FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Can I please have help answering #2. The financial statements are below, and the question is in the screen shot. Thank you

|

You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: |

| Lydex Company Comparative |

||||

| This Year | Last Year | |||

| Assets | ||||

| Current assets: | ||||

| Cash | $ | 820,000 | $ | 1,060,000 |

| Marketable securities | 0 | 300,000 | ||

| |

2,860,000 | 1,960,000 | ||

| Inventory | 3,640,000 | 2,400,000 | ||

| Prepaid expenses | 270,000 | 210,000 | ||

| Total current assets | 7,590,000 | 5,930,000 | ||

| Plant and equipment, net | 9,600,000 | 9,090,000 | ||

| Total assets | $ | 17,190,000 | $ | 15,020,000 |

| Liabilities and |

||||

| Liabilities: | ||||

| Current liabilities | $ | 4,050,000 | $ | 3,060,000 |

| Note payable, 10% | 3,700,000 | 3,100,000 | ||

| Total liabilities | 7,750,000 | 6,160,000 | ||

| Stockholders' equity: | ||||

| Common stock, $75 par value | 7,500,000 | 7,500,000 | ||

| |

1,940,000 | 1,360,000 | ||

| Total stockholders' equity | 9,440,000 | 8,860,000 | ||

| Total liabilities and stockholders' equity | $ | 17,190,000 | $ | 15,020,000 |

| Lydex Company Comparative Income Statement and Reconciliation |

||||

| This Year | Last Year | |||

| Sales (all on account) | $ | 15,900,000 | $ | 13,980,000 |

| Cost of goods sold | 12,720,000 | 10,485,000 | ||

| Gross margin | 3,180,000 | 3,495,000 | ||

| Selling and administrative expenses | 1,410,000 | 1,620,000 | ||

|

|

|

|

|

|

| Net operating income | 1,770,000 | 1,875,000 | ||

| Interest expense | 370,000 | 310,000 | ||

| Net income before taxes | 1,400,000 | 1,565,000 | ||

| Income taxes (30%) | 420,000 | 469,500 | ||

| Net income | 980,000 | 1,095,500 | ||

| Common dividends | 400,000 | 547,750 | ||

| Net income retained | 580,000 | 547,750 | ||

| Beginning retained earnings | 1,360,000 | 812,250 | ||

| Ending retained earnings | $ | 1,940,000 | $ | 1,360,000 |

|

To begin your assigment you gather the following financial data and ratios that are typical of companies in Lydex Company’s industry: |

| |

2.3 | |

| Acid-test ratio | 1.2 | |

| Average collection period | 32 | days |

| Average sale period | 60 | days |

| Return on assets | 9.7 | % |

| Debt-to-equity ratio | 0.65 | |

| Times interest earned ratio | 5.7 | |

| Price-earnings ratio | 10 | |

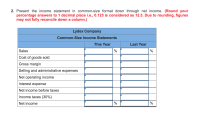

Transcribed Image Text:2. Present the income statement in common-size format down through net income. (Round your

percentage answers to 1 decimal place i.e., 0.123 is considered as 12.3. Due to rounding, figures

may not fully reconcile down a column.)

Lydex Company

Common-Size Income Statements

This Year

Last Year

Sales

%

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income

Interest expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Joseph Berio is a loan officer with the First Bank of Tennessee. Red Brick, Inc., a major producer of masonry products, has applied for a short-term loan. Red Brick supplies building material throughout the southern states, with brick plants located in Tennessee, Alabama, Georgia, and Indiana.The firm’s income statement and balance sheet are given below. The third table presents both a ratio analysis of Red Brick’s previous year’s financial statements and the industry averages of the ratios. Red Brick Income Statement (for the period ending December 12/31/20X1) Sales $ 151,000,000 Cost of goods sold 134,000,000 Administrative expenses 25,000,000 Operating income $ -8,000,000 Interest expense 13,000,000 Taxes 400,000 Net income $ -21,400,000 Red Brick Balance Sheet as of 12/31/20X2 Assets Liabilities and Stockholders’ Equity Cash $ 600,000 Accounts payable $ 33,000,000 Accounts receivable 39,000,000 * Notes payable 8,000,000…arrow_forwardYou are a Corporate Credit Analyst for your bank. A new corporate customer in the manufacturing sector approached your bank for a large credit facility in the sum of $20 million for production equipment and warehousing. The customer submitted the following financials to you. The cash position increased from $6.7 million in 2019 to $16 million in 2021. Does this signal a strengthening of the liquidity position of the firm? Explain.arrow_forwardPlease answer A,B,C You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 860,000 $ 1,100,000 Marketable securities 0 300,000 Accounts receivable, net 2,300,000 1,400,000 Inventory 3,500,000 2,000,000 Prepaid expenses 240,000 180,000 Total current assets 6,900,000 4,980,000 Plant and equipment, net 9,320,000 8,950,000 Total assets $ 16,220,000 $ 13,930,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 3,910,000 $ 2,780,000 Note payable, 10% 3,600,000 3,000,000 Total liabilities 7,510,000 5,780,000 Stockholders' equity:…arrow_forward

- In the Annual Report, Form 8K, and Form 10Q of a company, what type of financial information is found that can be useful in understanding the financial operation and condition of a company? If I have these forms from the past 3 years, what information can be found in these forms that could tell me about the operation and condition of the company?arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 860,000 $ 1,100,000 Marketable securities 0 300,000 Accounts receivable, net 2,300,000 1,400,000 Inventory 3,500,000 2,000,000 Prepaid expenses 240,000 180,000 Total current assets 6,900,000 4,980,000 Plant and equipment, net 9,320,000 8,950,000 Total assets $ 16,220,000 $ 13,930,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 3,910,000 $…arrow_forwardYou have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 980,000 $ 1,220,000 Marketable securities 0 300,000 Accounts receivable, net 2,780,000 1,880,000 Inventory 3,620,000 2,200,000 Prepaid expenses 260,000 200,000 Total current assets 7,640,000 5,800,000 Plant and equipment, net 9,560,000 9,070,000 Total assets $ 17,200,000 $ 14,870,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,030,000 $ 3,020,000 Note payable, 10% 3,680,000 3,080,000 Total liabilities 7,710,000 6,100,000 Stockholders' equity: Common stock, $75 par value…arrow_forward

- Rick's ROA?arrow_forward[The following information applies to the questions displayed below.] You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company’s financial statements, including comparing Lydex’s performance to its major competitors. The company’s financial statements for the last two years are as follows: Lydex CompanyComparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,010,000 $ 1,250,000 Marketable securities 0 300,000 Accounts receivable, net 2,900,000 2,000,000 Inventory 3,650,000 2,000,000 Prepaid expenses 270,000 210,000 Total current assets 7,830,000 5,760,000 Plant and equipment, net 9,620,000 9,100,000 Total assets $ 17,450,000 $…arrow_forwardThe balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company’s financial condition and performance. Cold Goose Metal Works Inc. is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet. Cold Goose Metal Works Inc. Balance Sheet for Year Ending December 31 (Millions of Dollars) Year 2 Year 1 Year 2 Year 1 Assets Liabilities and equity Current assets: Current liabilities: Cash and equivalents $4,612 Accounts payable $0 $0 Accounts receivable 2,109 1,688 Accruals 293 0 Inventories 6,187 4,950 Notes payable 1,660 1,562 Total current assets $14,062 $11,250 Total current liabilities $1,562 Net…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education