Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

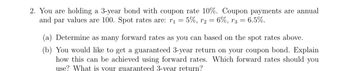

Transcribed Image Text:2. You are holding a 3-year bond with coupon rate 10%. Coupon payments are annual

and par values are 100. Spot rates are: r₁ = 5%, r₂ 6%, r3 = 6.5%.

(a) Determine as many forward rates as you can based on the spot rates above.

(b) You would like to get a guaranteed 3-year return on your coupon bond. Explain

how this can be achieved using forward rates. Which forward rates should you

use? What is your guaranteed 3-year return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please show work without calc or excel. In other words the actual equation.arrow_forwardCalculate the yield on the following bonds: A. Cost $1,000, semiannual coupon payment 3%. Since 3% is semiannual, then double it to get 6% annual yield. Always calculate yield in terms of annual percentage. B. Cost $950, semiannual coupon payment 3%. Since 3% is semiannual, then double it to get 6% annual yield. Always calculate yield in terms of annual percentage.arrow_forwardFind the price a purchaser should be willing to pay for the given bond. Assume that the coupon interest is paid twice a year. $19,000 bond with coupon rate 6% that matures in 4 years; current interest rate is 5% The purchaser should be willing to pay $ (Simplify your answer. Round to the nearest cent as needed.)arrow_forward

- You have a bond with the following features: - Semi-annual coupon payments. - Coupon rate 7.60%. - Face value $1,000. - 3.5 years to maturity. - Current market price $1,130. Requirements (A, B, and C are independent): 1. Calculate the duration and modified duration for this bond. Duration ___ Mduration ___ 2. Now, let’s assume the modified duration of this bond is 3 years. If the yield increases by 30 bps (basis points), what will the new price of the bond using modified duration? 3. If the yield drops by 75 bps, what is the actual new price of the bond?arrow_forwardConsider a 5 year non-call 3 year bond that is callable in 3 year and 4 year at prices of 101 and 100. It pays an annual coupon of 4% and is priced at 101. What is the yield-to-worst for this bond?arrow_forwardYou are considering a 10-year, Rs. 1000 par value bond. Its coupon rate is 10% and interest is paidsemiannually. If you require an effective annual interest rate of 8%, how much should you be willingto pay for the bond? Is effective annual interest rate differing from coupon rate? Explain.arrow_forward

- In calculating the current price of a bond paying semiannual coupons, one needs to O use double the number of years for the number of payments made. O use the semiannual coupon. O use the semiannual rate as the discount rate. O All of the above needs to be done.arrow_forwardFind the price of the bond. Solve the question without using Excel and provide the necessary calculations.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education