ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

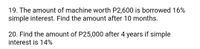

Transcribed Image Text:19. The amount of machine worth P2,600 is borrowed 16%

simple interest. Find the amount after 10 months.

20. Find the amount of P25,000 after 4 years if simple

interest is 14%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Find the uniform annual amount that is equivalent to a uniform gradient series in which first year's payment is $500, the second year's payment is $600, the thirds year's payment is $700, and so on, and there are total of 20 payments. The annual 6. interest rate is 8%.arrow_forwardSally purchases a perpetuity immediate with annual payments that pays $4000 today and Payments increase by 5% per year. She will pay for it with a single payment exactly 6 years from today. Assume a constant force of interest of 7%. Calculate the size of the payment at time 6.arrow_forwardAt what rate of interest will an investment double itself in 10 years?arrow_forward

- You want to borrow $1500 at 8% and you are willing to pay $210 in simple interest.How long can you keep the moneyarrow_forwardNo chatgpt used i will give 5 upvotes typing pleasearrow_forwardYou are saving money to buy a car. If you save $290 per month starting one month from now at an interest rate of 6%, how much will you be able to spend on the car after saving for 5 years?arrow_forward

- Joseph buys a new home using an interest only loan where he pays only the interest on the value of the home each month. The home is valued at $200,000 and Joseph pays 5% interest per year on the home. How much is his monthly interest payment?arrow_forwardShow complete solution (please write eligibly) 1. Find the uniform annual amount that is equivalent to a uniform gradient series in which the first year’s payment is $500, the second year’s payment is $600, the third year’s payment is $700, and so on, and there are a total of 22 payments. The annual interest rate is 11%. Round answer to 2 decimal places.arrow_forwardProblem 9. You have $8430 in credit card debt. The interest rate on the unpaid balance is 27% compounded. You decide to pay off the debt in equal monthly payments at the end of each month. (i) What should the monthly payments be to have the account paid off at the end of 3 years? (ii) How much interest have you paid?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education