ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

solve a,b,c,d for me please. and explain too.

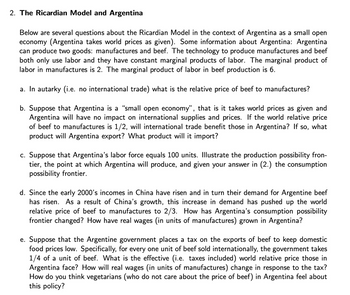

Transcribed Image Text:2. The Ricardian Model and Argentina

Below are several questions about the Ricardian Model in the context of Argentina as a small open

economy (Argentina takes world prices as given). Some information about Argentina: Argentina

can produce two goods: manufactures and beef. The technology to produce manufactures and beef

both only use labor and they have constant marginal products of labor. The marginal product of

labor in manufactures is 2. The marginal product of labor in beef production is 6.

a. In autarky (i.e. no international trade) what is the relative price of beef to manufactures?

b. Suppose that Argentina is a "small open economy", that is it takes world prices as given and

Argentina will have no impact on international supplies and prices. If the world relative price

of beef to manufactures is 1/2, will international trade benefit those in Argentina? If so, what

product will Argentina export? What product will it import?

c. Suppose that Argentina's labor force equals 100 units. Illustrate the production possibility fron-

tier, the point at which Argentina will produce, and given your answer in (2.) the consumption

possibility frontier.

d. Since the early 2000's incomes in China have risen and in turn their demand for Argentine beef

has risen. As a result of China's growth, this increase in demand has pushed up the world

relative price of beef to manufactures to 2/3. How has Argentina's consumption possibility

frontier changed? How have real wages (in units of manufactures) grown in Argentina?

e. Suppose that the Argentine government places a tax on the exports of beef to keep domestic

food prices low. Specifically, for every one unit of beef sold internationally, the government takes

1/4 of a unit of beef. What is the effective (i.e. taxes included) world relative price those in

Argentina face? How will real wages (in units of manufactures) change in response to the tax?

How do you think vegetarians (who do not care about the price of beef) in Argentina feel about

this policy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education