FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

7,8

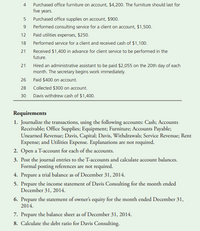

Transcribed Image Text:Purchased office furniture on account, $4,200. The furniture should last for

five years.

4

5 Purchased office supplies on account, $900.

9

Performed consulting service for a dient on account, $1,500.

12 Paid utilities expenses, $250.

18

Performed service for a client and received cash of $1,100.

21

Received $1,400 in advance for client service to be performed in the

future.

Hired an administrative assistant to be paid $2,055 on the 20th day of each

month. The secretary begins work immediately.

21

26 Paid $400 on account.

28

Collected $300 on account.

30 Davis withdrew cash of $1,400.

Requirements

1. Journalize the transactions, using the following accounts: Cash; Accounts

Receivable; Office Supplies; Equipment; Furniture; Accounts Payable;

Unearned Revenue; Davis, Capital; Davis, Withdrawals; Service Revenue; Rent

Expense; and Utilities Expense. Explanations are not required.

2. Open a T-account for each of the accounts.

3. Post the journal entries to the T-accounts and calculate account balances.

Formal posting references are not required.

4. Prepare a trial balance as of December 31, 2014.

5. Prepare the income statement of Davis Consulting for the month ended

December 31, 2014.

6. Prepare the statement of owner's equity for the month ended December 31,

2014.

7. Prepare the balance sheet as of December 31, 2014.

8. Calculate the debt ratio for Davis Consulting.

Transcribed Image Text:P2-43 Journalizing transactions, posting to T-accounts, and preparing

a trial balance

Problem P2-43 continues with the consulting business of Carl Davis, begun in

Problem P1-54. Here you will account for Davis Consulting's transactions as it is

actually done in practice.

Davis Consulting completed the following transactions during December 2014:

Dec. 2 Owner contributed $18,000 cash in exchange for capital.

2 Paid monthly office rent, $550.

3 Paid cash for a computer, $1,800. This equipment is expected to remain in

service for five years.

Purchased office furniture on account, $4,200. The furniture should last for

five years.

4

5 Purchased office supplies on account, $900.

9

Performed consulting service for a dient on account, $1,500.

Paid utilities expenses, $250.

12

18

Performed service for a client and received cash of $1,100.

Received $1,400 in advance for client service to be performed in the

future.

21

Hired an administrative assistant to be paid $2,055 on the 20th day of each

month. The secretary begins work immediately.

21

26

Paid $400 on account.

28 Collected $300 on account.

30 Davis withdrew cash of $1,400.

Requirements

1. Journalize the transactions, using the following accounts: Cash; Accounts

Receivable; Office Supplies; Equipment; Furniture; Accounts Payable;

Unearned Revenue; Davis, Capital; Davis, Withdrawals; Service Revenue; Rent

Expense; and Utilities Expense. Explanations are not required.

2. Open a T-account for each of the accounts.

3. Post the journal entries to the T-accounts and calculate account balances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 4 Listen Which of the following points are on the unit circle? Select all that apply. A (--) B (33.3) C 12 (1/13. 31/3)arrow_forwardI got to find if my general ledger is complete. So, In the general ledger, I add all the debits side and the credit side got a matching balance between the debit and credit in the general ledger. However, in the trial balance the total balance for the debit and credit does not match also differ from the general ledger. I will state that is not a complete because of those reasons. Let me know if I am correct or not. Please do example your reasoning?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education