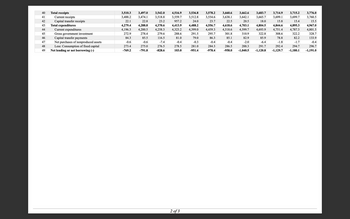

22. The Taxes on corporate income (included in current tax receipts) for the 4th quarter of 2019 is: $______ billions.

23.The Taxes on corporate income (included in current tax receipts) for the 4th quarter of 2017 is: $______ billions.

24.The change in the Taxes on corporate income, from 4th quarter of 2017 to the 4th quarter of 2019 is: ______ billions.

25. The Contributions for government social insurance FROM PERSONS for the 4th quarter of 2019 is: $______ billions.

26. The Contributions for government social insurance FROM PERSONS for the 4th quarter of 2017 is: $______ billions.

27. The change in the Contributions for government social insurance FROM PERSONS, from 4th quarter of 2017 to the 4th quarter of 2019 is: ______ billions.

![Table 3.2. Federal Government Current Receipts and Expenditures

[Billions of dollars] Seasonally adjusted at annual rates

Last Revised on: August 30, 2023 - Next Release Date September 28, 2023

2017

Line

1

2 Current tax receipts

3

Current receipts

5

6

7

Personal current taxes 1

Taxes on production and imports2

Excise taxes

Customs duties

Other

Taxes on corporate income

Taxes from the rest of the world

Contributions for government social insurance

From persons

From the rest of the world3

9

10

11

12

13 Income receipts on assets

14 Interest receipts4

15

Dividends

16

17

18

Rents and royalties5

19 Current transfer receipts

20

From business

21

22

23 Current surplus of government enterprises7

24

Current expenditures

Federal Reserve banks

Other

From persons

From the rest of the world6

25 Consumption expenditures

26 Current transfer payments

27

28

29

Government social benefits

To persons

To the rest of the world8

Other current transfer payments

Grants-in-aid to state and local governments

To the rest of the world6,8

30

31

32

33 Interest payments4

34

35

36 Subsidies7

37

38 Social insurance funds

39 Other

To persons and business4

To the rest of the world

Net federal government saving

Addenda:

