FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Effect of the error # 2 for the year 2019

Answer the ff:

| O-Overstated | U-Understated | X-No effect | |

| Purchases | |||

| Cost of Sales | |||

| Net income | |||

| Inventory | |||

| Accounts Payable | |||

| RE before closing | |||

| RE after closing |

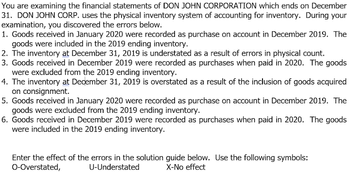

Transcribed Image Text:You are examining the financial statements of DON JOHN CORPORATION which ends on December

31. DON JOHN CORP. uses the physical inventory system of accounting for inventory. During your

examination, you discovered the errors below.

1. Goods received in January 2020 were recorded as purchase on account in December 2019. The

goods were included in the 2019 ending inventory.

2. The inventory at December 31, 2019 is understated as a result of errors in physical count.

3. Goods received in December 2019 were recorded as purchases when paid in 2020. The goods

were excluded from the 2019 ending inventory.

4. The inventory at December 31, 2019 is overstated as a result of the inclusion of goods acquired

on consignment.

5. Goods received in January 2020 were recorded as purchase on account in December 2019. The

goods were excluded from the 2019 ending inventory.

6. Goods received in December 2019 were recorded as purchases when paid in 2020. The goods

were included in the 2019 ending inventory.

Enter the effect of the errors in the solution guide below. Use the following symbols:

O-Overstated,

U-Understated X-No effect

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Effect of the error # 2 for the year 2020

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Effect of the error # 2 for the year 2020

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardOn December 31, 2023, Jen & Mink Clothing (J&M) performed the inventory count and determined the year-end ending inventory value to be $77500, it is now January 8, 2024, and you have been asked to double-check the year-end inventory listing. J&M uses a perpetual inventory system Note: Only relevant items are shown on the inventory listing. # 1 2 Jen & Mink Clothing Inventory Listing December 31, 2023 Inventory Number Inventory Description Quantity (units) Blue jackets. Black pants 7649 10824 104 308 Unit Cost ($) Total Value ($) 24 2,496 5,852 19 Total Inventory $77,500 The following situations have been brought to your attention: a. On January 3, 2024, J&M received a shipment of 104 blue jackets, for $2,496 (Item #7649). The inventory was purchased December 23, 2023, FOB destination from Global Threads. This inventory was included in J&M's inventory count and inventory listing. b. On December 29, 2023, J&M sold scarves (Item # 5566) to a customer with a sale price of $740 and cost of…arrow_forwardSolve both questions Do not give answer in imagearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education