FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

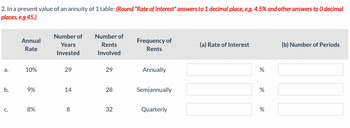

Transcribed Image Text:2. In a present value of an annuity of 1 table: (Round "Rate of Interest" answers to 1 decimal place, e.g. 4.5% and other answers to O decimal

places, e.g 45.)

a.

b.

C.

Annual

Rate

10%

9%

8%

Number of

Years

Invested

29

14

8

Number of

Rents

Involved

29

28

32

Frequency of

Rents

Annually

Semiannually

Quarterly

(a) Rate of Interest

%

%

%

(b) Number of Periods

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Coice 52,26,39 ,78arrow_forwardFollowing is a table for the present value of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 5 0.747 0.621 0.567 Following is a table for the present value of an annuity of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables provided, the present value of $57,000 (rounded to the nearest dollar) to be received 3 years from today, assuming an earnings rate of 6%, is a.$71,501 b.$152,361 c.$47,880 d.$57,000arrow_forward1.18q Determine the payment to amortize the debt. (Round your answer to the nearest cent.) Quarterly payments on $17,500 at 3.9% for 6 years.arrow_forward

- Following is a table for the present value of $1 at compound interest: Year 6% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 5 0.747 0.621 0.567 Following is a table for the present value of an annuity of $1 at compound interest: Year 6% 10% 1 0.943 0.909 2 1.833 1.736 3 2.673 2.487 4 3.465 3.170 4.212 3.791 10% 12% 0.893 1.690 2.402 3.037 5 3.605 Using the tables provided, the present value of $15,007 (rounded to the nearest dollar) to be received 4 years from today, assuming an earnings rate of 10%, is Oa. $11,886 Ob. $47,572 Oc. $10,250 Od. $15,007arrow_forwardCertain Concrete Company deposits $2,000 at the end of each quarter into an account paying 11% interest compounded quarterly. What is the value of the account at the end of 7 1/2 1 2 years? (a) State the type. A. present valueB. ordinary annuity C. sinking fund D. amortization E. none of these (b) Answer the question. (Round your answer to the nearest cent.)arrow_forwardNonearrow_forward

- Ma3. A loan is amortized by level payments made at the end of each quarter, for 25 years: The monthly rate is 1%. The principal in the 29th payment is 8370. Find OLB69 OA. 1,115,185.53 OB. 1,101,108.22 OC. The correct answer is not shown here. OD. 1,430,370.34 OF. 1,301,108.22arrow_forwardNonearrow_forwardFind the future value for each of the following scenarios, where m is the periodic deposit and r is the interest rate. Future Value $50,000 7.8% $225,000 6.9% $200,000 6.5% $275,000 3.9% $125,000 5.2% r compounding frequency annually semiannually quarterly monthly weekly time in years 6 15 10 $ 11 $ 13 $ periodic deposit (m) $ interest earnedarrow_forward

- For the case shown in the following table, determine the amount of the equal, end of year deposits necesssary to accumulate the given sum at the end of teh specified period, assuming the stated annual interest rate. Sum to be accumulated Accumulation Period (Years) Interest Rate $124,600 20 11%arrow_forwardFollowing is a table for the present value of $1 at compound interest: Year 6% 10% 1 0.943 0.909 0.890 0.826 0.840 0.751 0.792 0.683 5 0.747 0.621 Following is a table for the present value of an annuity of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables provided, the present value of $9,186.00 (rounded to the nearest dollar) to be received at the end of each of the next 4 years, assuming an earnings rate of 12%, is Oa. $9,186 Ob. $22,065 2 3 4 4 Oc. $27,898 Od. $33,116 12% 0.893 0.797 0.712 0.636 0.567arrow_forwardFuture value interest factor of an ordinary annuity of $1 per period at i% for n periods, FVIFA(i,n). Period 5.0% 5.5% 6.0% 1.0% 1.0000 1.5% 1.0000 2.0% 1.0000 1 1.0000 1.0000 1.0000 1.0000 1.0000 2 2.0050 2.0100 2.0150 2.0200 2.0250 2.0300 2.0350 1.0000 2.0400 3.1216 3 3.0150 3.0301 3.0452 3.0756 3.0909 3.1062 4 4.0301 3.0604 4.1216 5.2040 4.1525 4.1836 4.2149 4.2465 5 4.0604 4.0909 5.1010 5.1523 6.1520 6.2296 6.3081 5.0503 5.2563 5.3091 5.3625 5.4163 6 6.0755 6.3877 6.4684 6.5502 6.6330 7 7.1059 7.5474 7.6625 7.7794 7.4343 8.4328 8.5830 8 8.1414 9 10 11 12 13 14 15 16 17 18 19 6.5% 7.0% 7.5% 9.0% 8.5% 0.0% 0.5% 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 2.0450 2.0500 2.0550 2.0600 2.0650 2.0700 2.0750 2.0800 2.0850 2.0900 2.0950 3.1370 3.1525 3.1680 3.1836 3.1992 3.2149 3.2306 3.2464 3.2622 3.2781 3.2940 4.2782 4.3101 4.3423 4.3746 4.4072 4.4399 4.4729 4.5061 4.5395 4.5731 4.6070 5.4707 5.5256 5.5811 5.6371 5.6936 5.7507 5.8084 5.8666 5.9254 5.9847 6.0446…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education