Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

so.5

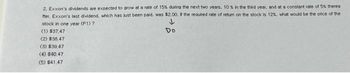

Transcribed Image Text:2. Exxon's dividends are expected to grow at a rate of 15% during the next two years, 10 % in the third year, and at a constant rate of 5% therea

fter, Exxon's last dividend, which has just been paid, was $2.00. If the required rate of return on the stock is 12%, what would be the price of the

stock in one year (P1) ?

↓

Do

(1) $37,47

(2) $38,47

(3) $39,47

(4) $40,47

(5) $41,47

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- If the last dividend paid by Chemical Brothers Inc. was $1.25 and analysts expect these payments to increase 4% per year, what will the stock price be next year if the required return is 15%? Select one: O a. $12.29 O b. $11.82 O c. $31.25 O d. $12.78 O e. $23.11arrow_forwardTarget Corporation (TGT) just paid a $3.14 dividend, and it is expected to grow at 6.25% for the next 3 years. After 3 years the dividend is expected to grow at the rate of 2.95% indefinitely. If the required return is 7.12%, what is the stock’s value today? A. $61.67 B. $70.95 C. $84.97 D. $98.04arrow_forwardOrwell building supplies' last dividend was $1.75. Its dividend growth rate is expected to be constant at 45.00% for 2 years, after which dividends are expected to grow at a rate of 6% forever. Its required return (rs) is 12%. What is the best estimate of the current stock price? Select the correct answer. a. $60.10 b. $58.56 c. $57.02 d. $59.33 e. $57.79arrow_forward

- Please choose the correct answerarrow_forwardThe Fl Corporation's dividends per share are expected to grow indefinitely by 8% per year. Required: a. If this year's year-end dividend is $3.00 and the market capitalization rate is 10% per year, what must the current stock price be according to the DDM? Note: Round your answer to 2 decimal places. b. If the expected earnings per share are $9.00, what is the implied value of the ROE on future investment opportunities? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. c. How much is the market paying per share for growth opportunities (i.e., for an ROE on future investments that exceeds the market capitalization rate)? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. a. Current stock price b. Value of ROE c. Amount % per sharearrow_forwardA company is currently paying dividend of Tk. 40 per share. The dividend is expected to grow at a 20% annual rate for two years, then at 15% rate for the next two years and then at 10% rate for the next two years, after which it is expected to grow at a 5% rate forever. What should be the current price of the share if required rate of return is 12%? (Consider upto 3 decimal placein case of all fractions).arrow_forward

- Orwell Building Supplies' last dividend was $1.75. Its dividend growth rate is expected to be constant at 25% for 2 years, after which dividends are expected to grow at a rate of 6% forever. Its required return (rs) is 12%. What is the best estimate of the current stock price? a. $41.58 b. $42.64 c. $43.71 d. $44.80 e. $45.92 What is the capital gains yield in the first year for Orwell Building Supplies using the information from the previous question? a. 8.33%. b. 6.87%. c. 12.00%. d. 6.00%. e. 8.00%.arrow_forwardH5.arrow_forwardA company just paid an annual dividend of $0.66. Dividends are expected to grow by 25% in 1 year, 20% in the second year, and 15% in the third year. After that, dividends are expected to continue to grow at an annual rate of 8% indefinitely. If the market's required rate of return on this stock is 17% per year. What is the current price per share?[Keep AT LEAST 4 decimal place on ALL intermediate steps. Round your final answer to 2 decimal places, expressed in dollars and cents (ie $12.34)] Current price =$ Blank 1. Calculate the answer by read surrounding text.arrow_forward

- F2arrow_forwardAlset Inc. just paid a $2.30 dividend, and its dividends are expected to grow at the rate of 12% for 6 years. You assume that after year 6 the growth rate of dividends will slow down to 4% per year forever. If the expected return on a comparable stock is 8%, what should be your estimate of the fair value of the Alset Inc.s stock today?a. $82.25b. $78.34c .$90.09d. $86.17e. $94.01arrow_forwardVenus Airlines will pay a $8 dividend next year on its stock, which is currently selling at $100 per share. What is the market's required return on this investment if the dividend is expected to grow at 5% forever? 3% 13% 5% 10% unansweredarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education