ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1

t

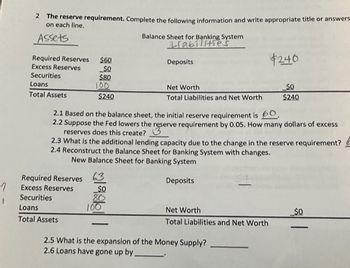

2 The reserve requirement. Complete the following information and write appropriate title or answers

on each line.

Assets

Required Reserves $60

Excess Reserves

_$0

Securities

$80

Loans

Total Assets

100

Required Reserves

Excess Reserves

Securities

$240

Loans

Total Assets

63

2.1 Based on the balance sheet, the initial reserve requirement is 60.

2.2 Suppose the fed lowers the reserve requirement by 0.05. How many dollars of excess

reserves does this create?

$0

Balance Sheet for Banking System

Lrabilities

2.3 What is the additional lending capacity due to the change in the reserve requirement?

2.4 Reconstruct the Balance Sheet for Banking System with changes.

New Balance Sheet for Banking System

Deposits

80

Deposits

100

Net Worth

Total Liabilities and Net Worth

$240

Net Worth

Total Liabilities and Net Worth

$0

$240

2.5 What is the expansion of the Money Supply?

2.6 Loans have gone up by.

_$0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Initial deposit ($100) The Money Multiplier Process Loan Loan $ University Bank Excess reserves: $25 Required reserves: $75 Deposit Bank #2 Deposit Excess reserves: $6.25 Required reserves: $18.75 Instructions: Round your responses to two decimal places. a. What volume of loans can the banking system in the figure support? Bank #3 Loan Deposit Excess reserves: $1.56 Required reserves: $4.69 Bank #4 etc. Excess reserves: $0.39 Required reserves: $1.17 b. If the reserve requirement were 15 percent rather than 75 percent, what would the system's lending capacity be?arrow_forward51)Consider the following for National City Bank. If the required reserve ratio is 4 percent, the excess reserves of National City Bank is Assets Liabilities Reserves $10,000 Deposits $100,000 Loans $90,000 Select one: a. $10,000 b. $6,000 c. $3,000 d. $4,000arrow_forwardThe table shows the commercial banks' balance sheet (aggregated over all the banks). The commercial banks' desired reserve ratio on all deposits is 10 percent and there is no currency drain. Calculate the bank's excess reserves. >>> Answer to 2 decimal places. Assets Reserves at the Fed Cash in vault Securities Loans The banks' excess reserves are $☐ million. Liabilities (millions of dollars) 2535 20 Checkable deposits 15 Savings deposits 40 95arrow_forward

- The table below shows information for United Bank. Deposits Reserves Reserve Requirement $300 million $33 million 10% Which of the following statements is true concerning United Bank in the federal funds market? Multiple Choice C O United Bank will lend $33 million reserves in the federal funds market. O United Bank will borrow $30 million reserves in the federal funds market. United Bank will lend $3 million reserves in the federal funds market. United Bank will borrow $3 million reserves in the federal funds market. @ a $ % Λ &arrow_forward2arrow_forward4. Working through an open-market operation Assume that the following balance sheet portrays the state of the banking system. The banks currently have no excess reserves. Assets (Billions of Dollars) Total reserves 5 Checkable deposits 25 20 50 Loans Securities Total O What is the required reserve ratio? 40% 25% Liabilities and Net Worth 5% 10% Total 50 50arrow_forward

- 10. If the reserve ratio is 20% and the banking system has excess reserves of $50, the maximum amount of new deposits that can be created through lending is $ Type your answer herearrow_forward7. The money creation process Suppose First Main Street Bank, Second Republic Bank, and Third Fidelity Bank all have zero excess reserves. The required reserve ratio is 10%. Hubert, a client of First Main Street Bank, deposits $500,000 into his checking account at First Main Street Bank. Complete the following table to reflect any changes in First Main Street Bank's T-account (before the bank makes any new loans). Assets Liabilities Complete the following table to show the effect of a new deposit on excess and required reserves when the required reserve ratio is 10%. Hint: If the change is negative, be sure to enter the value as negative number. Amount Deposited Change in Excess Reserves Change in Required Reserves (Dollars) (Dollars) (Dollars) 500,000 Now, suppose First Main Street Bank loans out all of its new excess reserves to Eileen, who immediately uses the funds to write a check to Clancy. Clancy…arrow_forwardAnswer all parts... I ll upvotearrow_forward

- i need the answer quicklyarrow_forwardPart 8 says reserves: number Part 9 says loans: numberarrow_forwarda). Calculate excess reserves when required reserve ratio on demand deposit is 14% and required reserve ratio on time deposit is 3%. b). suppose that required reserve ratios are changed to 16% on demand deposits and 0% on time deposits. Calculate excess reserves c. suppose bank sells 3 million in securities on the open market. Calculate the change in the bank's excess reserves when the required reserve ratio on demand deposits is 14%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education