FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

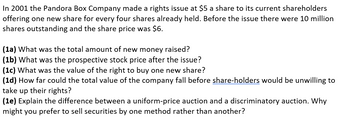

Transcribed Image Text:In 2001 the Pandora Box Company made a rights issue at $5 a share to its current shareholders

offering one new share for every four shares already held. Before the issue there were 10 million

shares outstanding and the share price was $6.

(1a) What was the total amount of new money raised?

(1b) What was the prospective stock price after the issue?

(1c) What was the value of the right to buy one new share?

(1d) How far could the total value of the company fall before share-holders would be unwilling to

take up their rights?

(1e) Explain the difference between a uniform-price auction and a discriminatory auction. Why

might you prefer to sell securities by one method rather than another?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- q7- Which of the following statements is true? Select one: a. Trailing P/E is based on the current share price and forward P/E is based on next year's forecast share price. b. Trailing P/E is based on last year's share price and forward P/E is based on the current share price. c. Both trailing and forward P/E are based on the current share price. d. Trailing P/E is based on last year's share price and forward P/E is based on next year's forecast share price. Clear my choicearrow_forwardHow do I calculate the net abount of stock issued when the firm pays X amount of dollars in dividends?arrow_forwardIf common stock is issued for an amount greater than par value, the excess goes to what account? a. Legal Capital b. Retained Earnings C. Cash d. Paid-in-Capital in Exess of Par Value A Moving to the next question prevents changes to this answer. & % #3 8.arrow_forward

- What would you expect to happen to an all-equityfirm’s stock price if its management announceda recapitalization under which debt would beissued and used to repurchase common stock?arrow_forwardCalculating Return Components An investor purchases one share of stock for $50. After one year, they sell the share for $55. During the year, they receive $7 in dividends. a) What was the dividend yield, in percentage terms? b) What was the capital gain from price appreciation on the stock, in percentage terms? c) What was the total return in dollars? What was the total return, in percentage terms?arrow_forward8. How would total stockholders' equity be effected by the declaration of each of the following? Stock dividend a. No effect b. Decrease c. Decrease d. No effect Stock Split Increase Decrease No effect No effectarrow_forward

- When it comes to the market value of a company, is it true or not that it equals the number of outstanding shares multiplied by the most recent transaction price per share.arrow_forwardWhen calculating book value per share of common stock, do you also subtract additional paid in capital of preferred stock?arrow_forwardWhich is not one of the three sources of return for an investor in a common stock? A-debt repurchase B-dividend C-earnings growth d-valuation changearrow_forward

- According to the basic Dividend Discount model, the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock. Is the above statement True or False? Please Explain.arrow_forwardA share of stock is worth the present value of all the cash flows an investor in said share of stock expects to receive. Group of answer choices True Falsearrow_forwardHow will the change in required return influence the price of a stock? How will the dividend growth rate influence the price of a stock?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education