Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

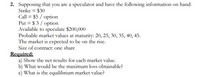

Transcribed Image Text:2. Supposing that you are a speculator and have the following information on hand:

Strike = $30

Call = $5 / option

Put = $ 3 / option

Available to speculate $200,000

Probable market values at maturity: 20, 25, 30, 35, 40, 45.

The market is expected to be on the rise.

Size of contract: one share

Required:

a) Show the net results for each market value.

b) What would be the maximum loss obtainable?

c) What is the equilibrium market value?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Hi, i need help with this question. The answer should be: potentially infinite but I dont understand how to get there. Please explain, thanks! Question: You establish a short strangle on a company using December call and put options. The call option has a strike price of $50 and the put option has a strike price of $45. The premium on the call option is $4.80 and the premium on the put option is $5.40. What is your maximum loss on this position?arrow_forward$80. The call premium is $6 and the put premium is $8. To keep thìngs simple, you can assume each contract allows the holder to buy or sell 13) You buy one call contract and also buy one put contract, both with the strike price of one (rather than the typical 100) share of the underlying stock. a. Compute the payoff to your option position if the stock price is $92 when the options expire. b. Compute the profit you made if the stock price is $92 when the options еxpire. c. What would happen to the value of your position if the volatility of returns for the underlying stock increases a day after you bought the call and the put? Please explain your answer for full credit. E FC MacBook Pro I A !!!arrow_forwardConsider a two-state outcome for the following problem: Winterhold Publishing House Current Stock Price $25.00 Exercise Price $27.00 Risk-free Rate 0.05 Share Price, High $30.00 Share Price, Low $20.00 Required: Using the data above, please find the hedge ratio. You currently own several shares of this company. The purchase puts according to the Hedge ratio to construct a non-random portfolio. Show the payoff for both outcomes, then solve for present value and the price of the put.arrow_forward

- What is the Step by Step of solving L?arrow_forwardAssume an interest rate of zero. A Call option and a Put option with the same exercise price, X = 100p are priced at 9p for the Call and 4p for the Put. What is the price of the synthetic share?arrow_forwardYou sold a put contract on EDF stock at an option price of $.25 and an exercise price of $22.50. The option expires today when EDF stock is selling for $21.70 a share. Ignoring transactions costs and taxes, what is your total profit on this investment?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education