ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

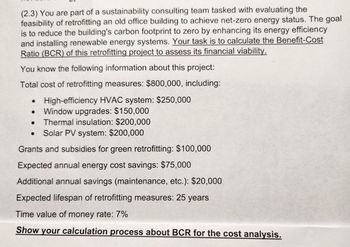

Transcribed Image Text:(2.3) You are part of a sustainability consulting team tasked with evaluating the

feasibility of retrofitting an old office building to achieve net-zero energy status. The goal

is to reduce the building's carbon footprint to zero by enhancing its energy efficiency

and installing renewable energy systems. Your task is to calculate the Benefit-Cost

Ratio (BCR) of this retrofitting project to assess its financial viability.

You know the following information about this project:

Total cost of retrofitting measures: $800,000, including:

High-efficiency HVAC system: $250,000

• Window upgrades: $150,000

Thermal insulation: $200,000

Solar PV system: $200,000

Grants and subsidies for green retrofitting: $100,000

Expected annual energy cost savings: $75,000

Additional annual savings (maintenance, etc.): $20,000

Expected lifespan of retrofitting measures: 25 years

Time value of money rate: 7%

Show your calculation process about BCR for the cost analysis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You are weighing the economics of installing a triple-glazed energy efficient window system in your building. The following life cycle costs and savings are provided. The study period is 25 years, and the discount rate is 10%. Is this an economically viable approach based on the Savings-to-Investment Ratio (SIR)? Triple- Glazed Energy Efficient Windows: Window Quantity takeoff: 10000 sf Initial Cost: $100/sf Annual Operating Costs: $2.5/sf Annual Energy Saving: $10/sfarrow_forwardYou must show all of vour calculation. You cannot use Excel to solve the problem. You need to show all the steps and process while solving the problem. Draw the cash flow diagrams properly. Improper drawn cash flow diagrams will be penalized.arrow_forwardYou and two friends find yourself craving a fresh pizza while preparing for the final exam on the engineering economy. You can't spend time picking up the pizza and you have to have it shipped. 'Pick-up-Sticks' offers 1-1/4-inch thick (including toppings), 20-inch square pizza with your option of two toppings for $15 plus 5 percent sales tax, and $1.50 delivery fee (no sales tax on delivery price). "Fred's" offers Sasquatch round, deep-dish, which is 20 inches in diameter. It is 1-3/4 inches thick, contains two toppings, and costs $17.25 plus sales tax of 5 percent and free delivery. (1) What is the problem in this situation? Please state that clearly and specifically. (2) Apply the seven principles of engineering economy systematically to the problem you set out in Part (1) (3) If your common unit of measurement is dollars (i.e., cost), what is the better value for having a pizza based on the criterion of reducing cost per unit volume? (4) What other criteria might be used to select…arrow_forward

- Please only answer part Barrow_forwardIf the profit function for selling smart phone screen magnifier is -4500p2 + 561500p – 11898000, what is the maximum profit that can be expected from selling smart phone screen magnifiers? Question 1 options: $ 0, no profit $ 5,617,681 $ 1,717,764 -$ 8,004,171arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education