FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:9:18:03 4

Ryan Albin 9:02 AM

to me

↓

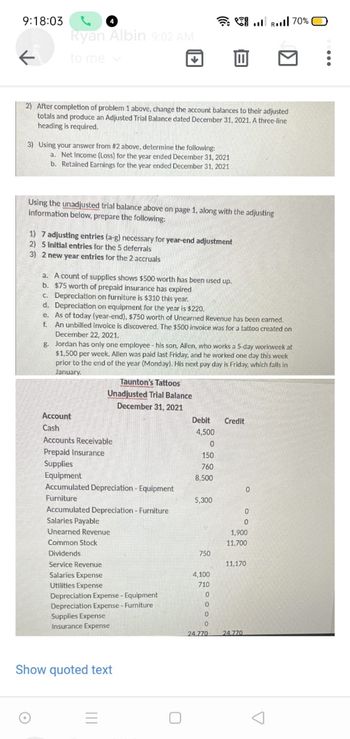

2) After completion of problem 1 above, change the account balances to their adjusted

totals and produce an Adjusted Trial Balance dated December 31, 2021. A three-line

heading is required.

3) Using your answer from #2 above, determine the following:

a. Net Income (Loss) for the year ended December 31, 2021

b. Retained Earnings for the year ended December 31, 2021

Using the unadjusted trial balance above on page 1, along with the adjusting

information below, prepare the following:

1) 7 adjusting entries (a-g) necessary for year-end adjustment

2) 5 Initial entries for the 5 deferrals

3) 2 new year entries for the 2 accruals

a. A count of supplies shows $500 worth has been used up.

b. $75 worth of prepaid insurance has expired

c. Depreciation on furniture is $310 this year.

d. Depreciation on equipment for the year is $220.

e. As of today (year-end), $750 worth of Unearned Revenue has been earned.

f.

An unbilled invoice is discovered. The $500 invoice was for a tattoo created on

December 22, 2021.

g. Jordan has only one employee - his son, Allen, who works a 5-day workweek at

$1,500 per week. Allen was paid last Friday, and he worked one day this week

prior to the end of the year (Monday). His next pay day is Friday, which falls in

January.

Taunton's Tattoos

Unadjusted Trial Balance

December 31, 2021

Account

Credit

Cash

Accounts Receivable

Prepaid Insurance

Supplies

Equipment

Accumulated Depreciation - Equipment

Furniture

Accumulated Depreciation - Furniture

Salaries Payable

Unearned Revenue

Common Stock

Dividends

Service Revenue

Salaries Expense

Utilities Expense

Depreciation Expense - Equipment

Depreciation Expense - Furniture

Supplies Expense

Insurance Expense

Show quoted text

Debit

4,500

0

150

760

8,500

5,300

750

4,100

710

0

0

0

0

24.770

0

24.770

0

0

1,900

11,700

11,170

70% O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- sarrow_forward(a) Describe the detail of the transaction being performed in the following screen. (b) Give the journal entry that MYOB made as a result of the transaction in part (a) (Note: account numbers are not required, just use account names.)arrow_forwardAccounts Receivable $160,250 Accumulated Depreciation-Building 783,500 Administrative Expenses 524,850 Building 2,563,700 Cash 184,450 Common Stock 306,600 Cost of Goods Sold 3,721,950 Dividends 185,600 Interest Expense 9,550 Inventory 1,005,950 Notes Payable 254,900 Office Supplies 20,800 Retained Earnings 1,324,350 Salaries Payable 8,100 Sales 6,255,450 Selling Expenses 692,550 Store Supplies 89,550arrow_forward

- Which of the following types of adjusting entries would result in a decrease in the amount of a one-year insurance policy premium reported on the balance sheet? Select one: O a. Prepaid expense b. Accrued expense C. Accrued revenue d. Unearned revenuearrow_forwardWhich of the following is not a category of adjusting entries? Question 27 options: Accruals. Estimates. Invoicing. Prepayments.arrow_forwardWhich of the following is true regarding adjusting entries? O a. Adjusting entries are dated as of the first day of the new accounting period. O b. Adjusting entries are not posted to the ledger. O c. Adjusting entries are usually recorded after the end of the period but are dated as of the last day of the period. O d. Adjusting entries are optional with accrual-basis accounting.arrow_forward

- Which of the following statements about an adjusted trial balance is correct? A. It is used to prepare financial statements. B. It is prepared to ensure assets equal liabilities. C. It is prepared at the beginning of the year. D. It is prepared before the adjusting journal entries have been made.arrow_forwardi Scenarios - a. Company A increases the allowance for doubtful accounts (ADA). Using the old estimate, ADA would have been $40,000. The new estimate is $45,000. X b. Company B omitted to record an invoice for a(n) $8,000 sale made on credit at the end of the previous year and incorrectly recorded the sale in the current year. The related inventory sold has been accounted for. c. Company C changes its revenue recognition to a more conservative policy. The result is a decrease in prior-year revenue by $3,000 and a decrease in current-year revenue by $4,000 relative to the amounts under the old policy.arrow_forwardGIVE A DETAILED ANSWER Describe the effect on the financial statements when an adjustment is prepared that records (a) unrecorded revenue and (b) unrecorded expense. On the basis of what you have learned about adjustments, why do you think that adjusting entries are made on the last day of the accounting period rather than at several times during the accounting period?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education