at the date of the sale. The remaining useful life of the plant is assessed as 12 years and the tax rate is 30 per cent. Required: a) Prepare the entries to eliminate the effects of the above intragroup transactions in the consolidation journal of Berny Ltd’s group at 30 June 2020 b) Prepare the entries to eliminate the effects of the above intragroup transactions in the consolidation journal of Berny Ltd’s group at 30 June 2021arrow_forwardOn January 1, 2020, Gardner bought 85% of Isbell. Gardner saw that there was an unrecorded asset on its accounting records that is valued at $71,000 and has 5 years remaining life. All excess fair value over book value was denoted as goodwill. During 2021, Isbell sold inventory to Gardner for $227,000 that cost $188,000, and of this amount, 30% remained unsold in Gardner’s ending inventory on December 31, 2021. Selected financial information for Gardner and Isbell on December 31, 2021: Gardner Isbell Inventory 685,000 475,000 Sales 1,275,000 983,000 COGS 705,000 545,000 Operating expenses 338,000 395,000 What is the value of the consolidated COGS?arrow_forward

- Rivendell Corporation uses the accrual method of accounting and has the following assets as of the end of 2020. Rivendell converted to an S corporation on January 1, 2021. (Leave no answer blank. Enter zero if applicable.)Asset Adjusted Basis FMVCash $ 40,000 $ 40,000Accounts receivable 30,000 30,000Inventory 130,000 60,000Land 100,000 125,000Totals $ 300,000 $ 255,000 b. Assuming the land was valued at $200,000, what would be Rivendell’s net unrealized gain at the time it converted to an S corporation? c. Assuming the land was valued at $125,000 but that the inventory was valued at $85,000, what would be Rivendell’s net unrealized gain at the time it converted to an S corporation?arrow_forwardPlease include all steps of calculations for my reference. Thanks!arrow_forwardDuring the current year, Hill Corporation sold equipment for $600,000 (adjusted basis of $360,000). The equipment was purchased a few years ago fo $760,000 and $400,000in MACRS deductions have been claimed. ADS depreciation would have been $300,000. As a result of the sale, the adjustment to taxable income needed to determine current E & P is A) No agjustment is required B) Subtract $100,000 C) Add $100,000 D) Add $80,000 E) None of the abovearrow_forward

- Fullerton Corporation owns 100% of Irvine Corporation's common stock. On January 2, 2020, Fullerton sold machinery with a carrying amount of $30,000 to Irvine Corp for $50,000. Irvine Corp is depreciating the acquired machinery over a 10-year life using the straight-line method. The related net adjustments to compute the 2020 and 2021 consolidated income (gain, loss, depreciation expense, etc.) before income tax would be an increase (decrease) of: Select one: a. $(16,000) for 2020 and $4,000 for 2021 b. $(18,000) for 2020 and $2,000 for 2021 c. $(20,000) for 2020 and $2,000 for 2021 d. $(20,000) for 2020 and $0 for 2021arrow_forwardOn November 4, 2021, Blue Company acquired and placed in service an asset (27.5-year residential real property) for $200,000 for use in its business. In 2021 and 2022, respectively, Blue deducted $642 and $5,128 of cost recovery. These amounts were incorrect; Blue applied the wrong percentages (i.e., those for 39-year rather than 27.5-year assets). Blue should have taken $910 and $7,272 cost recovery in 2021 and 2022, respectively. On January 1, 2023, the asset was sold for $180,000. If required, round all computations to the nearest dollar. Click here to access the depreciation tables in the textbook. a. The adjusted basis of the asset at the end of 2022 is $ b. The cost recovery deduction for 2023 is $ c. The on the sale of the asset in 2023 is $arrow_forwardPlease help me solve questions 1 2 & 3. Thank you! Placid Lake Corporation acquired 70 percent of the outstanding voting stock of Scenic, Inc., on January 1, 2017, when Scenic had a net book value of $440,000. Any excess fair value was assigned to intangible assets and amortized at a rate of $7,000 per year. Placid Lake's 2018 net income before consideration of its relationship with Scenic (and before adjustments for intra-entity sales) was $340,000. Scenic reported net income of $150,000. Placid Lake declared $140,000 in dividends during this period; Scenic paid $44,000. At the end of 2018, selected figures from the two companies' balance sheets were as follows: Placid Lake Scenic Inventory $ 180,000 $ 94,000 Land 640,000 240,000 Equipment (net) 440,000 340,000 During 2017, intra-entity sales of $95,000 (original cost of $50,000) were made. Only 10 percent of this inventory was still held within the consolidated entity at the end of…arrow_forward

- Asempa Ltd disposed of its entire holding in Daakye Ltd on 30the September 2013 for GH¢ 12 million, on which date the net assets of Daakye Ltd was GH¢9.6 million. It is the policy of measuring NCI at acquisition at proportionate of the fair value of identifiable net asset and no goodwill is impaired as at 30th September 2013. Tax is charged at 25%. Required Calculate the profit or loss on disposal for: (i) Asempa Ltd’s individual financial statements (ii) Consolidated financial statementsarrow_forwardGreg Company was granted a patent on January 1, 2017 and appropriately capitalized P 450,000 of related costs. The entity was amortizing the patent over the useful life of 15 years, During 2020, the entity paid P 150,000 in legal costs in successfully defending an attempted infringement of the patent. After the legal action was completed, the entity sold the patent to the plaintiff for P 750,000. The policy is to take no amortization in the year of disposal. The entry to record the sale of patent in 2020:arrow_forwardDuckworth Corporation purchases an 80% interest in Panda Corporation on January 1, 2017, in exchange for 5,000 Duckworth shares (market value of $18) plus $155,000 cash. The fair value of the NCI is proportionate to the price paid by Duckworth for its interest. The appraisal shows that some of Panda’s equipment, with a 4-year estimated remaining life, is undervalued by $20,000. The excess is attributed to goodwill. Panda Corporation’s balance sheet on December 31, 2016 is attached.The following information relates to the activities of the two companies for 2017:a. Panda pays off $10,000 of its long-term debt.b. Duckworth purchases production equipment for $76,000.c. Consolidated net income is $103,200; the NCI’s share is $5,000. Depreciation expense taken by Duckworth and Panda on their separate books is $92,000 and $28,000, respectively.d. Duckworth pays $30,000 in dividends; Panda pays $15,000.Prepare the consolidated statement of cash flows for the year ended December 31, 2017, for…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education