ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

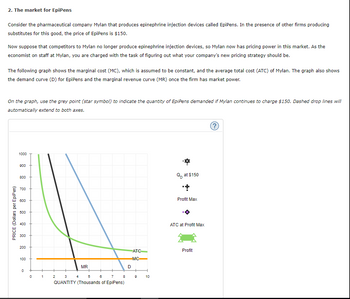

Transcribed Image Text:2. The market for EpiPens

Consider the pharmaceutical company Mylan that produces epinephrine injection devices called EpiPens. In the presence of other firms producing

substitutes for this good, the price of EpiPens is $150.

Now suppose that competitors to Mylan no longer produce epinephrine injection devices, so Mylan now has pricing power in this market. As the

economist on staff at Mylan, you are charged with the task of figuring out what your company's new pricing strategy should be.

The following graph shows the marginal cost (MC), which is assumed to be constant, and the average total cost (ATC) of Mylan. The graph also shows

the demand curve (D) for EpiPens and the marginal revenue curve (MR) once the firm has market power.

On the graph, use the grey point (star symbol) to indicate the quantity of EpiPens demanded if Mylan continues to charge $150. Dashed drop lines will

automatically extend to both axes.

PRICE (Dollars per EpiPen)

1000

900

800

700

600

500

400

300

200

100

0

0 1

MR

2 3 4

5

6 7

QUANTITY (Thousands of EpiPens)

8

D

ATC

MC

+

9

10

Qat $150

+

Profit Max

ATC at Profit Max

Profit

?

Transcribed Image Text:If Mylan continues to charge $150 per EpiPen, Mylan will earn negative economic profit.

True or False: Given the demand curve for EpiPens, you should tell Mylan's CEO that total revenue will increase if she raises the price of EpiPens

because the demand curve in this region is relatively inelastic.

True

False

On the previous graph, use the black point (plus symbol) to indicate the profit-maximizing price and quantity. Dashed drop lines will automatically

extend to both axes.

On the previous graph, use the purple point (diamond symbol) to indicate the average total cost at the profit-maximizing quantity. Then use the green

rectangle (triangle symbols) to shade the area indicating the firm's economic profit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The pen industry is an increasing cost industry. If a pen is an inferior good, and consumer's incomes permanently increase, the equilibrium price of a pen ____ in the long run, the equilibrium quantity of pens ______in the long run, and the number of firms in the market ____ in the long run. Word Bank: Decreases, Decreases, Decreases, Increases, Increases, Increases, does not change, does not change, does not change.arrow_forward6. A record company estimates the industry demand for "hard alternative rock" albums to be: QD-1000 -125 P. It estimates the industry supply to be: QS = 125-P a. Given these estimates, what does it expect the industry output and price to be? b. A government commission announces that lyrics on "hard alternative rock" albums are offensive and should be banned. This causes consumers to purchase 20% more of such albums at any given price, compared to question 6a. What effect will this have on industry output and the price? c. Calculate the consumer surplus for parts a and b above. Are consumers better or worse off given the commission's recommendation?arrow_forward2. The market for EpiPens Consider the pharmaceutical company Mylan that produces epinephrine injection devices called EpiPens. In the presence of other firms producing substitutes for this good, the price of EpiPens is $150. Now suppose that competitors to Mylan no longer produce epinephrine injection devices, so Mylan now has pricing power in this market. As the economist on staff at Mylan, you are charged with the task of figuring out what your company's new pricing strategy should be. The following graph shows the marginal cost (MC), which is assumed to be constant, and the average total cost (ATC) of Mylan. The graph also shows the demand curve (D) for EpiPens and the marginal revenue curve (MR) once the firm has market power. On the graph, use the grey point (star symbol) to indicate the quantity of EpiPens demanded if Mylan continues to charge $150. Dashed drop lines will automatically extend to both axes. PRICE (Dollars per EpiPen) 1000 900 800 700 600 500 400 300 200 100 0 0 +…arrow_forward

