FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

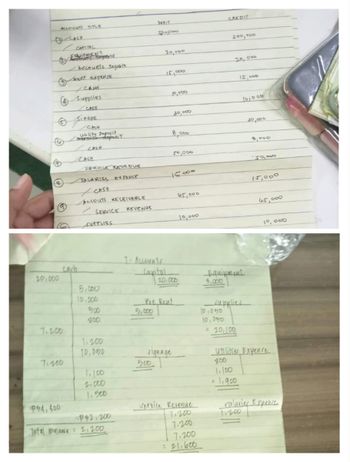

Please give the Journal and Title Accounts of each event

The same with the 2nd picture thankyou

Transcribed Image Text:ACCOUNTS TITLE

(3) kent expense.

CASH.

Supplies

/CASE

B

20,000

Ⓒinage

7.200

CAPITAL

EQUIPMENTyle

7:200

Recounts Payable

P34,400

utility Deposit..

merater deposit

CASH

SERVICE REVENUE

SALARIES EXPENSE

✓CASH

ACCOUTS RECEIVABLE

SERVICE KEVENUE

SUPPLIES

5,000

10.000

500

800

1.200

10,050

1,100

2.000

1.500

32.200

Total Balance 2,200

200,000

1- Accounts

20,000

500

15,000

10,000

rignage

30,000

8,000

Pre Rent

50,000

15,000

20,000

65,000

10,000

Service Revenue

71200

7.200

7.200

= 21.600

CREDIT

200,000

101050

10,090

20,000

15,00

Equipment

3,000

supplier

= 20, 100

10,000

30,000

11200

8,000

65,000

10, 000

Utilities Expence

860

1.100

= 1,900

ralaries Expence

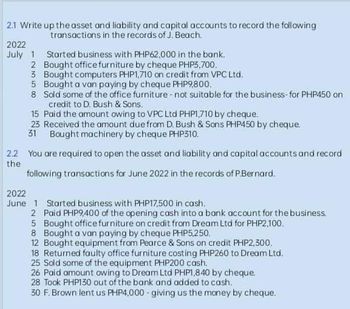

Transcribed Image Text:2.1 Write up the asset and liability and capital accounts to record the following

transactions in the records of J. Beach.

2022

July 1 Started business with PHP62,000 in the bank.

2 Bought office furniture by cheque PHP3,700.

3 Bought computers PHP1,710 on credit from VPC Ltd.

Bought a van paying by cheque PHP9,800.

5

8 Sold some of the office furniture - not suitable for the business-for PHP450 on

credit to D. Bush & Sons.

15 Paid the amount owing to VPC Ltd PHP1,710 by cheque.

23 Received the amount due from D. Bush & Sons PHP450 by cheque.

31 Bought machinery by cheque PHP310.

2.2 You are required to open the asset and liability and capital accounts and record

the

following transactions for June 2022 in the records of P.Bernard.

2022

June 1 Started business with PHP17,500 in cash.

2 Paid PHP9,400 of the opening cash into a bank account for the business.

5 Bought office furniture on credit from Dream Ltd for PHP2,100.

Bought a van paying by cheque PHP5,250.

8

12 Bought equipment from Pearce & Sons on credit PHP2,300.

18 Returned faulty office furniture costing PHP260 to Dream Ltd.

25 Sold some of the equipment PHP200 cash.

26 Paid amount owing to Dream Ltd PHP1,840 by cheque.

28 Took PHP130 out of the bank and added to cash.

30 F. Brown lent us PHP4,000 giving us the money by cheque.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please help with the question that is attached as a picture. thanksarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardChrome File Edit View History Bookmarks Profiles Tab Window Help Project Chapters 5-7 Content WP NWP Assessme X 2,041 Content OCT 26 education.wiley.com/was/ui/v2/assessment-player/index.html?launchId=36ec0bd6-8a4b-4bac-8fcd-95120acedb08#/question/0 Question 1 of 1 View Policies Show Attempt History Current Attempt in Progress Cash On December 1, 2022, Sheffield Corp. had the following account balances. Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Dec. 7 1. × 2. 12 (a) 17 19 22 26 31 Adjustment data: terms 1/10 n/30 × bExplain the appl X During December, the company completed the following transactions. > Debit $18,100 2,500 7,800 tv 15,500 1,500 28,100 $73,500 Accumulated Depreciation-Equipment Accounts Payable Common Stock Retained Earnings Depreciation was $210 per month. Insurance of $400 expired in December. Your answer is partially correct. Credit $3,100 6,000 loc 50,300 Received $3,600 cash from customers in payment of account (no discount allowed).…arrow_forward

- Can you help me with posting this. 1st photo is question. 2nd photo is general journalarrow_forwardWhich of the following is described as an online “living entity”? Social media résumé Chronological résumé Functional résumé Infographic résumé Traditional résumé All of these choices are correct. Explain your answer, and cite sources.arrow_forwardDinesh bhaiarrow_forward

- Screenshot of question is attached. thanks in advancearrow_forwardProfiles Tab Window Help A CengageNOWv2 | Online teach x K Counseling eAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false MLA Citation Gen. Spinbot.com - Arti. Plagiarism Checke.. edunav cenage Inflaor 围 eBook Show Me How Retained earnings statement Instructions Labels and Amount Descriptions Retained Earnings Statement Instructions Financial information related to Healthy Products Company for the month ended November 30, 2018, is as follows: Net income for November $160,000 Cash dividends paid during November 23,500 Retained earnings, November 1, 2018 371,000 1. Prepare a retained earnings statement for the month ended November 30, 2018. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. If a net loss is incurred or dividends were paid, enter that amount as a negative number using a minus sign. 2. Why is the retained earnings statement…arrow_forwardWhen do we make closing journal entries?arrow_forward

- Need help with answering the questiins. Thank youarrow_forward* CengageNOWv2 | Online teachin X b Home | bartleby x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false * D 9 : M Gmail O YouTube Maps Blackboard HW #9 - Chpt 21 O eBook Show Me How E Print Item 1. TMM.21.01 Contribution Margin and Contribution Margin Ratio For a recent year, Wicker Company-owned restaurants had the following sales and expenses (in millions): 2. TMM.21.02 Sales $14,100 3. TMM.21.03 Food and packaging $5,994 Рayroll 3,600 4. TMM.21.04 Occupancy (rent, depreciation, etc.) 1,986 5. EX.21,01 General, selling, and administrative expenses 2,100 $13,680 6. EX.21.02 Income from operations $420 7. EX.21.03 Assume that the variable costs consist of food and packaging; payroll; and 40% of the general, selling, and administrative expenses. 8. EX.21.06.ALGO a. What is Wicker Company's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) million 9. EX.21.09.ALGO b. What is Wicker…arrow_forwardcan you provide me the listing and examples of the closing entriesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education