FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:E

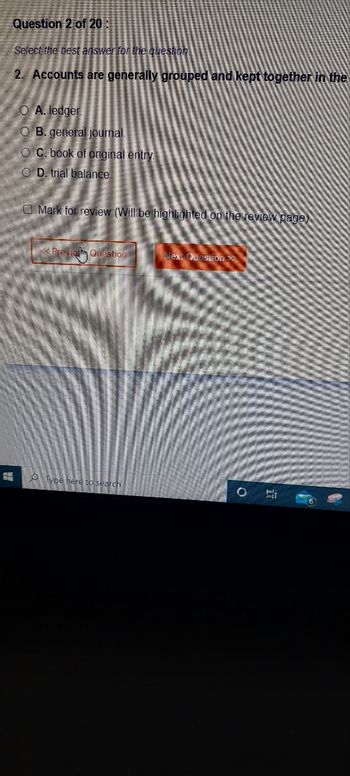

Question 2 of 20:

Select the best answer for the question.

2. Accounts are generally grouped and kept together in the

O A. ledger

O B. general journal.

OC. book of original entry

OD. trial balance.

Mark for review (Will be highlighted on the review page)

<< Previol Question

Type here to search

Next Question

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SLO-2.3. The first or original step in recording transactions is in the OLedger Journal OTrial Balance OBalance Sheetarrow_forwardAn invoice number is: a.added to the Post Ref. column of the ledger account. b.mentioned in the explanation of the related journal entry. c.added to the Post Ref. column of the journal. d.mentioned in the ledger accounts related to the journal entry.arrow_forwardDiamondback Welding & Fabrication Corporation sells and services pipe welding equipment in Illinois. The following selected accounts appear in the ledger of Diamondback Welding & Fabrication at the beginning of the current year: Preferred 2% Stock, $80 par (100,000 shares authorized, 60,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock Common Stock, $9 par (3,000,000 shares authorized, 1,750,000 shares issued) Paid-In Capital in Excess of Par-Common Stock Retained Earnings During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Purchased 87,500 shares of treasury common for $8 per share. b. Sold 55,000 shares of treasury common for $11 per share. c. Issued 20,000 shares of preferred 2% stock at $84. d. Issued 400,000 shares of common stock at $13, receiving cash. e. Sold 18,000 shares of treasury common for $7.50 per share. f. Declared cash dividends of $1.60 per share on preferred…arrow_forward

- Instructions Adele Corp., a wholesaler of music equipment, issued $31,400,000 of 20-year, 5% callable bonds on March 1, 20Y1, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions Refer to the Chart of Accounts for exact wording of account fifles 20Y1 Mar. Sept. 20Y5 Sept. Chart of Accounts Journal 1 Issued the bonds for cash at their face amount. Paid the interest on the bonds 1 1 Called the bond issue at 103, the rate provided in the bond indenture. (Omit entry for payment of interest.) Xarrow_forwardComplete the statement: closing entries ________ A. Reflect the net income for the accounting period B. Are also posted in the subsidiary ledgers C. Involve all ledger accounts D. Are recorded in the special journals The process wherein transactions are recorded in the journal are transferred to the appropriate accounts in the general ledger and subsildiary ledgers, if appropriate, is called ___________ A. Ledgering B. Analyzing C. Posting D. Journalizingarrow_forwardWhich among the following is considered as the book of original entry? a. Trial Balance b. Balance Sheet c. Journal d. Ledgerarrow_forward

- A company has a $1,000,000 bond issue outstanding with unamortized premium of $10,000 and unamortized issuance cost of $5,300. What is the book value of its liability?arrow_forwardDate General Account Titles and Explanations Ref. Debit Creditarrow_forwardPharoah Company had these transactions during the current period. June 12 July 11 Nov. 28 Issued 81,500 shares of $1 par value common stock for cash of $305,625. Issued 4,150 shares of $102 par value preferred stock for cash at $109 per share. Purchased 3,050 shares of treasury stock for $9,800. Prepare the journal entries for the Pharoah Company transactions shown above. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)arrow_forward

- Posting:a. involves transferring the information in journal entries to the general ledger.b. is an optional step in the accounting cycle.c. is performed after a trial balance is prepared.d. involves transferring information to the trial balance.arrow_forwardQUESTION 2 Study the following transactions that occurred during August 2022 for Renwick & Co. Aug 2 - Renwick & Co. sold 40 office desks costing $2,000 each, at a unit price of $4,500 to Shams Ltd. Terms: 2/10, n/30. Aug 7- Shams Ltd. Returned for full credit 6 of the desks acquired on August 2 because they were of the incorrect size and style. Aug 8 - Renwick & Co. returned the office desks to its inventory. Aug 9 - Renwick & Co. received payment by cheque from Shams Ltd. for 30 office desks. Aug 27 - Renwick & Co. received payment in cash from Shams Ltd. in full settlement for the remaining office desks acquired on August 2. Renwick & Co. uses the net method to record sales and cash discounts and the perpetual inventory system. You may copy and paste from this list: Accounts receivable Discount Interest income Bad debt expense Bank Cash Cost of Goods Sold COGS REQUIRED: Interest receivable Inventory Notes receivable Par Premium Sales discounts Sales discounts forfeited Sales returns…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education