FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the correct answer to the question?

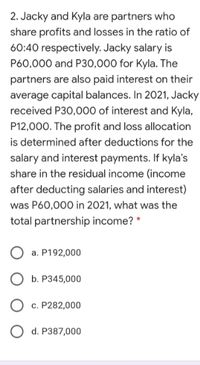

Transcribed Image Text:2. Jacky and Kyla are partners who

share profits and losses in the ratio of

60:40 respectively. Jacky salary is

P60,000 and P30,000 for Kyla. The

partners are also paid interest on their

average capital balances. In 2021, Jacky

received P30,000 of interest and Kyla,

P12,000. The profit and loss allocation

is determined after deductions for the

salary and interest payments. If kyla's

share in the residual income (income

after deducting salaries and interest)

was P60,000 in 2021, what was the

total partnership income? *

a. P192,000

ОБ. Р345,000

О С. Р282,000

O d. P387,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- JJ and KK are partners who share profits and losses in the ratio of 60%:40% respectively. JJ’ssalary is 60,000and 30,000 to KK. The partners are also paid interest on their average capitalbalances. In 2021, JJ received 30,000 of interest and KK 12,000. The profit and loss allocation isdetermined after deductions for salary and interest payments. If KK’s share in the residual income(income after salaries and interest) was 60,000, what was the total partnership income?a. 192,000b. 345,000c. 282,000d. 387,000arrow_forwardBloom and Carnes share profits and losses in a ratio of 2:3, respectively. Bloom and Carnes receive salary allowances of $10,000 and $20,000, also respectively, and both partners receive 10% interest based upon the balance in their capital accounts on January 1. Partners’ drawings are not used in determining the average capital balances. Total net income for 2021 is $60,000. If net income after deducting the interest and salary allocations is greater than $20,000, Carnes receives a bonus of 5% of the original amount of net income. Bloom Carnes January 1 capital balances $ 200,000 $ 300,000 Yearly drawings ($1,500 a month) 18,000 18,000 A. What are the total amounts for the allocation of interest, salary, and bonus, and, how much over-allocation is present? B. If the partnership experiences a net loss of $20,000 for the year, what will be the final amount of profit or (loss) closed to each partner’s capital account?arrow_forwardJohn and Paul are partners who share profits and losses in the ratio of 3:2 respectively. John’s salary is P180,000 and Paul’s is P140,000. The partners are paid interest on their average capital balances where John received interest of P 30,000 and Paul, P 15,000. The profit and loss allocation is determined after deduction for the salary and interest payments. If John received P280,000 from partnership income, what was the total partnership income? Please provide a good accounting form in the solution. Thank youarrow_forward

- How much of the P112,500 partnership profit for 2020 should be distributed was P112,500, and the average capital account balances for that year were 3. The partnership contract of the Taluban, Ugaban, and Villanueva Partnership provided for the division of net income or losses in the following manner: 1. Bonus of 20% of income before the bonus to Taluban. 2. Interest at 15% on average capital account balance to each partner. 3. Remaining income or loss, equally to each partner. Net income of the Taluban, Ugaban, and Villanueva Partnership for 2020 Taluban, P125,000; Ugaban, P250,000; and Villanueva, P375,000. to Taluban? P33,750 b. P7,500 P48,750 a. С. d. P41,250arrow_forwardKwong and Morales entered into a partnership as at Mar. 1, 2019 by the investing P125,000 andP75,000, respectively. They agreed that Kwong, as the managing partner, was to receive a salary ofP30,000 per year and a bonus computed at 10% of the profit after adjustment for the salary; the balanceof the profit was to be distributed in the ratio of their original capital balances. On Dec. 31, 2019, normalaccount balances were as follows:Cash P70,000 Accounts Payable P 60,000Accounts Receivable 67,000 Kwong, Capital 125,000Furniture and Fixtures 45,000 Morales, Capital 75,000Sales Returns 5,000 Kwong, Drawing 20,000Purchases 196,000 Morales, Drawing 30,000Operating Expenses 60,000 Sales 233,000Inventories on Dec. 31, 2019, were as follows: supplies, P2,500, merchandise, P73,000. Prepaidinsurances was P950 while accrued expenses were P1,550. Depreciation rate was 20% per year. Thepartner’s capital balances on Dec. 31, 2019, after closing the profit and drawing accounts, were:Kwong Moralesa.…arrow_forwardG, E and N are partners with average capital balances during 2020 of P400,000, P200,000 and P150,000respectively. Partners receive 10% interest on their average capital balances. After deducting salaries ofP100,000 to G and P50,000 to E the residual profit and loss is divided equally. In 2020 the partnershipsustained a P99,000 loss after interest and salaries to partners.By what amount should G's capital account change?A. 107,000 C. 32,000B. 67,000 D. 17,000arrow_forward