- Consider This) In the 1300s, the French government claimed for itself a monopoly over the sale of salt. Over the next few centuries Multiple Choice The French government would retain that monopoly, earning tremendous economic profits. The French government auctioned off the monopoly right to sell salt, earning large sums and freeing itself of collection costs. The French government retained that monopoly, selling salt at below market prices to ensure widespread access to salt. The French government deregulated the salt industry, ensuring that multiple sellers would create competitive market conditions and keep prices lower.arrow_forward1. There are two brands of cigarettes X, Y. The demand for each is as follows: Qx = 80 - 2p Qy = 60 - 0.5p Assume that the marginal cost of producing cigarette X is $10, the marginal cost of producing cigarette Y is $8, and that the market for both cigarettes is perfectly competitive. Assume that each pack of cigarette X smoked does $5 worth of health damage to the smoker, and a total of $4 worth of health damage to the smoker’s neighbors via second-hand smoke. Each pack of cigarette Y smoked does $6 worth of health damage to the smoker, and $5 health damage to the smoker’s neighbors. (a) Explain why the public supply curves differ from the private supply curves, and how this represents the externality from second-hand smoke. Highlight the area(s) of your diagram that represents a social loss. (b) Calculate the social loss for both. (c) Suppose the government decides to pursue a Pigouvian solution to eliminate social loss. What's amount of tax or subsidy would the government…arrow_forwardThe following graph shows the daily market for small cardboard boxes in San Diego. PRICE (Dollars per small box 10 9 Demand 0 161 6 QUANTITY (Millions of small boxes) 2 Supply 19 10 Suppose that Talero is one of more than a hundred competitive firms in San Diego that produce such cardboard boxes. Based on the preceding graph showing the daily market demand and supply curves, the price Talero must take as given isarrow_forward

- 3. Consider the Smith family who have the following demand for rental housing (q, measured in square feet): q=0.5*(y/p), where y is the Smith family income and p is the price of housing per square foot. The Smith's income is $4000 per month and initially the price of housing is $2 per square foot per month. a. If the Smiths are operating on their demand curve, how much housing are they consuming? b. How much is the Smith family's monthly rent? How much does the Smith family spend on other consumption? c. Starting from the initial equilibrium, the government now grants the Smiths a proportional rent subsidy with B=0.5. How much housing does the Smith family purchase given the subsidy? d. What is the gross market rent per month paid by the Smith family? What is the net rent (after deducting the subsidy) paid by the Smith family? How much does the Smith family spend on other consumption in its new equilibrium? e. What is total dollar outlay of the government for the Smith's housing…arrow_forwardI pretty sure I got the first part right. I am struggling with bottom parts.arrow_forwardThe young expert Hand written solution is not allowed.arrow_forward

- 250 225 Revenue Lost 200 175 150 Revenue Gained 125 Demand 100 75 50 25 3 4 7 8 9. 10 QUANTITY (Fire engines) Gilberto increase production from 7 to 8 fire engines because the dominates in this scenario. True or False: If Gilberto's Fire Engines were a competitive firm instead and $100,000 were the market price for an engine, decreasing its price from $100,000 to $50,000 would result in the same change in the production quantity and, thus, total revenue. O True O False acer Σ 2. 1. PRICE (Thousands of dollars per fire engine)arrow_forwardUse the orange points (square symbol) to plot the initial short-run industry supply curve when there are 10 firms in the market. (Hint: You can disregard the portion of the supply curve that corresponds to prices where there is no output since this is the industry supply curve.) Next, use the purple points (diamond symbol) to plot the short-run industry supply curve when there are 15 firms. Finally, use the green points (triangle symbol) to plot the short-run industry supply curve when there are 20 firms. PRICE (Dollars per pound) 100 90 80 70 80 50 40 30 20 10 0 0 125 250 375 500 825 750 875 1000 1125 1250 QUANTITY (Thousands of pounds) Demand Because you know that competitive firms earn Supply (10 firms) True Supply (15 firms) If there were 10 firms in this market, the short-run equilibrium price of rhodium would be $ would . Therefore, in the long run, firms would False Supply (20 firms) per pound. From the graph, you can see that this means there will be ? per pound. At that price,…arrow_forwardPlease explain how to graph this. From the curve of the demand and supply and the factors that affects the grapharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education