2017

Q2

3,474.1

1,982.0

2017

Q3

3,518.8

2,021.4

1,600.1 1,623.2

131.7

131.9

91.5

39.0

1.2

225.4

24.8

1,275.1

1,269.9

5.2

142.4

29.1

107.5

87.2

20.2

5.8

73.5

42.8

26.9

3.9

1.0

2017

Q4

3,559.7

2,052.8

1,649.1

134.9

94.2

39.5

1.2

243.0

25.9

1,309.1

1,303.9

5.2

122.9

31.4

84.6

72.8

11.8

6.8

73.8

43.8

27.0

2.9

4,196.3

1.1

4,200.5 4,258.3 4,323.2

973.4

978.7

981.0

997.0

2,703.4 2,693.1 2,734.5 2,773.1

2,095.4 2,109.1 2,127.4 2,146.5

2,074.0 2,087.4 2,105.5 2,124.2

21.4

21.7

21.9

22.2

608.0

584.0

607.1

626.7

562.8

542.4

562.9

573.6

45.2

41.6

44.3

53.1

460.7

471.2

481.5

493.4

351.7

358.2

362.2

368.5

109.0

113.0

119.2

124.9

58.8

57.5

61.4

59.6

-708.1

-726.4

-763.5

-327.8

-328.9

-329.2

-380.3

-397.5

-434.3

Q1

3,488.2

1,943.3

1,580.0

127.5

89.0

37.4

1.2

211.7

24.0

1,262.7

1,257.4

5.4

162.8

29.0

128.4

88.4

40.0

5.3

119.0

65.3

26.9

26.8

0.3

92.5

38.2

1.2

241.3

25.1

1,290.3

1,285.1

5.2

130.4

29.7

94.3

73.7

20.6

6.3

75.4

43.3

26.9

5.2

1.3

-739.5

-330.4

-409.1

1 of 3

2018

2018

Q1

Q2

3,512.8 3,554.6

1,979.0 2,016.0

1,597.1 1,607.0

150.5

156.1

107.6

108.0

41.7

46.9

1.2

1.2

206.5

227.2

24.9

25.7

1,328.9 1,338.6

1,323.6 1,333.2

5.3

5.3

120.0

114.7

35.9

2018

2018

Q3

Q4

3,638.1 3,642.1

2,043.2 2,079.7

1,625.5 1,630.1

163.3

185.4

109.3

112.2

52.7

71.9

1.3

1.3

229.0

237.2

25.5

26.9

1,355.1 1,363.4

1,349.7 1,358.0

5.4

5.4

130.7

127.9

37.5

38.1

2019

2019

2019

Q1

Q2

Q3

3,665.7 3,699.1 3,699.7

2,090.9 2,106.4 2,100.6

1,687.7 1,692.6 1,700.6

174.6

171.3

176.3

98.0

98.0

95.1

75.3

72.0

79.9

1.3

1.3

1.3

202.8

215.9

196.9

25.8

26.6

26.8

1,395.2 1,402.6 1,410.0

1,389.8 1,397.2 1,404.7

5.5

5.4

109.8

121.2

37.5

37.6

5.3

100.1

34.2

38.1

78.4

71.0

85.1

81.5

64.0

75.1

53.6

78.3

67.1

60.7

55.2

44.9

58.8

53.4

0.2

3.9

24.4

26.3

19.1

16.3

0.2

7.3

7.7

8.0

8.3

8.4

8.5

8.4

84.3

85.2

110.1

73.2

72.4

72.1

91.7

53.2

45.4

63.5

38.7

35.9

38.5

54.6

27.8

27.9

28.1

28.3

28.3

28.2

27.8

12.0

18.6

8.3

5.3

9.4

-3.1

3.3

6.3

0.6

0.1

-1.0

-2.1

4,399.0 4,459.3 4,518.6 4,599.7

1,014.6 1,030.5 1,049.4 1,057.4

2,818.7 2,839.0 2,858.8 2,890.7

2,193.2 2,206.1 2,224.3 2,247.3

2,170.8 2,183.4 2,201.3 2,224.3

22.4

23.0

643.4

-2.7

-2.8

4,693.9 4,751.4 4,787.3

1,070.2 1,096.5 1,103.5

2,971.4 3,004.9 3,019.3

2,326.9 2,343.1 2,358.0

2,303.4 2,319.4 2,333.8

23.5

23.7

24.3

644.5

661.8

661.2

22.7

23.0

625.5

632.9

634.5

581.2

579.5

581.7

587.8

592.4

615.5

610.4

44.3

53.3

52.8

55.6

46.3

50.8

52.1

583.8

507.6

532.2

553.1

573.7

591.6

584.0

376.9

396.9

413.2

430.0

435.5

442.2

437.3

130.8

135.3

139.9

143.7

146.7

58.1

57.7

57.3

-880.5

148.3

149.5

77.9

68.5

58.3

80.6

-957.6 -1,028.2 -1,052.3 -1,087.6

-372.4 -395.6 -407.1

-886.3

-904.8

-343.1

-350.3

-355.9

-416.4

-543.2

-554.5

-524.6

-585.3

-632.5

-645.1

-671.2

2019

Q4

3,760.5

2,156.4

1,726.4

176.9

91.9

83.8

1.3

226.2

26.8

1,429.0

1,423.7

5.2

108.6

37.7

62.6

62.4

0.2

8.3

68.4

35.5

27.0

5.9

-1.8

4,801.5

1,109.0

3,040.7

2,370.8

2,346.4

24.5

669.8

617.5

52.3

569.8

430.9

138.9

82.1

-1,041.0

-411.5

-629.5](https://content.bartleby.com/qna-images/question/8fd71a05-cce6-42ce-8872-636d0d92cbc9/df219e0c-54ab-4629-9a20-fe1e58d4c641/80j3cm_thumbnail.png)

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

- Title Actions by the Federal Government that decrease the progressivity of the tax system: a. decrease th Description Actions by the Federal Government that decrease the progressivity of the tax system: a. decrease the amount of government spending b. increase the effects of automatic stabilizers c. decrease the effects of automatic stabilizers d. increase the amount of taxationarrow_forward1arrow_forwardALL QUESTIONS GO WITH BOTH CHARTS 6. Focusing on the tax cut of 1964, the personal current tax receipts for 1968, four years after the tax cut is $ _______ billion. 7. Focusing on the tax cut of 1964, the personal current tax receipts for 1969, five years after the tax cut is $ _______ billion. 9. Focusing on the tax cut of 1982, the personal current tax receipts for 1981, the year before the tax cut is $ _______ billion. 10. Focusing on the tax cut of 1982, the personal current tax receipts for 1982, the year of the tax cut is $ _______ billion.arrow_forward

- 7. The national debt a. Is paid off each fiscal year when the debt is refinanced. b. Will never be paid off in any given year, but it will be entirely paid off when it is refinanced over a number of years. Will be paid off when the budget is finally balanced. Equals the dollar amount of outstanding U.S. Treasury bonds. c darrow_forwardARTICLE: LUSAKA, Sept 27 (Reuters) - Zambia will not replace its value-added tax (VAT) with a non-refundable sales tax, Finance Minister Bwalya Ng'andu said on Friday, after the proposal met substantial opposition from businesses. "Government has decided to maintain the Value Added Tax, but address the compliance and administrative challenges," Ng'andu said in a budget speech. Zambia's mining industry fiercely opposes the tax - just one sore point between the government and the economy's most important sector. Based on your review of the article above, do you think that Zambia should replace the VAT tax with a national sales tax? Discuss the difficulties inherent in collecting the VAT tax compared to the simplicity of a sales tax. What are the pros and cons of each system?arrow_forward3. Focusing on the tax cut of 1964, the personal current tax receipts for 1965, the year after the tax cut is $ _______ billion. 4. Focusing on the tax cut of 1964, the personal current tax receipts for 1966, two years after the tax cut is $ _______ billion. 5. Focusing on the tax cut of 1964, the personal current tax receipts for 1967, three years after the tax cut is $ _______ billion.arrow_forward

- Economicsarrow_forwardSuppose that in 2012 the government collected $320 billion in revenue and spent $380 billion, while in 2013 the government revenue increased to $350 billion and its spending fell to $330 billion. If the government had a debt of $600 billion at the beginning of 2012, how much debt would it have by the end of 2013? Select one: a. $620 billion b. $640 billion c. $650 billion d. $660 billion e. $680 billionarrow_forwardCalculate the value of total expenditure if budgetary deficit is $20,000 million and the total receipts is $6000 millionarrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education