FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

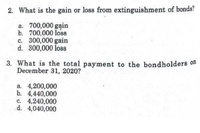

Transcribed Image Text:2. What is the gain or loss from extinguishment of bonds?

a. 700,000 gain

b. 700,000 loss

c. 300,000 gain

d. 300,000 loss

3. What is the total payment to the bondholders on

December 31, 2020?

a. 4,200,000

b. 4,440,000

c. 4,240,000

d. 4,040,000

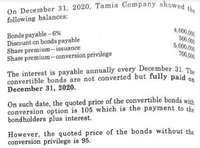

Transcribed Image Text:On December 31, 2020, Tamia Company showed the

following balances:

4,000,000

Bonds payable -6%

Discount on bonds payable

Share premium – issuance

Share premium- conversion privilege

500,000

5,000,000

700,000

The interest is payable annually every December 31. The

convertible bonds are not converted but fully paid

December 31, 2020.

On such date, the quoted price of the convertible bonds with

conversion option is 105 which is the payment to the

bondholders plus interest.

However, the quoted price of the bonds without the

conversion privilege is 95.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following bond was quoted in The Wall Street Journal: Bonds Current yield Volume Close Net change NJ 4.125% 35 0.3% 5 79.875% +1.0625% Eight bonds were purchased yesterday, and 8 bonds were purchased today. How much more did the 8 bonds cost today?arrow_forwardThe following bond was quoted in The Wall Street Journal: Bonds Current yield Volume Close Net change NJ 4.125% 35 2.5% 5 112.875% +1.25% Seven bonds were purchased yesterday, and 7 bonds were purchased today. How much more did the 7 bonds cost today?arrow_forwardPlease question #4 of P9.26. Calculate the resulting gain or loss. What is the impact of the gain or loss on Bonds payable, Bond discount and Cash? Where will the gain/loss be reported n the company's statement of cash flows?arrow_forward

- B D E F 1 2 Consider the following newly issued bonds-a coupon-bearing bond, a zero-coupon bond, and a perpetuity. 3 4 Inputs Kimball Industries Coupon Bond 5 Settlement Date 1/1/2020 Blake & Associates Zero-Coupon Bond 1/1/2020 PJ Financial Perpetual Bond 1/1/2020 6 Maturity Date 1/1/2040 1/1/2040 Indefinite/Infinite 7 Coupon Rate 2.44% 0.00% 2.06% 8 Face Value 9 Coupons per Year 100 1 100 100 1 2 10 11 Market Data 12 Yield 3.93% 13 14 Required: 15 Note: Use cells A2 to B12 from the given information to complete this question. 16 17 Using any necessary data above, calculate the Macaulay Duration of each bond. Then, use the Macaulay Duration to solve for the Modified Duration. 18 19 Kimball Industries Coupon Bond Blake & Associates Zero-Coupon Bond PJ Financial Perpetual Bond 20 Price 21 Macaulay Duration 22 Modified Duration 23 24arrow_forwardSuppose that the current carrying value of Old Navy's $1872000 face value bonds is $1865200. If the bonds are retired at 101, what would be the amount Old Navy would pay its bondholders? $1890720 $1874080 $1865200 $1872000arrow_forward65 The amortization of a premium on bonds payable Group of answer choices increases the carrying amount of the bond. decreases the balance of the bonds payable account. increases the amount of interest expense reported. increases the cash payment to bondholders.arrow_forward

- Bonds with a face value of $530000 and a quoted price of 96.25 have a selling price of $508933. O $511450. $508813. O $510125.arrow_forward39. Help me selecting the right answer. Thank youarrow_forward92 Parts I and J: Pure Discount Bond (Treasury Bills) 93 Purchase price 94 Face value 95 Time to maturity (days) 96 Time to maturity (years) 9,750.00 10,000.00 182 0.49863 97 98 Part I: Pure Discount Bond, Compound Daily Return 99 Daily interest rate 100 YTM-the annualized rate 101 102 Part J: Pure Discount Bond, Calculate the continuously compounded return 03 Continuously compounded 04 05 06arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education