- Marc, Jacobs and Benetton share profits in the ratio 2:3:5. On September 30, Partner Benetton opted to retire from the partnership. The capital balances on this date are the following: Marc-P50,000; Jacobs-P 80,000; Benetton-P 70,000. How much is to be debited from Marc assuming Benetton is paid P 78,000 in full settlement of his interest? Use Bonus method.arrow_forwardG. Bench, Mark, Spencer, and Lee are partners, sharing earnings in the ratio of 3:4:6:8, respectively. The balances of their capital accounts on December 31, 2019 are as follows: Bench - P 1,000 Mark - P 25,000 Spencer - P 25,000 Lee - P 9,000 The partners decide to liquidate, and they accordingly convert the non-cash assets into P 23,200 of cash. After paying the liabilities amounting to P 3,000, they have P 22,200 cash to divide. Assume that a debit balance of any partners' capital is uncollectible. 1. How much is the cash balance before realization? 2. How much is the share of Bench in the loss upon conversion of the non-cash assets into cash?arrow_forwardBefore beginning their partnership, A and B agreed that net income would beallocated based first on 10% interest paid on their beginning capital balances.These were A – $100,000; B – $200,000. Profits would then be allocated basedon yearly “salaries” paid as follows: A – $70,000; B – $50,000. They also agreedthat any remaining profit and loss would be shared in the ratio of 3:2. Netincome for the first year is $150,000. This amount would be allocated as: Group of answer choices: A: $75,000; B: $75,000 A: $80,000; B: $70,000 A: $90,000; B: $60,000 None of the above The allocated amounts cannot be determinedarrow_forward

- Nancy and Peter enter into a partnership and decide to share profits and losses as follows: 1 The first allocation is a salary allowance with Nancy receiving $16,000 and Peter receiving $14,000. 2. The second allocation is 20% of the partners' capital balances at year end. On December 31, 2019, the capital balances for Nancy and Peter are $88,000 and $25,000, respectively 3. Any remaining profit or loss is allocated equally. For the year ending December 31, 2019, the partnership reported a net loss of $95,000. What is Peter's share of the net loss? OA. $40,200 OB. $7,300 OC. $21,200 OD. $19,000arrow_forwardQuestion: What is Patrick's equity balance at December 31, 2021 after dividing the profit?arrow_forwardThe partnership agreement of Kray, Lamb, and Mann provides for the division of net income as follows: 1. Lamb who manages the partnership, is to receive a salary of P550,000 per year. 2. Each partner is to be allowed interest at 10% on beginning capital. 3. Remaining profits are to be divided equally. During 2020, Kray invested additional P200,000 in the partnership. Lamb withdrew P250,000, and Mann withdrew P200,000. No other investments or withdrawals were made during 2020. On January 1, 2020 the capital. balances of Kray, P3,250,00, Lamb P3,750,000, and Mann P3,500,000. Total capital at year end was PP12,600,000. Required: Prepare a statement of partners' capital for the year ended December 31, 2020.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education