Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

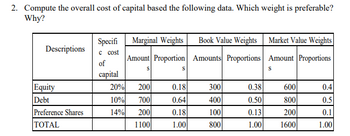

Transcribed Image Text:2. Compute the overall cost of capital based the following data. Which weight is preferable?

Why?

Descriptions

Equity

Debt

Preference Shares

TOTAL

Specifi

c cost

of

capital

20%

10%

14%

Marginal Weights

Amount Proportion

S

200

700

200

1100

S

0.18

0.64

0.18

1.00

Book Value Weights

Amounts Proportions

300

400

100

800

0.38

0.50

0.13

1.00

Market Value Weights

Amount Proportions

S

600

800

200

1600

0.4

0.5

0.1

1.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 11arrow_forwardEvans Technology has the following capital structure. Debt Common equity 40% 60 The aftertax cost of debt is 8.00 percent, and the cost of common equity (in the form of retained earnings) is 15.00 percent. a. What is the firm's weighted average cost of capital? Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places. Debt Common equity Weighted average cost of capital Weighted Cost % % An outside consultant has suggested that because debt is cheaper than equity, the firm should switch to a capital structure that is 50 percent debt and 50 percent equity. Under this new and more debt-oriented arrangement, the aftertax cost of debt is 9.00 percent, and the cost of common equity (in the form of retained earnings) is 17.00 percent. Debt Common equity Weighted average cost of capital b. Recalculate the firm's weighted average cost of capital. Note: Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal…arrow_forwarda. How much is the cost of equity using the capital asset pricing model? b. How much is the cost of equity using the bond plus risk premium?arrow_forward

- For an unlevered firm, the cost of capital can be determined by using the ________. A. Preferred stock yield B. Yield to maturity on the traded debt C. Capital Asset Pricing Model D. Dividend yieldarrow_forwardAccording to the simplified Brennan Lally CAPM, what is the cost of equity for A Ltd? Using the cost of debt, cost of equity, market value of debt and market value of equity given in the table given, what is the weighted average cost of capital (WACC) for B Ltd? Thank you!arrow_forwardle1.du.edu.om/mod/quiz/attempt.php?attempt=3518968&cmid3229109&page%=D2 Google Translate Moodle English (en) - purses / BUSS 105-5-20202 / General / TEST 2 Suppose a firm is using only two forms of financing i.e. Debt and Equity. Consider the following capital structure with different debt-equity combinations and calculate Weighted Average Cost of Capital Components Cost Weight Debt 7.85% 45% Equity 26.70% Select one: O a. 18.21% O b. 17.52% O G. 17.50% O d. None Wiole 18% U ENG A 40) A s 米 % $ 4. 8 #3 3. V Y 1 F 1 H K Garrow_forward

- A firm's capital is composed of the following sources and proportions: Source of Capital Weights Cost Long-term Debt 25% 6.0% Preferred Stock 35% 7.0% Common Stock 40% 8.0% The weighted average cost of capital is: A. 7.15%B. 6.85%C. 5.25%D. 7.00%arrow_forwardam. 123.arrow_forward1. The leverage ratio is the proportion of debts that a bank has compared to its equity/capital. Please answer one that is most correct Select one: a. Debt to Equity = Total debt / Shareholders Equity. b. Debt to Capital = Total debt / Capital (debt+equity) c. There are different leverage ratios such as. Debt to Equity = Total debt / Shareholders Equity. Debt to Capital = Total debt / Capital (debt+equity) Debt to Assets = Total debt / Assets. 2. Which of the following amortization methods is most likely to evenly distribute the cost of an intangible asset over its useful life? Select one: a. Units-of-production method. b. Straight-line method. c. Double-declining balance method 3. What ratio is a cash and marketable securities based (it removes Inventory) ? Select one: a. Quick Ratio b. Current Ratio c. Dupont Analysis set of ratios 4. Which of the following is an appropriate method of computing free cash flow to the firm? Select one: a. Add operating cash flows to…arrow_forward

- Get the solution with explanation of the questionarrow_forward-n Weighted average cost of capital (WACC) is the: O A. O B. O C. O D. O E. Average IRR of the firm's current projects. Required rate of return on a firm. Cost of utilizing debt financing. Average rate of return needed to increase the value of a firm's stock. Cost of obtaining equity financing.arrow_forwardSuppose your firm has a market value of equity is $500 million and a market value of debt is $475 million. What are the capital structure weights (i.e., weight of equity and weight of debt)? Group of answer choices A) weight of equity is 51.28%, , weight of debt is 48.72% B) weight of equity is 48.72%, , weight of debt is 51.28% C) weight of equity is 47.62%, , weight of debt is 52.38%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education