FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

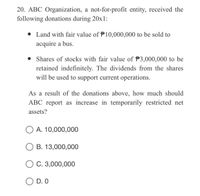

Transcribed Image Text:20. ABC Organization, a not-for-profit entity, received the

following donations during 20x1:

Land with fair value of P10,000,000 to be sold to

acquire a bus.

• Shares of stocks with fair value of P3,000,000 to be

retained indefinitely. The dividends from the shares

will be used to support current operations.

As a result of the donations above, how much should

ABC report as increase in temporarily restricted net

assets?

O A. 10,000,000

B. 13,000,000

C. 3,000,000

D. 0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the information provided in points bellow "..." calculate the net chargeable gain arising on the disposal of the freehold warehouse and shares in The City Limited, on the basis that any reliefs available are claimed. "On 25 April 2022 The City received proceeds of £250,000 for the sale of a warehouse which had been used for trading purposes. The original warehouse cost £25,000 when it was first acquired in December 1978 and was valued at £55,000 in March 1982. The sale was due to the company downsizing and The City bought a smaller replacement warehouse in October 2021 for £200,000 On 10 March 2022 The City sold its 100% investment in Lisbonnete Limited for £20,000. The expenses associated with the sale amounted to £5,000 and the original cost of the shares (in July 1992) was £80,000. Lisbonnete Limited was an active trading company throughout the period that it was owned by The City Limited."arrow_forwardAm120.arrow_forwardAnswerarrow_forward

- barrow_forwardManjiarrow_forwardRST Charities received equities securities valued at $100,000 as an unrestricted gift. At year end, the securities had a fair market value of $110,000. By what amount did these transactions increase RST's net assets? A.) $100,000 B.) $105,000 C.) $110,000 D.) $115,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education