Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

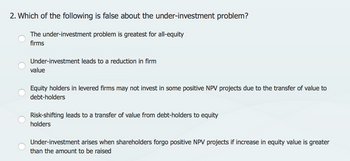

Transcribed Image Text:2. Which of the following is false about the under-investment problem?

The under-investment problem is greatest for all-equity

firms

Under-investment leads to a reduction in firm

value

Equity holders in levered firms may not invest in some positive NPV projects due to the transfer of value to

debt-holders

Risk-shifting leads to a transfer of value from debt-holders to equity

holders

Under-investment arises when shareholders forgo positive NPV projects if increase in equity value is greater

than the amount to be raised

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which statement below is incorrect? Select one: A. Compared to interview, survey is more suitable to ask standardised questions. B. If a firm has more intangible assets, according to the trade-off theory, it is more likely to have a higher leverage. C. If a firm is more profitable, according to the pecking order theory, it should use less debt for financing. D. The CAPM model implies that a stock with a higher beta has a higher return on average.arrow_forwardQ.A low debt ratio, compared to other industry competitors with similar operating leverage, most likely means the firm has A. a higher cost of capital than the competition. B. a higher EVA than the competition. C. a lower bond rating than the competition. D. none of the above.arrow_forwardCompany PL and company NL are identical except PL has positive financial leverage whereas NL has negative financial leverage. Which of the following are true? You can select more than one. PL’s return on invested capital (ROIC) is more volatile than NL’s ROIC. PL’s return on equity (ROE) is more volatile than NL’s ROE. PL’s ROIC and NL’s ROIC are equally volatile. PL’s ROE and NL’s ROE are equally volatile. PL’s return on invested capital (ROIC) is less volatile than NL’s ROIC. PL’s return on equity (ROE) is less volatile than NL’s ROEarrow_forward

- What types of firms would we expect to observe higher direct agency costs of equity, such as consuming excessive perquisites by management ? Question 7 options: a) Firms with high free cash flows b) Firms with fewer growth opportunities c) Firms with weak governance structures d) All of the above options are correct e) None of the options are correctarrow_forwardModigliani and Miller suggest that, under certain assumptions, financing decisions do not matter in that they do not affect the value of the firm. They define when these assumptions hold as perfect markets. Which of the following are assumptions that they claim must hold for financing decisions to be irrelevant? Group of answer choices There are no taxes There are no transaction costs The firm has a fixed investment policy The sun must rise in the North and set in the Southarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education