ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Don't answer by pen paper and don't use chatgpt

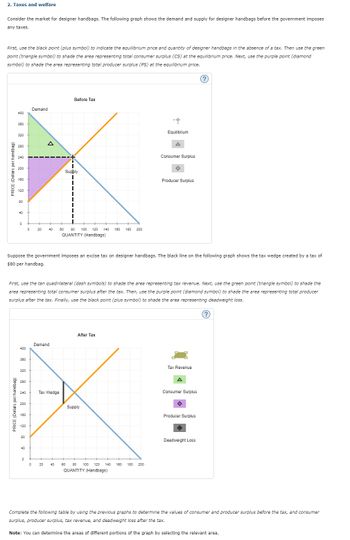

Transcribed Image Text:2. Taxes and welfare

Consider the market for designer handbags. The following graph shows the demand and supply for designer handbags before the government imposes

any taxes.

First, use the black point (plus symbol) to indicate the equilibrium price and quantity of designer handbags in the absence of a tax. Then use the green

point (triangle symbol) to shade the area representing total consumer surplus (CS) at the equilibrium price. Next, use the purple point (diamond

symbol) to shade the area representing total producer surplus (PS) at the equilibrium price.

PRICE (Dollars per handbag)

400

380

PRICE (Dollars per handbag)

320

280

240

200

40

0

400

360

320

280

240

200

160

120

Suppose the government imposes an excise tax on designer handbags. The black line on the following graph shows the tax wedge created by a tax of

$80 per handbag.

80

Demand

First, use the tan quadrilateral (dash symbols) to shade the area representing tax revenue. Next, use the green point (triangle symbol) to shade the

area representing total consumer surplus after the tax. Then, use the purple point (diamond symbol) to shade the area representing total producer

surplus after the tax. Finally, use the black point (plus symbol) to shade the area representing deadweight loss.

40

20

0

A

40

Demand

0 20

Tax Wedge

Before Tax

Supply

40

60 80 100 120 140 160 180 200

QUANTITY (Handbags)

After Tax

Equilibrium

Supply

Consumer Surplus

60 80 100 120 140 160 180 200

QUANTITY (Handbags)

Producer Surplus

Tax Revenue

A

Consumer Surplus

(?)

Producer Surplus

Deadweight Loss

(?

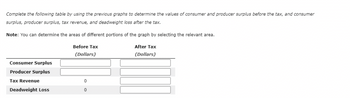

Complete the following table by using the previous graphs to determine the values of consumer and producer surplus before the tax, and consumer

surplus, producer surplus, tax revenue, and deadweight loss after the tax.

Note: You can determine the areas of different portions of the graph by selecting the relevant area.

Transcribed Image Text:Complete the following table by using the previous graphs to determine the values of consumer and producer surplus before the tax, and consumer

surplus, producer surplus, tax revenue, and deadweight loss after the tax.

Note: You can determine the areas of different portions of the graph by selecting the relevant area.

After Tax

Before Tax

(Dollars)

(Dollars)

Consumer Surplus

Producer Surplus

Tax Revenue

Deadweight Loss

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What are some strategies for protecting consumer privacy on an online e-commerce platform selling coffee beans?arrow_forwardhow was EVwSample info calculated for this problem?arrow_forwardWhat benefits are their in operating a business to consumer online business model for consumers and the owner?arrow_forward

- Imagine you are the mayor of a town and you are trying to decide if you should pay for a fireworks show. Your staff survey your 400 citizens who say that they each value a fireworks show at $10. The fireworks show only costs $3,000 so you put on the show but when you ask for donations to pay for the fireworks you only receive $25 total. What does this result show? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. You staff's survey must have overestimated the value of a fireworks show. b The fireworks cost must have been greater than their economic benefit. The firework show suffered from the Tragedy of the Commons problems d The town's citizens were free-riders.arrow_forwardOnly typed answer and please don't use chatgpt You are looking for a new apartment in Manhattan. Your income is $4,000 per month, and you know that you should not spend more than 25 percent of your income on rent. You have come across the following listing for one-bedroom apartments on craigslist. You are indifferent about location, and transportation costs are the same to each neighborhood. Chelsea $1,200 Battery Park $2,200 Delancey $950 Midtown $1,500 Instructions: You may select more than one answer. Click the box with a check mark for correct answers and click to empty the box for the wrong answers. a. Which apartments fall within your budget? Chelsea Battery Park Delancey Midtown b. Suppose you adhere to the 25 percent guideline but also receive a $1,000 monthly cost-of-living supplement since you are living and working in Manhattan. Which apartments fall within your budget now? Chelsea Battery Park Delancey Midtownarrow_forwardWhat are the ethical issues that could be encountered when running an e-commerce platform?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education