Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

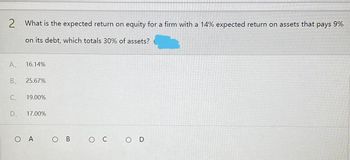

Transcribed Image Text:2 What is the expected return on equity for a firm with a 14% expected return on assets that pays 9%

on its debt, which totals 30% of assets?

A

16.14%

B 25.67%

C₁

19.00%

D 17.00%

OA

O C

OD

O B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following average annual returns: Average Return 23.5% 13.1% 7.5% 6.8% 4% Investment Small Stocks S&P 500 Corporate Bonds Treasure Bonds Treasury Bills What is the excess return for corporate bonds? O A. 1.8% OB. 0% OC. 7% OD. 3.5%arrow_forwardA firm has an equity multiplier of two and total assets of $300. If its return on equity is 10%, what is its net income? O $15.00 O $10.00 O $30.00 O $22.50 O $7.50arrow_forwardWhat is the weighted average cost of capital (WACC) for ABC Limited which has the following capital structure? $5m of equity with a cost of equity of 15%; $2m of mezzanine finance with a cost of 9.5%; $1m of senior debt with a cost of debt of 7%. Review Later 9.56% 8.63% 12.63% 13.73%arrow_forward

- Question 1Firm A’s capital structure contains 20% debt and 80% equity. Firm B’s capital structurecontains 50% debt and 50% equity.Both firms pay 7% annual interest on their debt. Firm A’s shares have a beta of 1.0and Firm B’s beta of 1.375. The risk-free rate of interest equals 4%, and the expectedreturn on the market portfolio equals 12%. RequiredA. Calculate the WACC for each firm assuming there are no taxes.B. Recalculate the WACC figures assuming that the two firms face a marginaltax rate of 34%. What do you conclude about the impact of taxes from yourWACC calculations? C. Explain the simplifying assumptions managers make when using WACC asa project discounting method and discuss some of the common pitfallswhen using WACC in capital budgeting.arrow_forward5. You are given the following information for company's Financial: Long-term debt outstanding: Current yield to maturity (r debt): Number of shares of common stock: Price per share: Book value per share: Expected rate of return on stock (requity): a) Computed company's cost of capital. Ignore taxes. $300,000 8% 10,000 $50 $25 15%arrow_forwardWhat is the debt ratio for a firm with an equity multiplier of 3.5? ____ 44.09 percent ____ 58.51 percent ____ 66.25 percent ____ 71.43 percentarrow_forward

- What is the ROE for a firm with a times interest earned ratio of 2, a tax liability of $1 million, and interest expense of $1.68 million if equity equals $1.68 million? O 23.81% O 25.22% 33.60% 40 48% 21arrow_forwardAssume there are two firms with a MV of $50,000,000. Firm A consists of 10% debt and 90% equity. Firm B consists of 40% debt and 60% equity. Assume perfect capital markets and M&M Proposition 2 holds. Which firm will have a higher expected return for equity holders? Why? For the toolhar prace ALT+F10/PC or ALT+FN+F10 (Mac).arrow_forward14 A. Assume Skyler Industries has debt of $4,377,783with a cost of capital of 9.7% and equity of $5,791,640 with a cost of capital of 6%. What is Skyler’s total weighted average cost of capital? Round to the nearest hundredth, two decimal places and submit the answer in a percentagearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education