ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

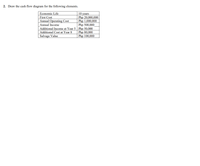

Transcribed Image Text:2. Draw the cash flow diagram for the following elements.

Economic Life

10 years

Php 20,000,000

Php 1,000,000

Php 500,000

Additional Income at Year 5 Php 50,000

Php 80,000

Php 100,000

First Cost

Annual Operating Cost

Annual Income

Additional Cost at Year 8

Salvage Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- m mmm. m Given the cash flows in table below, determine the rate of return. Year Cash Flow 0 $10K 1 $0 2 $5K 3 $0 4 $10K Group of answer choices Cannot determine 100% 8.91% 7.6% 4.9% 11.2% Flag question: Question 8arrow_forwardWhat Term goes with what Conceptarrow_forwardPlease no written by hand and no emagearrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardLittrell's Nursery needs a new irrigation system. System one will cost $145,000, have annual maintenance costs of $10,000, and need an overhaul at the end of year six costing $30,000. System two will have first year maintenance costs of $5,000 with increases of $500 each year thereafter. System two would not require an overhaul. Both systems will have no salvage value after 12 years. If Littrell's cost of capital is 4%, using annual worth analysis determine the maximum Littrell's should be willing to pay for system two.arrow_forwardFor the project with cash flow given below find the most sensitive factor among annual benefit, annual cost and salvage value if the changes by ±20%. Initial investment Annual revenue Annual Cost Salvage Value MARR Life in years Project Rs.2,00,000 Rs.1,00,000 Rs. 40,000 Rs. 50,000 10% 5arrow_forward

- Please use the formulae and make the solution Project Month Month Month Month Status at the end of Month 3 Phases 1 2 3 4 Requirements Definition S-F Complete, spent $10,000 Architecture and Design SPF F Complete, spent $12000 Development and unit testing System testing and Operation S -PF 50% done, spent $9000 Not yet startedarrow_forwardthis are homework questions, pls explain the correct answer :arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education